The Vitals

Paying the rent for a decent home is not

just a challenge for low-income families. As housing affordability increasingly

creates stress on middle-income families, local governments, philanthropies,

and even employers are debating new strategies to address the problem.

-

Housing stress on middle-income families is most acute in expensive metropolitan areas where regulatory barriers have driven up costs and restricted new development.

-

Cities clearly benefit financially from having more middle-class residents. It’s less clear if growth in middle-class residents brings broader social benefits.

-

Local governments considering creating a housing subsidy targeted at middle-income families should consider the potential costs – both political and financial.

A Closer Look

In the past year, Facebook,

Google,

Microsoft,

and the Chan-Zuckerburg

Initiative have pledged contributions ranging from $500 million to

$1 billion to help build more middle-income housing in their respective

backyards (literally for Google, which is proposing to convert some of its

Mountain View campus to housing). The District of Columbia’s mayor, Muriel

Bowser, proposed a $20

million Workforce Housing Fund

to help subsidize housing for typical middle-income occupations like “teachers,

police officers, janitors, [and] social workers.”

In this brief, we discuss the rationale for housing subsidies targeted to middle-income families, review past examples of policies referred to as “workforce housing,” and discuss some political and economic implications of these policies.

How are “workforce” and “middle-income” housing different from “affordable” housing?

The term “workforce housing” is most often

used to indicate a program targeted at households that earn too much to quality

for traditional affordable housing subsidies. The largest rental subsidy

program, housing

vouchers funded by the U.S. Department of Housing and Urban Development

(HUD), targets families making up to 50% of the median income for their

metropolitan area (AMI). Households earning up to 80% of AMI are eligible to

live in Low

Income Housing Tax Credit properties. Relative to these programs,

workforce housing is most commonly intended for households with incomes between

80% and 120% of AMI.

The term “workforce” housing is not only

imprecise, it is controversial:

many poor households who receive federal housing subsidies are

employed, so why are those subsidies not considered “workforce”

housing? As we discuss below, while “middle-income housing” would be more

precise language, it raises some politically awkward questions.

Some “workforce” housing programs—such as

those aimed at teachers and police officers—are tied both to household income

and to occupations or industries. There is a specific history of housing

assistance for certain public-sector employees, stemming in part from local

government requirements that those workers live within their employing

political jurisdiction.

What are the pros and cons to cities of attracting middle-income households?

