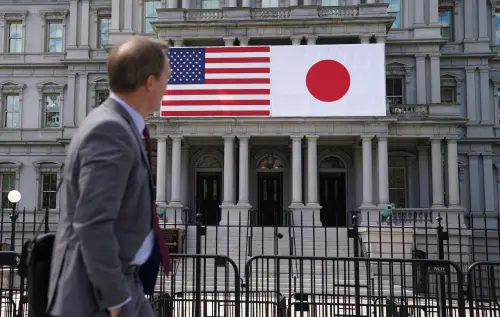

Mireya Solis spoke with The Oriental Economist about President Trump’s economic policies, U.S.-Japan trade, and the possibility of punitive trade measures against Tokyo. This interview originally appeared in the April 2017 issue of The Oriental Economist.

TOE: Is President Donald Trump a “paper tiger” when it comes to trade, as some have suggested? He did not keep his campaign pledge to name China as a “currency manipulator” on his first day in office, and he left currency rates out of his executive orders on investigating why America runs chronic trade deficits with certain countries. His requested terms for a renegotiated NAFTA seem much milder than expected. And Trump said he might postpone talk of tariff threats vis-à-vis China to his second summit with Chinese President Xi Jinping. (This interview took place before Trump’s summit with Xi, which, as expected downplayad trade conflicts.) Reports say he will take action on steel “dumping,” but many administrations have done this.

SOLIS: I think it’s too soon to feel relief that Trump will hold back on some of his hardcore nationalist campaign pledges. But, maybe, some sense of reality has arrived. Blanket punitive tariffs of 45% applied to China, or 35% applied to Mexico, are very crude measures that would boomerang and hurt the US economy.

However, even in that NAFTA draft, there are things with substantial negative implications. One is a brief mention of Mexico’s value-added tax (VAT) system, the same system followed by most of Europe. The Trump camp claims that a VAT system penalizes American products. I don’t think making another country’s entire tax system a point of negotiation qualifies as moderate. Another issue of concern is a brief mention of some kind safeguard mechanism: if any US industry is hurt by a sudden surge in imports, tariffs could be brought back. What’s worrisome here is that this could be applied, not just to actual damage but to the threat of damage as well. That’s a very slippery slope.

TOE: Japanese auto and electronics firms that produce in Mexico to export to the US are very concerned about any change in the rules of origin (i.e., that a certain share of any product must have content from the three NAFTA countries to enjoy duty-free exports from Mexico or Canada to the US).

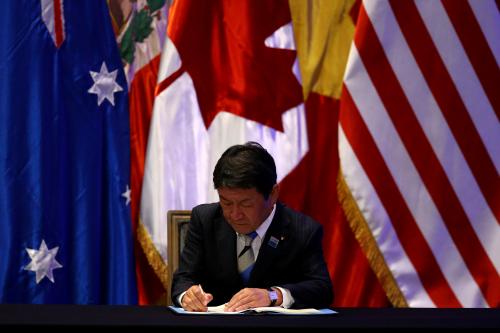

SOLIS: The autoworkers union wants a change of the rules of origin. So far, there are no specific proposals. But Trump does not believe in the entire logic of NAFTA: an integrated, North American production platform. His instincts are all about insuring that production takes place in the US. The problem with rules of origin is that you take a snapshot of how a product is produced at a certain moment, and then you draft rules to ensure that a certain share of content comes from the three NAFTA countries. But we know that the production of cars and autos has changed substantially. Parts cross the borders many times. So, depending on how the rules of origin are “updated,” this could put severe restrictions on firms and reduce their incentive to invest in Mexico. Rules of origin became one of the big sticking points between the US and Japan during the Trans-Pacific Partnership (TPP) talks.

TOE: During the campaign, Trump talked about withdrawing from NAFTA if his demands are not met. Is that a real threat?

SOLIS: It’s unclear, partly because the administration thinks uncertainty helps their negotiating position. For example, as soon as the NAFTA negotiation objectives were made public, White House spokesman Sean Spicer said that the document did not really reflect where the administration stands on trade. On the other hand, I think that the administration is getting an earful from farm interests. They know that, if the US leaves NAFTA, Mexico could import farm goods from other countries. Mexico has already contacted corn producers in South America. Trump administration assumes that Mexico has no choice because it sends 80% of its exports to the US, but that’s not necessarily how Mexico will operate.

