City, metropolitan area, and state leaders across the country continue to look for ways to re-energize the American economy and make it work better for more people. One way they are doing that is by looking to expand the nation’s advanced industries.

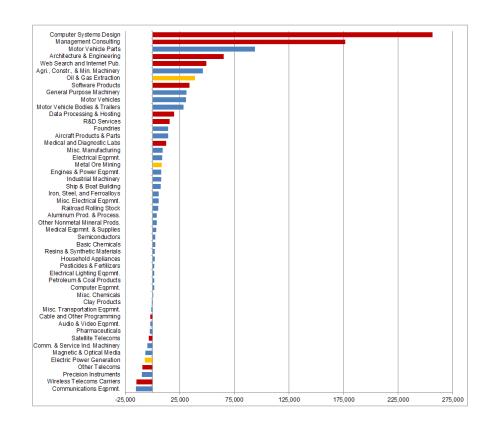

As defined and tracked by Brookings over the last few years, the 50 R&D- and STEM (science, technology, engineering, and math)-worker intensive industries that make up the advanced sector are going to be crucial in building a growth economy that works for all.

These high-value industries, ranging from auto manufacturing to high-tech services, play a huge role in developing and applying innovations that drive productivity growth necessary for increased living standards. In addition, the sector promotes inclusive prosperity because it pays well (including to the half of its workforce that lacks a college degree); supports long supply chains; supports local consumer spending; and helps other industries and firms to raise productivity and pay standards.

So how is this critical sector doing? The release today of a new Metro Program trend update and interactive data resource sheds some light on what’s been happening in the last two years. What emerges from the update is a mixed picture of progress and drift. Momentum continues in the manufacturing sub-sector, but the energy sector has slumped. And though high-tech services are booming, in aggregate the advanced industries growth base narrowed.

On the up side, continued growth of the sector—notwithstanding weak business investment, global headwinds for exports, and overall sluggishness of the expansion—gives cause for encouragement. Output growth across the 50 industries increased during the last two years even as employment growth remained positive and delivered 600,000 new jobs (11 percent of the national job total). Moreover, the truly dynamic and broadly dispersed growth of the advanced services sub-sector bodes well. Digital technology services are currently the most effective tools available for raising the nation’s productivity, and wages with it. That advanced services grew by nearly 4 percent a year between 2013 and 2015 to add 500,000 jobs in the recent period (80 percent of the aggregate advanced sector’s job creation) suggests the broad value and momentum of tech.

With that said, though, many of the trends revealed by this update are disquieting. Although half of the nation’s advanced industries gained momentum in the last two years, half lost it, and others among the growing industries were progressing only slowly.

In this regard, the slowing of manufacturing employment growth and the collapse of it in the energy sub-sector means that the advanced sector’s growth base has narrowed. Those slow-downs, combined with last week’s dreary output report from the Commerce Department, raise concerns about the durability of the current expansion. One takeaway: Regional and metropolitan economic development leaders may have less momentum to work with in the most important sector of their local economies going forward. That could complicate securing inclusive growth.

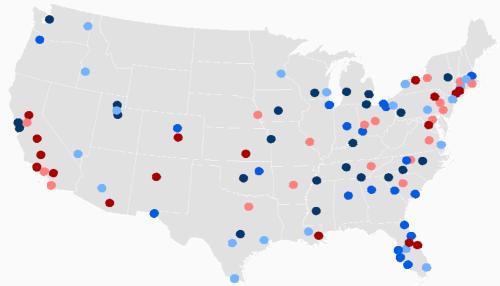

Similarly, the geography of advanced industries’ progress remains uneven. At the state level, momentum accelerated along the West Coast and in the Northeast (traditionally strong in tech services), and persisted in auto-centric Michigan and the Southeast. Energy states struggled.

Across the map of metros below, the distribution remained highly variegated. To be sure, most of the nation’s large metropolitan areas in most regions continued to produce advanced industry output and employment growth. All told, 80 of the largest metros experienced some degree of output and employment growth. With that said, output or employment growth was slowing in some 59 locations during the two years. In addition, the metro growth map depicts stark contrasts. Some 23 high-tech, southern, or manufacturing metros clocked annual advanced sector growth rates of 4 percent or more. By contrast, 14 disparate metros actually lost advanced sector jobs.

Moreover, the metropolitan “rich” got richer. While the 20 most advanced-sector-intensive metros accounted for 71 percent of the sector’s growth from 2010 to 2013, their share in the last two years grew to 80 percent. Likewise, while 47 large metropolitan areas (just under half of large regions) managed to increase the share of their output derived from advanced industries between 2010 and 2015, 53 actually grew less specialized in advanced industries. These trends mean that while a dynamic shorter list of metropolitan areas continued to make real progress towards an advanced economy that supports inclusive growth, half of the nation’s large metros were actually moving away from that vision. That drift should be deeply troubling for policymakers and city and metropolitan leaders. It means that fewer cities and fewer regions are deepening their participation in the industries that matter most for constructing broadly shared prosperity.

Given that, the new data—mixed as they are—clearly challenges metropolitan and state leaders to weigh a new round of strategies to stimulate, broaden, and sustain advanced industries growth. There is much work to be done to solidify and expand a key portion of the industry base that is going to be necessary to craft an advanced economy that works for all.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Economic inclusion requires a robust advanced sector, but too few of these industries are growing

August 4, 2016