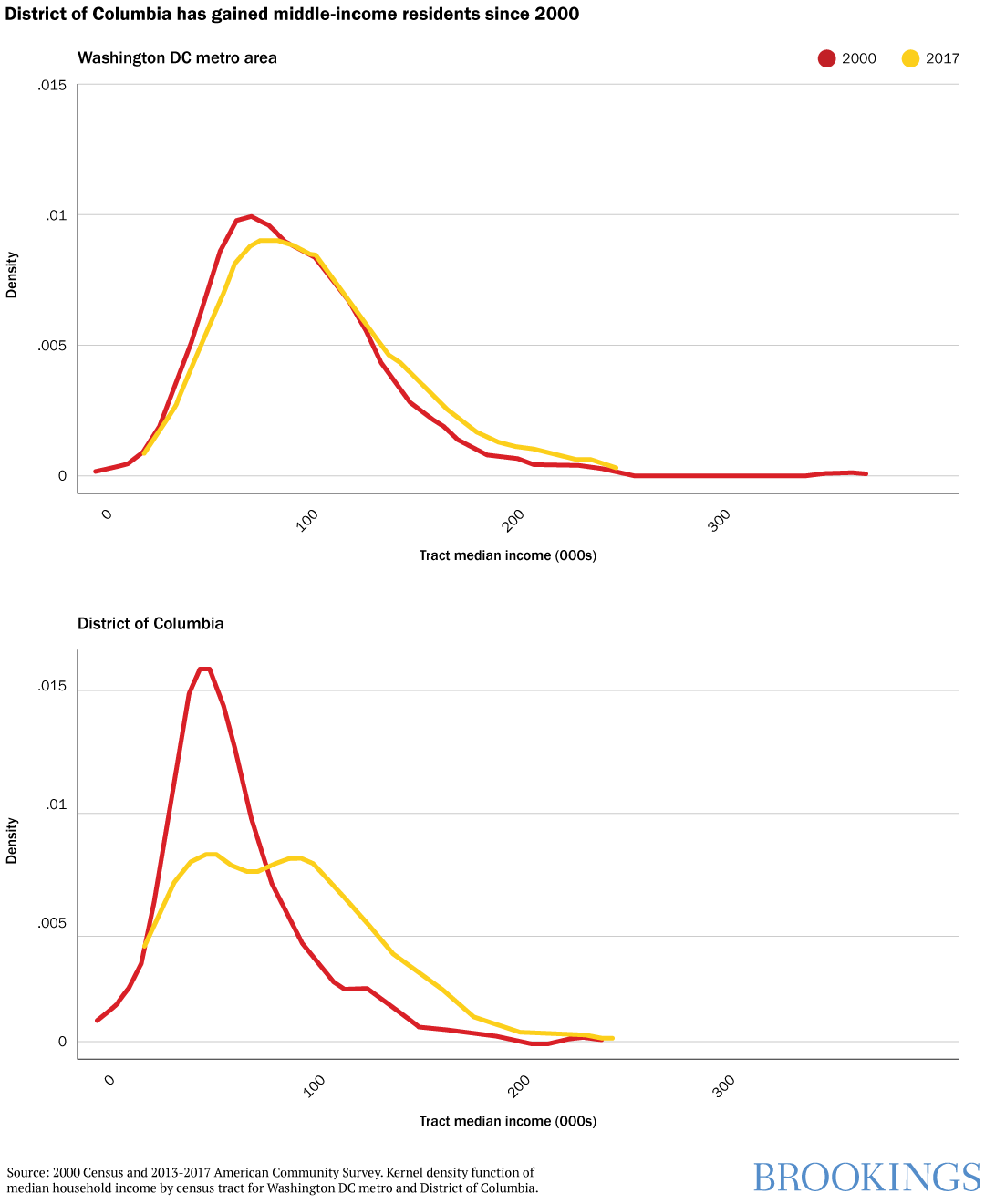

Dedicating subsidies to middle-income households may seem odd today, when many cities fret over gentrification. But in the not too distant past, most central cities were substantially poorer than their surrounding suburban jurisdictions. Washington, D.C., offers a clear example, as we can see by comparing the income distribution of central city neighborhoods and the entire metropolitan area over time.

In 2000, about one in three neighborhoods

in the Washington, D.C., metro area had median incomes between $72,000 and

$108,000 (80% and 120% of AMI, respectively). Only 16% of neighborhoods in the

District of Columbia were middle income. By 2017, middle-income neighborhoods

(between $80,000 and $120,000) constituted 35% of the metropolitan area and 31%

of the District. Other major cities such as New York, Boston, San Francisco,

and Seattle experienced similar growth in middle-income households during this

period. But many mayors and city councilors have personal and professional

experiences dating back to times when cities cast about for strategies to

attract affluent residents in from the suburbs (or keep from losing the ones

already there).

Cities clearly benefit

financially from having more middle-class residents. Property taxes

make up the largest source of local government revenue for most cities. Cities

made up of a few very wealthy residents and many poor residents face difficult

choices: imposing high property tax rates may push their most affluent

constituents into lower-tax suburbs, but allowing the quality of public

services to deteriorate also threatens stability. When more middle-income

residents move into a jurisdiction, renting or purchasing homes, cities can

collect more property tax revenues from a broader cross section of households.

Middle-class residents also hit the sweet spot for consumer spending: they have

more disposable income than poor households to spend on groceries, restaurants,

movies, and dry cleaners—all items that are consumed locally. (Wealthy

households tend to spend a smaller share of

their income, so generate a smaller economic multiplier in their local area.)

It is more ambiguous whether the growth in

middle-income residents creates broader social benefits for cities. On the plus

side, middle-class residents can generate more pressure on local officials to

invest in transportation, parks, libraries, and shared community assets. If

middle-income families send their children to public schools, they bring to

those schools greater financial resources, as well as social and

human capital. But research shows mixed

results on whether and how higher-income families interact in

schools and social settings with lower-income neighbors. Moreover, an influx of

more affluent households can drive up housing

costs, leading to displacement of existing lower-income residents,

especially if local governments impose regulations

that limit new housing development.

How have past workforce/middle-income housing programs been designed?

Middle-income and workforce housing programs

have taken a variety of forms across different time periods and geographies.

While not a comprehensive inventory, below we describe a few of the more notable

programs.

New York City

As one of the nation’s most expensive

housing markets, New York City was an early entrant into workforce housing. Two

of its first examples, the Mitchell-Lama program and Stuyvesant Town, still

exist today, although both have undergone changes since their initial design.

