Editor’s note: This post originally appeared on April 8 for the Health Affairs blog. View the original post here.

The Medicare Shared Savings Program (MSSP), Medicare’s main program for accountable care organizations (ACOs), has grown rapidly since it began in 2012. It added 89 new provider organizations earlier this year, bringing the total to over 400 Medicare ACOs across the country. About one in six beneficiaries in the traditional Medicare program now receive care from physicians, hospitals, and other providers participating in Medicare ACOs. The program continues to receive a high level of public and policymaker attention because of expectations that it may enable these health care providers to get more support for delivering higher quality care at a lower overall cost. The Department of Health and Human Services recently affirmed ACOs will be a core part of its efforts to transition to value-based payments in the years ahead.

In the initial years of the MSSP, however, the potential still mostly remains to be realized. As we noted in a recent post, early results show that the Medicare ACOs have achieved high quality in many areas, while only a quarter of the MSSP ACOs have been able to reduce spending enough to share in savings generated from their efforts so far. The Pioneer ACO Program has also experienced mixed results to-date, and as we describe below, may transition to a “next generation” ACO model.

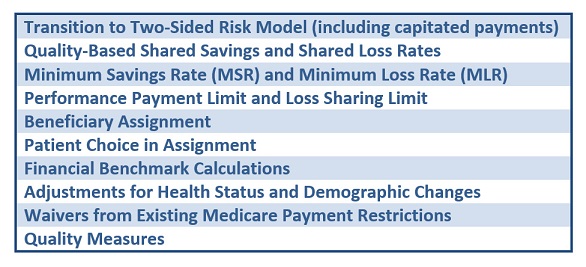

Given the high expectations and the many startup issues around Medicare ACOs, it is no surprise that the recent proposed rule for reforming the MSSP received a lot of attention. The proposal from the Centers for Medicare and Medicaid Services (CMS) described a broad range of changes in the ACO program (Exhibit 1), in what could amount to “Version 2.0” of Medicare ACOs. Along with about 300 other organizations, we submitted comments on the proposed rule. In this post, we review the major areas of proposed changes along with our views and some notable comments submitted by other groups. (We have also summarized many of these issues in a detailed chart.)

Exhibit 1. Major technical areas of public comment on the Medicare Shared Savings Program

As we have learned through six years of experience with our ACO Learning Network, the process of becoming and implementing an ACO is often cumbersome and uncertain. There is not a “one size fits all” model for an ACO; organizations have both different starting points and different opportunities to transform care based on their current capabilities. ACO successes to date appear to have been driven by a variety of factors, including ACO activities as well as market factors and regional differences (e.g., higher baseline Medicare spending). Given the early stage of empirical evidence on which factors are most important, and the benefits of keeping the program focused on delivering results rather than specifying how to get there, the next phase of the MSSP will continue to need to support organizations of varying size, experience, and other characteristics.

At present, however, many Medicare ACOs seem stuck in the early “shared savings” stage of moving away from fee-for-service (FFS) payment, which makes it more difficult to sustain significant reforms in the way care is delivered. To enable more meaningful improvements in care, the coming ACO reforms must provide a better path for ACOs to adopt more meaningful shifts in payment.

Many of our comments, and those from others, relate to five key themes that seem essential for program success: 1) creating greater certainty for program participants; 2) establishing a clear and achievable transition path to financial risk; 3) engaging patients; 4) aligning MSSP with other Medicare payment programs; and 5) taking lessons from commercial ACO.

Creating Greater Certainty For Program Participants

A primary concern across the broad spectrum of Medicare ACOs is the uncertainty currently associated with MSSP program participation. One source is the current method for calculating an ACO’s financial benchmark, which takes account of the variation of the health status of ACO patients in a restricted way, so that real improvements in financial and quality performance may not be captured accurately.

