The U.S. and Ukraine’s allies met Russia’s invasion two years ago with an unprecedented set of sanctions. They put a price cap on Russian oil exports, froze $300 billion worth of Russian foreign exchange reserves, and severed many of the links between Russia’s financial institutions and the rest of the world.

Architects of the sanctions say they were designed to maximize the costs imposed on Russian President Vladimir Putin, degrade his ability to project power on the world stage, and show other autocracies (China, perhaps) that redrawing borders by force would be punished. The sanctions remain a work in progress. They clearly have reduced Russia’s oil and gas revenue, weakened its ability to produce nondefense goods, made importing high-tech components harder, and shaken the country’s banking system. But the Russian economy has yet to implode. And although the sanctions have multiplied over the course of the war, they have yet to weaken Putin’s determination to keep fighting. It is increasingly obvious that the United States and its allies need a better strategy to restrain Russian’s imperialist behavior.

We asked several experts to put the sanctions in perspective and to offer proposals on what might be done to tighten the sanctions noose, then convened an expert panel to discuss these proposals. Watch the full video of the event, read summaries of the proposals, and download each of the reports below.

On May 28, the Economic Studies and Foreign Policy programs at Brookings considered the effectiveness of the sanctions and ways to tighten them with the release of a series of working papers and a conversation. Daleep Singh, deputy national security advisor for international economics, delivered keynote comments. His remarks were followed by a panel with economist Yuriy Gorodnichenko of the University of California-Berkeley, who wrote one of the essays, Agathe Demarais of the European Council on Foreign Relations, and Brookings Senior Fellow Fiona Hill. The panel was moderated by Reuters Diplomatic Correspondent Arshad Mohammed.

Sergey Aleksashenko

The U.S. and other Western countries have imposed economic sanctions to weaken the Russian economy and limit the Kremlin’s ability to continue its aggression in Ukraine. Although sanctions have had a significant impact, they have had less impact than expected. Moreover, some of the sanctions related to the Russian financial sector have made it easier for the Kremlin to maintain economic stability. The solution: Instead of making it harder for Russians to move money outside the country, make it easier for them to do so, thereby depressing the value of the ruble, making imports more expensive, and putting pressure on Russian bank balance sheets.

Torbjörn Becker and Yuriy Gorodnichenko

Too little has been done to limit the resources available to Russia to wage war against Ukraine. There is a common misperception that sanctions are “not working” and that they hurt the sanctioning countries more than Russia. This false narrative is largely due to the piecemeal implementation of sanctions and problems with monitoring and enforcement. It is high time to change the resources available to Russia, the narratives around sanctions, and the reality for any Western company doing business in Russia: Introduce a full embargo on all business with Russia, including trade, investments, and finance—with a limited set of exceptions rather than a long list of what is sanctioned. “Shock and awe” should be the leitmotif of limiting Russia’ economic capacity to wage war. Russia’s horrific violence imposed on Ukraine qualifies Russia as a criminal state and is thus sufficient to make the moral argument for not doing business with Russian-based companies or individuals.

Emily Blanchard

The U.S. needs guiding principles for policymakers as they craft and deploy new sanctions and export controls before measures are undertaken. Robust and rigorous planning offers the best chance to tailor sanctions or export control measures that deliver efficient, effective, and predictable results. Among the principles: Establish interagency and interdisciplinary collaboration; identify specific, achievable goals with clear metrics for success; evaluate likely costs and consequences of proposed actions; take account of the broader context of any proposed sanction or export control policy, provide for regular review and adjustments; and develop a clear, comprehensive communications strategy.

“Robust and rigorous planning offers the best chance to tailor sanctions or export control measures that deliver efficient, effective, and predictable results.”

Lee Branstetter

Export controls on semiconductor technologies adopted by the Biden administration and enforced by key allies represent a significant shift in the technological competition between the U.S. and China. Unlike many past efforts, these sanctions are designed not to change Chinese behavior but to inhibit the development of China’s technological capabilities. These sanctions have been paired with extensive subsidies designed to build up U.S. firms’ technical capabilities and “reshore” semiconductor manufacturing. Current sanctions and subsidies will likely prove inadequate to meet the policy goals of the Biden administration or future administrations, such as forcing fundamental change in Chinese behavior. The U.S. should cultivate a multinational supply chain and specialize in the highest-return, highest-value parts of that chain; reduce reliance on supplies from Taiwan; and bolster the supply of engineers in the U.S. by increasing the flow of STEM-trained immigrants.

Simon Johnson and Catherine Wolfram

To make the oil-price cap more effective, the U.S. and other supporters of Ukraine should, among other steps, continue to demand attestations for every shipment and increase funding for review teams, prohibit sale of tankers from coalition countries to Russia, establish a “white list” of allowed traders, and consider imposing secondary sanctions on any market participant involved in a transaction with oil priced above the cap.

Peter E. Harrell

The past couple of decades have been “a golden age of sanctions” for the U.S., beginning with the financial sanctions deployed after 9/11 and intensifying in the 2010s against Iran, North Korea, Syria and Russia. Sanctions have proven effective at changing the behavior of individual firms and have had clear economic impact on their targets. But the policy outcomes of many of the toughest sanctions programs since the 2015 U.S.-Iran nuclear deal have been decidedly mixed. American policymakers tend to ask too much of our economic tools. Geopolitics and market forces are giving rise to more effective alternative payment and financial channels over which the U.S. can exert much less direct control. What should the U.S. do? Maintain the primacy of the U.S. dollar in global payment systems, throw sand in the gears of Russian and Chinese efforts to internationalize their payment systems; deploy secondary sanctions; and continue to innovate.