In the 1940s, the New York and the Metropolitan Life

Insurance company created an early public-private partnership to create Stuyvesant

Town, a massive

residential development, containing more than 11,000 apartments on 80 acres of

land. The city used eminent domain to assemble land for the project and grant

MetLife over $1 million in property tax exemptions annually for 25 years.

MetLife built the complex to house moderate-income families, including veterans

returning from World War II. From its inception, the project drew criticism for

excluding Black residents and for the top-down, undemocratic process of the

development.

New York State established the Mitchell-Lama

program in 1955 with the Limited

Profit Housing Companies Law. The program offers a combination of low-interest

mortgage loans, property

tax abatements, and land to encourage developers

to build housing with rents that are affordable to moderate- and

middle-income households (roughly the middle third of the city’s income distribution). More than 100,000 Mitchell-Lama apartments exist

across New York City.

Housing for teachers, employer-provided housing

Although

not widespread, some school districts and affiliated non-profits have developed

workforce housing specifically

reserved for teachers. This partly reflects legacies from the 1970s

and 1980s, when local governments

often required public employees, including teachers and emergency

responders, to live in the jurisdiction where they worked. Some cities,

including Chicago,

still have residency requirements. Cities and towns with expensive housing

often have difficulty

attracting and retaining high quality teachers, and may have less

flexibility in increasing salaries. Because school quality is capitalized into local

housing prices, there is a certain financial logic to local governments using

public resources to subsidize teachers housing, especially in mostly

residential suburbs. But arguments can be made that other, similarly paid

occupations also provide social value to their communities. And some expensive

communities (including San Francisco Bay Area suburbs) are actively

hostile to building rental housing even if it would be reserved for

teachers or other public servants.

Historically,

many employers have provided housing to their workers: examples include the

“model town” of Pullman,

Illinois, dormitories for textile workers in New England factory

towns, and farmers who hire seasonal agricultural workers. Often these

instances have given employers undue power over their workers, with the potential

for exploitation or abuse. Oddly, one remaining example of

employer-provided housing can be found among elite universities in expensive

housing markets: Columbia,

New York University,

and Stanford

provide below-market apartments for selected faculty and staff.

While most

of HUD’s subsidies target low- to moderate-income families, regardless of

occupation, the agency’s “Good

Neighbor Next Door” offers discounted home prices to teachers, police,

firefighters, and emergency medical technicians in designated “revitalization

areas.” The goal is to encourage households with stable employment to become

homeowners in lower-income neighborhoods. And some local governments, including

the District

of Columbia, offer first-time homebuyer assistance that to

households with incomes that roughly correspond to local government salaries.

In well-functioning housing markets, middle-income families shouldn’t need subsidies

Local governments considering creating a

housing subsidy targeted at middle-income families should consider the

potential costs—both political and financial. Proposals to set aside scarce

public resources for middle-income households are likely to face considerable opposition

from traditional affordable housing

advocates (and some voters), given that only one

in five low-income households receives federal housing assistance.

Besides the direct subsidy cost, any program imposes some administrative costs on

the government agency in charge of implementation. Staff time must be allotted

to process applications, reviewing eligibility by income and employment,

similar to administering housing vouchers. There could be labor market

implications of tying housing benefits to specific employers or occupation. To

the extent that changing jobs might mean losing one’s housing, such programs

could create disincentives for labor market mobility. Subsidies that are targeted

at public-sector employees may also raise concerns: why should public employees

receive subsidies that are not available to private or nonprofit employees earning

the same income, and facing the same housing affordability challenges?

Housing stress on

middle-income families is most acute

in expensive metropolitan areas where regulatory barriers have driven up costs and restricted new development.

These regulatory barriers reflect the policy choices that local governments have

made; by changing the rules for housing development, local governments can

bring down housing prices overall, benefitting all households. Two changes in

particular would ease the burden on middle-income households. First, localities

can reduce barriers to building a diverse housing stock in every neighborhood. Minneapolis

and Oregon

have recently taken steps to allow small apartment buildings by right in all

neighborhoods; other states and cities are considering following suit. Second,

local governments can simplify

and streamline the housing development process, especially for

multifamily buildings. Making the process shorter, simpler, more

transparent, and less uncertain would allow more households to afford their

rent without creating new subsidy programs.

Commentary

How are communities making housing more affordable for middle-income families?

November 8, 2019