This blog is based on a new report from the Social Policy Institute on the child tax credit. You can read the full report here. The blog was updated on September 29, 2021.

With COVID-19’s disruptions in employment, child care, and education, it is unsurprising that child poverty substantially increased in 2020—roughly 1.2 million more children were living in poverty in 2020 when compared to 2019 (an increase from 15.7% to 17.5%). As child poverty is unequally distributed in America, so too were its increases—poverty rates grew the most among Latino children (4.2 percentage points), Black children (2.8 percentage points), and children from female-headed families (4.1 percentage points), while they remained flat for white and Asian children.

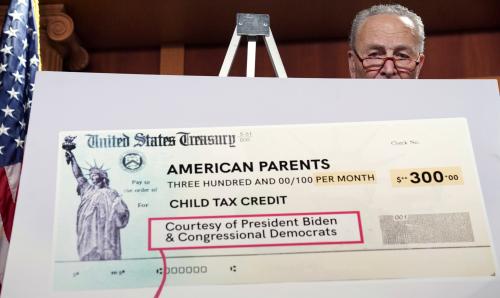

In response to these trends, President Biden signed a bill this March that restructures the child tax credit (CTC) for one year—making it larger ($3,000 per child between the ages of six and 17 and $3,600 per child under six), broader (gradual phaseouts start at $75,000 for individuals and $150,000 for those married filing jointly), and more periodic (monthly payments). This restructuring would allow the CTC to act like a child allowance, which has been used in a variety of other countries. While the new CTC officially launched in July of 2021, policymakers are already considering whether or not to extend the new CTC beyond 2021. Here, policymakers are not only considering the impact that the new CTC will have on child poverty, but also the impact that it could have on family social mobility.

Concerning child poverty and racial/ethnic equity, researchers from Columbia University estimate that the new CTC could cut child poverty by 45 percent and would have the largest impacts on Latino and Black children. Considering other outcomes, some scholars argue that the new CTC could disincentivize parental employment and thus curb social mobility, while other scholars argue the contrary: Cash payments can simultaneously decrease child poverty and increase mobility. Some scholars also suggest that policies like the CTC could increase birth rates, an important consideration given that recent declines in U.S. birth rates may pose both social and economic challenges such as reductions in GDP growth rates.

Our findings suggest that the child tax credit will not only act as a tool for decreasing child poverty in the short term, but also as a tool for increasing family social mobility in the long term.

As policymakers grapple with whether or not to extend the new CTC beyond 2021, it is important to understand how families will use the CTC payments. To inform these policymakers, we utilized a probability-based online panel to survey a nationally representative group of 1,514 U.S. parents eligible for the credit. The survey was administered immediately before the first CTC payments were delivered. One of the key questions we asked parents in this survey was how they planned to use their CTC payments. Our findings suggest that the CTC will not only act as a tool for decreasing child poverty in the short term, but also as a tool for increasing family social mobility in the long term.

Figure 1. Planned usage of the child tax credit

Source: Employment, Financial and Well-being Effects of the 2021 Expanded Child Tax Credit, Social Policy Institute.

Notes: n=1,056 – 1,078 respondents who anticipate receiving the CTC. Responses differ slightly across categories as some respondents skipped answering yes/no for certain categories.

Overall, 64 percent of eligible parents anticipated receiving the CTC. We examine how these parents planned to use these payments in Figure 1. The most common planned use was building emergency savings (75%), followed by paying for routine expenses (67%), essential items for children (58%), purchasing more or better food (49%), starting or growing a college fund (42%), and paying for child activities (42%), moving or making home improvements (32%), health care expenses (29%), child care expenses (26%), spending more time with children (20%), and purchasing gifts or entertainment (20%). Relatively few parents planned to use the CTC to pay for tutors for children (7%), working less or changing jobs (6%), or sending their children to a different school (6%).

In Figure 2, we look at the relationship between planned uses of the CTC and families’ income in 2020. Overall, we find that:

- Families across the income spectrum planned to use the CTC to build emergencies savings at similar rates.

- A greater proportion of lower-income families (76%) planned on using their CTC for routine expenses than middle- (64%) and higher-income (54%) families.

- A substantially greater proportion of lower-income families (75%) planned on using their CTC for essential items than middle- (52%) and higher-income (37%) families.

- A substantially greater proportion of lower-income families (66%) planned on using their CTC to purchase more or better food than middle- (44%) and higher-income (27%) families.

- A slightly smaller proportion of lower-income families (38%) planned on using their CTC to start or grow a college fund than middle- (42%) and higher-income (50%) families.

- A slightly greater proportion of lower-income families (45%) planned on using their CTC for child activities than middle- (44%) and higher-income (32%) families.

- A slightly greater proportion of lower-income families (29%) planned on using their CTC for child care expenses than middle- (24%) and higher-income (24%) families.

- A substantially greater proportion of lower-income families (28%) planned on using their CTC to spend more time with their children than middle- (16%) and higher-income (11%) families.

- A greater proportion of lower-income families (12%) planned on using their CTC to hire tutors for their children than middle- (5%) and higher-income (3%) families.

Figure 2. Planned usage of the child tax credit, by 2020 household income

Source: Employment, Financial and Well-being Effects of the 2021 Expanded Child Tax Credit, Social Policy Institute.

Notes: n=1,049 – 1,071 respondents who anticipate receiving the CTC. Responses differ slightly across categories as some respondents skipped answering yes/no for certain categories.

There are four main takeaways from these results:

- The results show that the new CTC will likely have the intended effect of alleviating child poverty, as seen in the relatively large proportions of respondents planning to use their CTC for emergency savings, routine expenses, essential items, purchasing more or better food, and paying for health care and child care expenses.

- The results show that the new CTC will likely increase social mobility both for families and their children. For example, when considering family social mobility, a relatively large proportion of respondents planned to use their CTC for moving and making home improvements or starting/growing a college fund for their children.

- While some fear that the CTC will disincentive work, this fear appears to be relatively unfounded, as only 6 percent of families planned on working less or changing jobs.

- These results show that low-income families planned to use the CTC to both cover the essential expenses for their households and children, while also commonly planning to use the CTC to build their emergency savings. This is important for promoting the financial well-being of these families, who often struggle with severe budgetary constraints and have very minimal amounts of emergency savings.

U.S. families, and low- and middle-income families in particular, must often manage tight budgets that make it difficult to build even modest savings and put them at risk of taking on high (and often expensive) debt burdens. Based on these results, it appears that the CTC will help give families a little more slack in their budgets to help them meet their essential needs, while also allowing them to make important investments in their children’s future, such as college savings or paying for extracurricular activities. Both of these functions may help improve children’s well-being both now and over the long term, and policymakers should consider these benefits as they debate whether or not to make the CTC permanent.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

The new child tax credit does more than just cut poverty

September 24, 2021