TOE: Is disagreement among Trump’s advisors part of the reason for the uncertainty? Tokyo hopes that people with real world experience, like former Goldman Sachs President Gary Cohn, now director of Trump’s National Economic Council, or even Commerce Secretary Wilbur Ross, an investor in steel and textiles and Japanese banks, will have more influence on trade issues than the extremely hawkish academic, Peter Navarro, Assistant to the President for Trade and Industrial Policy.

SOLIS: In the early days, it was Peter Navarro, because he got put in his job the earliest. He was put there because his worldview is completely in accordance with Trump’s view. He provides the analytical justifications as to why Trump’s views make sense. Yet, he has a very small staff. And now that other players are slowly coming into place, he’s competing for attention. The arrival of Wilbur Ross has shifted the gravity, and you will soon have the soon-to-be-confirmed nomination of Robert Lighthizer as US Trade Representative (USTR). None of these are traditional free traders. They all support some form of economic nationalism. Yet, a certain sense of reality is becoming more influential, and much of that seems to come from Cohn. One member of his team is a former leading negotiator on TPP.

TOE: Typically, currency issues are left to the Treasury Department, whose new Secretary is former hedge fund operator Steven Mnuchin. Will Mnuchin set the policy on currency or will it be the White House?

SOLIS: That’s not clear. Nor has Mnuchin given us any solid guideposts on his own ideas on currency policy. The only thing we know is that China was not immediately labeled a “currency manipulator.” Quite frankly, the facts are not there to justify the charge. China is no longer intervening to cheapen its currency, but rather to prevent it from falling even more than it has. I doubt that they can bring binding currency manipulation rules into the next batch of trade agreements. Every country in the TPP rejected such a notion.

TOE: Trump has said he is willing to use Section 301 of the US trade law, which gives him very broad authority, and that, if the World Trade Organization (WTO) rules that such actions are illegal, the US could leave the WTO. This is a very, very big threat, and a lot of US multinational companies are worried about the havoc this would wreak. How seriously do you take such a threat?

SOLIS: I would like to think that it’s a negotiating tactic and that they’re aware of how disruptive that would be. Moreover, while there are some things the President can do unilaterally, some things require Congressional approval and Trump is also subject to lobbying from various US interest groups that would be hurt by such actions. In the real world, he cannot act unilaterally as much as he may think he can.

TOE: Trump won the election because he turned five traditionally “blue (Democratic) states” in the Midwest “rust belt” to his side. In those states more than elsewhere, Japan—not just China or Mexico—is a big issue because of automotive issues. If Trump turns out to be “all talk, no action” on his promises of tough trade actions, I’d assume he’d face political backlash. How much does that pressure impact Trump’s decisions?

SOLIS: It’s very important. There are a couple of issues in which Trump has very fixed ideas that go back 30 years. One of these is the notion that trade is a zero sum game in which America is being cheated by everyone. On top of that is Trump’s strong sense that he got to the White House because he tapped frustration on trade. The Japanese government and business interests have responded to this by trying to speak Trump’s language. They have highlighted the contributions that Japanese firms make to job creation through their investments in the US, and that they do not lay off workers during slow times. They’ve also talked about the growing presence of Japanese investment in the Midwest, the region that turned the tide in favor of Trump.

TOE: If Trump does decide that he has to do something to look tough on trade, how might this kind of action affect Japan in general and the auto industry in particular?

SOLIS: He already has done something: withdrawing from TPP. This is such a huge blow to Japan, partly because of the role that the TPP plays in Abe’s economic revitalization strategy. It’s also geopolitically important because it provides reassurance that the US is fully committed to the region, and that Japan is a very special partner. TPP withdrawal is not necessarily a blow to the auto sector, because the US negotiated very defensively in that sector. It was going to take 30 years to eliminate its tariffs on Japanese trucks and 25 years on cars. The negotiations on NAFTA have introduced a lot of uncertainty that will affect the investment plans in North America of Japanese automakers and other firms. These companies have already made a lot of investments; so any change in the rules of the game could have costly implications for Japanese companies.