Consequently, we and others recommended that CMS transition the benchmark calculation over time to a blend of the ACO’s historical spending on the patients attributed to it and regional spending, eventually relying entirely on a regional spending benchmark as in the Medicare Advantage program. The Medicare Payment Advisory Committee (MedPAC) also proposed a benchmark with a similar transition, presenting a thoughtful approach that seeks to address both near-term sustainability of the benchmarking model and longer-term issues related to balancing historical and regional benchmarks.

Why not just start with regional benchmark? For one thing, that might be too much of a lift for some high-cost ACOs. For another, starting with a regional benchmark means that any low-cost provider organization could switch to the ACO program and get additional Medicare payments without changing their practice — which would mean higher costs for Medicare. However, ACOs that achieve persistently lower costs in their region should be rewarded financially, to encourage them to keep up their efforts and expand. These benchmark proposals aim to strike a good balance, and over time would align Medicare ACO benchmarks with Medicare Advantage benchmarks.

Another source of uncertainty involves the patients attributed to the ACO, for whom the ACO is accountable for improving results. In the current method used by Medicare for attributing patients, providers do not have a very clear picture which patients have been assigned to them until afterwards. For these reasons, we encouraged a transition to “prospective” attribution for all ACOs assuming two-sided risk, as well as the option of patient “attestation”—a patient declaration that a specific ACO is his or her primary provider—at the beginning of each performance year for these participants.

Some organizations, such as the American Hospital Association (AHA) and the Association of Medical Colleges (AAMC) along with a number of ACOs, suggested that such prospective attribution be extended to organizations in all tracks. However, we believe that this should be reserved for only those moving beyond shared savings to assume downside risk. This provides an incentive to make the transition to higher risk over time. It also reflects the reality that ACOs implementing more significant shifts away from FFS payment need to engage in more extensive steps with their patients to reform care.

We also believe that for all ACOs, CMS should adopt a full and up-to-date risk adjustment to account accurately for population health status; payments should accurately reflect changes in the health risks of the ACO’s beneficiaries. While this step would likely create opportunities for ACOs to increase payments in the short term simply by coding their beneficiaries’ comorbidities more completely, we believe this is outweighed in the long term by the benefits of encouraging ACOs to take steps to improve care and reduce costs for higher-risk patients. Significant “creep” in coding could be addressed by adjustments in overall payment formulas over time, rather than by discouraging ACOs from attracting and retaining higher-risk beneficiaries.

In addition, ACOs need more timely and readily usable Medicare claims data and attribution information to improve their ability to close quality gaps and avoid unnecessary costs. We encouraged CMS to provide claims data on a monthly schedule, rather than the current quarterly one, and continue assessing which data best capture real clinical improvement. We also suggested that CMS should develop enhanced communication channels for participants to work with CMS staff and better understand program expectations, deadlines, and long-term options. To make significant investments in improving care, program participants should be able to map out a multiyear strategy that extends beyond the three-year participation agreement.

These last steps would create more administrative burdens for CMS, which is why it’s important to limit the administrative costs and complexity of the program where possible. A number of other organizations, including the National Association of ACOs (NAACOS), have emphasized the importance of making MSSP attractive for a wide range of ACOs with varying levels of sophistication and experience through a significantly broader range of payment tracks and options. However, a large number of options for ACOs would make the program more difficult to administer consistently and clearly, and more difficult to keep up to date, and may not be worthwhile if many of the options do not represent significant paths away from FFS payment.

While we believe there should be a range of distinct ACO program options, we do not believe that organizations in the same financial track should be allowed to choose significantly different program conditions, such as national or regional benchmarks, prospective or retrospective attribution, levels at which shared savings or shared losses begin, and other factors. Rather, the MSSP should include a coherent set of options with clear features and conditions of participation that form a pathway for organizations to make meaningful shifts from FFS payment to population-based payment.

