We assess how rising concerns about climate change affect disclosures to financial markets.

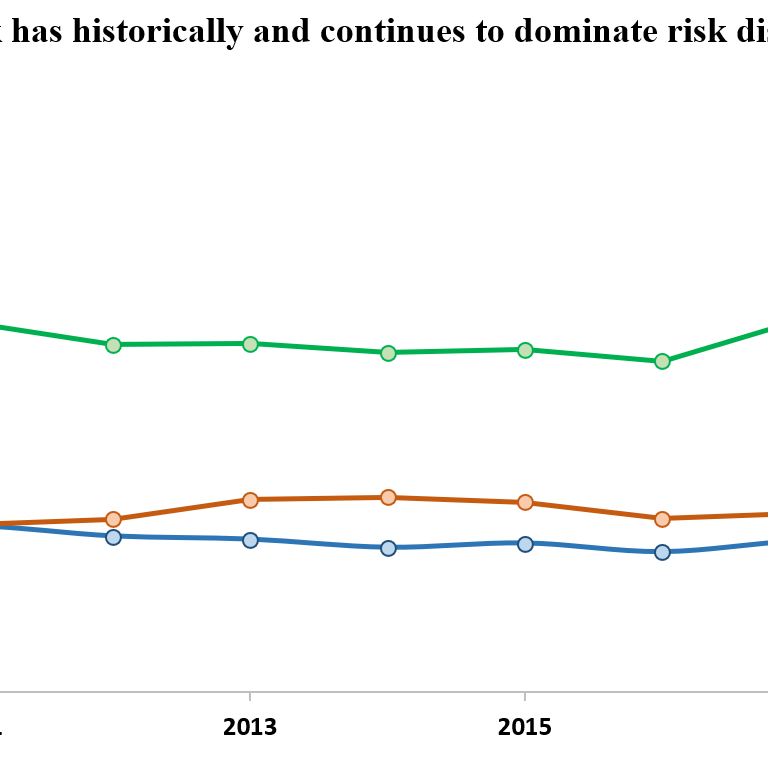

For equities, we look systematically at 10-K filings from the 3,000 largest U.S. publicly traded firms over the last 12 years and samplings of Official Statements from U.S. municipal bonds. Disclosure has risen sharply. Today, 60 percent of publicly traded firms reveal at least something about climate change. The largest volumes of information concern risks due to possible transition away from fossil fuels. By contrast, there is much less disclosure around the physical risks of climate change, such as sea-level rise (see chart).

In municipal finance, disclosure of physical risks is even weaker, although many municipalities are exposed to flood, fire, heat stress, and other perils that could destroy infrastructure and undermine the tax and income bases essential to repayment of long duration bonds. Looking at large samples of the Official Statements released with new municipal debt issuances, we find no relationship between objective measures of which municipalities are most exposed to climate impacts and what they disclose to the markets.

Although policy makers and investor ESG frameworks have focused klieg lights on the financial risks that might accompany policy-driven transitions away from fossil fuels, the real mispriced risks lie with the raw physical risks of a changing climate. Details are presented in the Supplemental Information appendix.

Note: The methodology for gathering this data is explained in Figure 1 and Figure 3 of the working paper. The figure above looks at the average number of risk mentions by category in one 10-K per company by year. It is clear from the chart above that transition risk has historically and continues to dominate climate risk discussion. There is an open question about why the amount of disclosure spiked between 2009 and 2010. It is possible that the 2008 New York AG lawsuits against Xcel and AES played a role. It seems probable that the TCFD report in 2017 spurred the inflection seen in the graph for the years 2017-2020.

Note: The methodology for gathering this data is explained in Figure 1 and Figure 3 of the working paper. The figure above looks at the average number of risk mentions by category in one 10-K per company by year. It is clear from the chart above that transition risk has historically and continues to dominate climate risk discussion. There is an open question about why the amount of disclosure spiked between 2009 and 2010. It is possible that the 2008 New York AG lawsuits against Xcel and AES played a role. It seems probable that the TCFD report in 2017 spurred the inflection seen in the graph for the years 2017-2020.

Source: Ceres/Cook/Morningstar 10-K Database and analysis by authors

We make two central arguments:

- The quality of disclosure is highly uneven and generally lousy.

- New analytical tools, regulatory incentives, and business practices can lower the cost and raise utility of meaningful disclosure, particularly if accompanied by stronger regulatory rules and industry norms. New practices at credit ratings agencies and rethinking of liability rules could accelerate best practices.

Among our specific findings:

- In 2009, the average firm mentioned climate-related risks 8.4 times in its 10-K. In 2020, that number was 19.1 times, primarily because a growing number of firms cite the risk.

- Four industries (oil and gas, power utilities, coal mining, and other mining) constitute 8 percent of the Russell 3000 (by count), but 58 percent of the mentions of climate-related risks in 2019.

- In our sample of municipal bond Official Statements, 10.5 percent of bonds tied to specific streams of revenue refer to climate risks, but only 3.8 percent of general obligation bonds do.

- Innovations in climate science over the last decade make it possible to assess these physical risks at fine geographical resolution, but we find no relationship between such measures and municipal disclosure.

- Climate risks are rarely material rating decisions of major credit rating agencies.

Among our policy conclusions:

- Disclosure reflects a lack of imagination; much of the disclosure reflects risks easiest to measure, namely transition risk, rather than significant physical risk. What’s missing is an effort with a system-wide view, primarily rating agencies and regulators, to tie the risks together.

- Disclosure by issuers of municipal debt would be improved by building national databases of critical infrastructure and exposure to climate-related perils. Regulators in states most vulnerable, such as Florida and California, could take the lead in experimentation. National regulators (FASB, PCAOB, the Fed) should promote best practices and emphasize fiduciary responsibilities.

- Incentives must be better aligned to promote forthright disclosure, particularly via practices at FEMA and flood insurance providers.

- Activists and analysts are fighting the wrong fight. The extraordinary attention to transition risk aligns with most mental models of how financial assets might be affected by climate policy, but the real push for better disclosure should be on physical risks.

Find supplemental information here»

Eric Gesick was the Chief Underwriting Officer for AXIS Capital, a global specialty insurer and reinsurer, until July 31, 2020. The authors did not receive financial support from any firm or person for this article or from any firm or person with a financial or political interest in this article. They are currently not an officer, director, or board member of any organization with an interest in this article.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).