TOE: What about Trump’s tweet threatening a big border tax on Toyota if it does not make more investments in the US instead of Mexico. What might Trump do?

SOLIS: I’m glad you asked that, because few people have really investigated exactly what Trump could do. The President has the power—through the Trading With the Enemy Act, and Section 301—of targeting specific countries that he claims are engaging in unfair trading practices. But I have not seen anything in US law that allows him to single out the behavior of individual companies and subject them to a border tax or some other punitive action. Still, these companies have to worry about PR damage and try to adjust to that. They’ll probably just repackage some of the investment decisions that they have already made. But my sense is that many of these companies are preparing to ride the wave. They don’t know how long Trump will last: eight years, four years, or even two years [if he is impeached]. They will not lightly make the costly decision to restructure their footprint across the region if Trump will only be in power a few years.

TOE: Is there any evidence that Toyota’s sales have been hurt by the Trump Tweets?

SOLIS: I have not seen any evidence.

TOE: Under Section, 301, the President can decide that, if a country practices something that he thinks is unreasonable, he can take unilateral action. So, theoretically, Trump could declare Japan a currency manipulator, on the grounds, as he said in a speech, that the Bank in Japan (BOJ) is expanding the money supply to weaken the yen. Then, under US law, he could apply punitive tariffs on Japanese car companies if he is that reckless and is willing to ignore, or leave, the WTO. Can you imagine him going that far?

SOLIS: That would be reckless. It would also be hard to choose the monetary policy of the BOJ as the basis of trade actions, since the US Federal Reserve also massively expanded US money supply after the Lehman Shock in 2008. Every time they threaten to do anything like this, there are the risks of retaliation. As the US economy suffered the effects of this, it would be hard for Trump to tell the US public that he got a better deal through his tough tactics.

TOE: One of the other measures that would affect Japanese exports to the US is the proposed “border adjustment tax (BAT),” in which the US would apply exempt companies’ export revenues from income taxes, but not let companies deduct the costs of imports in the same way that they deduct the costs of domestic purchases. This could be the equivalent of a 20% tariff on imports and 20% subsidy on exports. There are some economists who say this won’t really affect anything, because the dollar will adjust. However, lots of retailers and other US firms that depend on imports think that is head-in-the-clouds thinking. I agree with the latter.

SOLIS: The US business community is completely divided on this. Some major importers are opposing it with all their might. There is also a division within the base of the Republican Party and among Senate Republicans. I’m not a tax expert, but everything that I read about the measure gives me concern. We cannot just assume that a major adjustment in the dollar will take place, and that therefore consumers will essentially continue to pay the same price for imports. Besides, having a sudden leap in the dollar’s strength would have other economic consequences.

I just saw a study from the Japan Center for Economic Research (JCER) about the costs of the BAT for Japanese industry, and they’re very high. The most affected sector would be automotive because this operates with a global supply chain, and relies very heavily on imports. [Autos and auto parts account for a third of all Japanese exports to the US—TOE]. The BAT could cause a major hit to production levels, not just in Japan, but also in Europe. The Europeans, the Mexicans and others have already said that they would seek trade remedies at the WTO if Trump goes ahead with this. Congress has to take this into account.

TOE: If the BAT is implemented, what would be the response of Japanese firms that invest here, and which import a lot of parts? Would that cause them to ship more parts production to the US? Would it cause them to invest less in the US, because it would be more costly to produce?

SOLIS: It’s just a hunch, but I think it would create an incentive to bring more parts manufacturers to the US. But it would also make their products more costly, and that could affect their sales.

TOE: Tokyo is very worried that the US and China will make some sort of deal at the expense of Japan. In one scenario, the Chinese will invest a lot of money in Trump’s proposed infrastructure bonds. In that case, goes the scenario, Trump would then focus more on Japan than China in any harsh trade actions. What’s your view of this fear?

SOLIS: If there were such a deal, it probably would have to be something that Trump could sell as helping reduce the trade deficit, because that is the core of everything he says about China. So what could that be? Maybe pledges to increase access to the Chinese market. I don’t think a summit is a setting that provides for a major tangible, meaningful breakthrough. I think the risk to Japan lies in something other than economic deals. Abe’s summit was so successful in establishing a rapport with Trump, and of Japan standing out as a special ally, the gateway to Asia, the interpreter of Asia to Trump. If Xi establishes a good working relationship with Trump, that special role for Japan loses some of its appeal.