Establishing an Achievable Transition Path Away From Fee-for-Service Payment

The point of the Medicare ACO program is not simply to enroll organizations, but to provide a worthwhile alternative to FFS payment at one extreme and capitated Medicare Advantage payment on the other, enabling providers who could improve care in a different financing model to do so. To support this goal, MSSP ought to enable participating organizations that can succeed as an ACO to move to increasing financial risk over time in a predictable and logical way; while they need not move to full capitation, the ACO model should be different enough to enable reforms in care that are reimbursed poorly under FFS to be sustainable, without raising overall costs. This means that organizations must face new downside financial risk. Many organizations commented that it will require at least several more years to build the competencies necessary to do so, especially in the absence of greater certainty about a pathway to success. Thus, CMS needs to do more to facilitate and encourage the transition to greater accountability and financial risk.

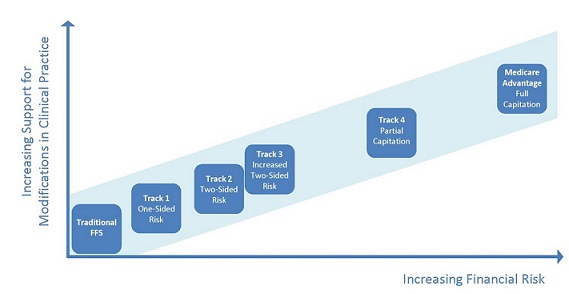

We appreciate the CMS proposals for a Track 3 for those ready to do so, and for waivers of some FFS reimbursement requirements, but we believe that these alternatives should not be viewed so much as separate “tracks” but as points along a spectrum moving away from FFS [see Exhibit 2 below]. This transition should be accompanied with greater “carrots” that may not be appropriate in FFS Medicare but should be available for organizations that show they can improve quality and lower costs.

For example, building on the regulatory waivers proposed by CMS, ACOs that take on risk should have more flexibility to provide remote monitoring equipment or other services that could add to costs in a FFS environment but that, if well targeted, could reduce costs while improving outcomes in an at-risk ACO. Similarly, we proposed a number of other regulatory reforms that are appropriate for ACOs that have moved further along the risk continuum, including lower thresholds for savings, increased regulatory flexibility, and more certainty about their patient population. To complete the pathway away from FFS, we proposed adding a Track 4 with a 50 percent capitated payment for historical Medicare Part A and Part B. This additional program option would support organizations willing to move to even higher levels for financial risk.

We applaud the recent announcement by CMS about the creation of the Next Generation ACO Model, which we see as a potential transition path for existing Pioneer ACO Program participants and other organizations willing and able to assume increased levels of financial risk. Like the Track 4 we previously proposed, the Next Generation model includes prospective attribution, refined financial benchmarking, the option of patient attestation, waiver from current FFS payment restrictions, and the option of moving to a capitated payment model. If well coordinated with the new MSSP, the Next Generation Model could be a mechanism for implementing our proposal to support ACOs that wish to move further away from FFS.

Integrating the Next Generation ACO Model with a set of finalized MSSP financial tracks to form a complete pathway would give ACOs more clarity and confidence about transitioning to increased financial risk over a reasonable time period. This would reinforce the Medicare ACO program’s shift from a startup program to a long-term program that can be well integrated with FFS and Medicare Advantage. A committed organization could enter at its comfort level and progress to a point that shifts significantly away from FFS where care is improving and cost growth is being slowed.

Exhibit 2: Proposed transition path to increasing financial risk in MSSP

Engaging Patients

Because patient engagement in their care is a critical part of achieving better outcomes, ACOs need more support to improve communication with, and engagement of, beneficiaries. More activated patients are critical for appropriate decisions about how, when, and where to seek care that is best for them, depending on their preferences and health status. There is increasing clinical evidence that informed and engaged patients can achieve improved clinical outcomes, patient experience, and satisfaction. However, while Medicare beneficiaries are notified that their providers are participating in an ACO, they have only limited opportunities and incentives to become active participants in ACO care.