“The last decade has been a golden age of sanctions. The U.S. dramatically expanded the number of people, companies, and foreign government instrumentalities it sanctions each year: In 2022 and 2023 the U.S. imposed more than three times as many sanctions annually as it did a decade earlier.”

Craig Kennedy

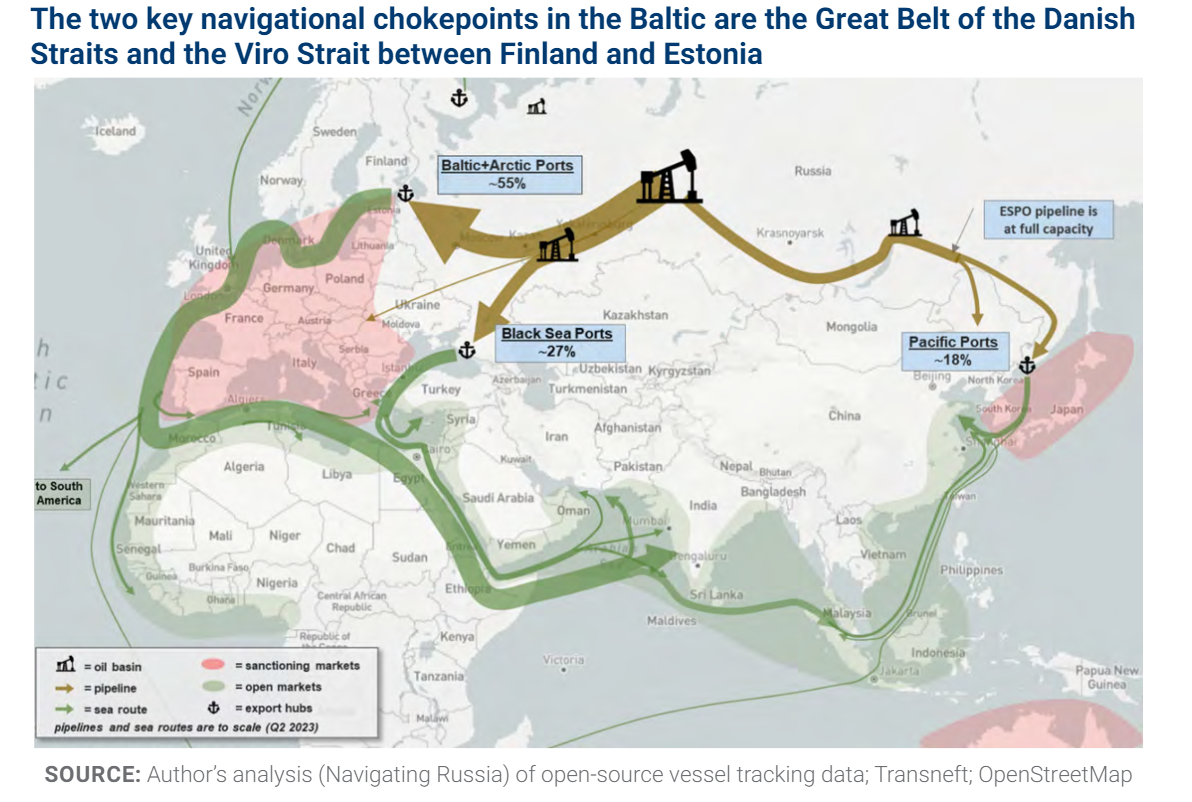

Half of Russia’s daily oil exports are shipped through the Baltic Sea where they routinely transit the territorial waters of European Union member states, and roughly half of those cargoes are carried by Russia’s shadow fleet, the second-hand, often dilapidated ships that Russia bought to avoid Western sanctions. These ships pose three threats: (1) they enhance Russia’s ability to fund its war of aggression against Ukraine by circumventing price-cap sanctions; (2) they likely violate international shipping law by not complying with mandatory oil spill insurance requirements; and (3) they present a heightened risk of oil spills, owing to the poor condition of the aging fleet. So all tankers operating in the Baltic should have to verify the adequacy of their spill liability insurance. Those tankers that have inadequate insurance should be sanctioned by the U.S. Treasury’s Office of Foreign Asset Control.

Janis Kluge

The embargo on Russia’s import of technology has been a partial success. Sanctions on Russian oil and other commodity exports have reduced Russia’s revenues. Financial sanctions have complicated Russia’s external economic relations and raised its costs. It’s time to take a longer-run view of using sanctions to restrain Russia. Specifically, reduce the volume of Russia’s oil exports, keep West Siberian natural gas in the ground, and enable the outflow of hard currency from Russia.

“… Russia will remain a threat to U.S. interests, and especially to its allies in Europe, for many years to come. It is therefore prudent to take a long-term view of sanctions policy.”

“Designing the most effective set of sanctions, including the seizure of assets, is one of the few peaceful weapons within our arsenal.”

Joseph Stiglitz and Andrew Kosenko

Congress passed the Rebuilding Economic Prosperity and Opportunity for Ukrainians Act (REPO), which authorizes President Biden to confiscate Russian sovereign assets held in the United States and use the money to help rebuild Ukraine and stave off the Russian invasion. Biden should use this power—to shrink the Russian central bank’s balance sheet, potentially devalue the ruble and prompt bank runs within Russia, and weaken the bank’s ability to extend credit—which might ultimately undermine Putin’s military production capacity.

More on Russian sanctions

Robin Brooks, Ben Harris

June 26, 2024

Sam Boocker, Alexander Conner, David Wessel

June 17, 2024

December 29, 2022