TOE: If you think that, for blue collar voters in those five key Midwest states, Trump has to do something to somebody on trade, the question is: which country or countries will he target? It could be Japan or China or Mexico, or more than one.

SOLIS: My sense is that, the first country to be targeted will be Mexico. It’s already begun. Mexico triggers two of the sensitive issues in Trump’s mindset: trade and immigration. Also, he believes that Mexico will be weak. So, he can assert his weight and then turn around to his rust-belt voters and show a victory.

TOE: Trump says he prefers bilateral trade agreements and some people in his camp have talked about a US-Japan pact. How serious is Trump about this? I find it hard to see how Japan would benefit, except maybe to placate the US President. I cannot imagine Trump offering Japan better terms on autos than the lousy terms Japan got in TPP, and I can’t imagine Trump asking for less than TPP asked Japan to do vis-à-vis farm goods.

SOLIS: Trump wants to get these bilateral pacts to establish a record in accomplishing things. And he says: I’m not against trade, but I can negotiate a better deal. So I think that Trump will push very hard to get bilateral agreements and Japan is probably among the first countries on the list.

Japan would be better off deferring this for as long as it can. Tokyo probably feels that it cannot say no, because this is where economics and security gets mixed with each other. Tokyo does not want to sour relations with its most important security partner. But there’s the risk of a failed trade negotiation becoming a source of friction. In strictly economic terms, there is very little that Japan would gain. The room for agreement has actually decreased because, the terms in TPP would become the floor for the next deal. PM Abe would have to be able to tell the public: I’m going to get you a better deal than TPP, and that would have to be faster reduction in auto tariffs. But I don’t think that the climate in Washington makes anything like that feasible.

Meanwhile, Trump would have to tell the Japanese: I want faster and more extensive opening of agriculture. I don’t know whether or not he’d bring in the currency manipulation issue. If a bilateral US-Japan trade pact involved the usual mutual concessions in market opening, it would be a good thing. But that’s not what I see going on here.

TOE: Japan is still trying to do TPP without the US, in the hopes that the US will eventually join. What can we realistically expect? A lot of the terms of TPP were concessions to the US that countries made only because they wanted the US market. If the US is not there, I imagine a lot of players would want to change those concessions. But if they change the terms, that might make it even more difficult for the US to join.

SOLIS: It’s going to be heavy lifting for all parties, but it is possible. Six of the TPP countries already have trade agreements with the US, and the US did not give them any additional market openings in TPP. So, for them, there is not much to be lost in moving forward without the US. They joined because they wanted access to the other markets and they wanted to be part of a multilateral framework.

Japan does not have a bilateral trade agreement with the US, so this was the first time it was going to receive access on preferential terms. On the other hand Professor Kenichi Kawasaki has calculated very interesting econometric estimates of the income gains for Japan for the whole TPP, i.e., 12 countries including the US, versus the TPP-11 without the US. He shows that Japan’s income gains from tariff elimination go down in a TPP-11 scenario, from 0.24% of GDP to 0.07%. But the largest economic benefits for Japan in the TPP come from the reduction of nontariff measures, and America’s exit from the trade agreement does not erode them markedly: from 1.13% to 1.04%. In Kawasaki’s estimation, overall economic gains for Japan in a TPP-1 are paired down but remain meaningful: from 1.37% to 1.11%.

I think these results stem from the fact that a lot of the benefits of TPP for Japan have to do with their own domestic reforms and with having a rulebook that helps Japan’s own global production network. So, these gains would still justify Japan going ahead. Moreover, I believe that the only route to a TPP-12 including the US is to start with TPP-11. The real question involves two countries: Vietnam and Malaysia. They were the countries that made the most painful, sensitive concessions, because they were going to get, for the first time, access to the US on preferential terms. They were going to be the big winners in terms trade and investment. The success of these talks really depends on political will. It could be that the TPP-12 goes to TPP-8, and eventually could grow again. But it could fizzle out. It’s a very fluid situation.

Commentary

Will Trump hit Japan on trade?

April 2017