To enhance beneficiary engagement in Medicare ACOs, we proposed expanding CMMI’s current pilot program for a select number of Pioneer ACOs to implement an “attestation model,” in which beneficiaries can affirmatively identify their ACO. We proposed implementing this approach for all ACOs that assume two-sided risk, along with a number of steps to administer this process effectively. We also strongly recommended that CMS allow additional incentives for patient participation in the ACOs, including waiving or reducing copays and deductibles for patients when they receive care from their primary care physician or other providers in the ACO.

These proposals for patient attestation and additional financial incentives are consistent with those from a number of other commenters and have been used effectively in non-Medicare ACOs. In conjunction with these beneficiary engagement steps, CMS should also support better beneficiary education around the goals and features of Medicare ACOs, and around how beneficiaries can work with their providers to improve care.

Aligning MSSP With Other Medicare Payment Programs

The MSSP is just one of a growing number and variety of payment reform models being implemented for Medicare patients. While this creates more potential for care improvement, it also creates more potential for administrative complexity and lack of alignment. Consequently, we proposed some steps for aligning MSSP processes and requirements with other payment models that support more person-focused care, such as the Bundled Payments for Care Improvement Initiative and the Comprehensive Primary Care Initiative. These payment models can reinforce the beneficial effects of ACOs, and for this reason they are often implemented with ACO reforms in commercial insurance plans.

Steps toward alignment among Medicare’s alternative payment models could include consistent quality measures, risk adjustment calculations, shared savings calculations, reporting mechanisms and requirements, data collection and dissemination, and other core elements of participation. In addition to aligning these programs, CMS should make it easier for ACOs to participate in multiple reform models. Creating a more cohesive payment reform strategy across Medicare’s payment initiatives could facilitate more learning and more innovation in improving care and lowering costs.

Taking Lessons From Commercial ACOs

While MSSP has already achieved higher quality its first three years, and some Medicare ACOs have achieved significant early savings, many ACOs have found that accountable care arrangements in the private sector can support greater innovation in care. One way, as we have noted, is through implementing ACOs in alignment with other payment reform options like medical home payments and bundled payment. Many commenters also noted that data and performance indicators are supplied more frequently and completely from commercial health plans — usually on a monthly basis rather than a quarterly or annual basis, with less of a lag time than CMS.

At the moment, while Medicare has a large number of shared-savings ACOs, the commercial sector seems to be leading in payment and contracting innovation that can enable larger shifts away from FFS payment with downside financial risk, and CMS should seek to reinforce these successful steps. CMS is already working to align performance measures that are appropriate for both Medicare and commercial populations, with an emphasis on shifting toward more outcome-oriented quality measures, particularly those that are patient reported. CMS should undertake efforts to further align CMS and commercial plans around data sharing, performance indicators, and multi-payer ACO reforms.

Next Steps

As a result of a thoughtful proposed rule that put many key issues on the table, along with the recently announced Next Generation ACO pilot, CMS has the opportunity to build on the early MSSP experience and create a more integrated accountable care. Medicare’s ACO initiatives have already attracted broad interest and contributed to growing certainty that payment is shifting meaningfully toward value in American health care. But there is still a long way to go, and the next step is for CMS to consider and act on the nearly 300 comments received.

While some details remain to be specified, the Next Generation ACO Model includes many of the steps describe here that could help providers move away from “shared savings”-only payment models and increase the impact of the program. This is important progress, and should make it easier for CMS to adopt complementary reforms in the “next generation” of the MSSP program as well.

But it is critical for CMS to provide a clearer pathway for all Medicare ACOs as soon as possible. Given the start of new MSSP participants affected by this rule in January 2016, the MSSP proposal needs to be finalized before summer to allow potential ACOs the time they need to make decisions and participate effectively. The steps already taken in the Next Generation ACO model, combined with the thoughtful comments on a wide range of issues discussed in the proposed rule, provide a foundation for timely and effective finalization by CMS. With more clarity based on the comments provided, Medicare ACOs can be a leading part of the shift to higher-value health care.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Changes needed to fulfill the potential of Medicare’s ACO program

April 8, 2015