As we discussed yesterday, one of goals of the Lee-Rubio proposal for a new child tax credit is to reduce the so-called parent penalty. We’ve already touched on the question of whether the government should try to eliminate this “penalty”—but it’s equally important to consider the following: how much is the government already spending on parents and children?

Government spending on children by income level

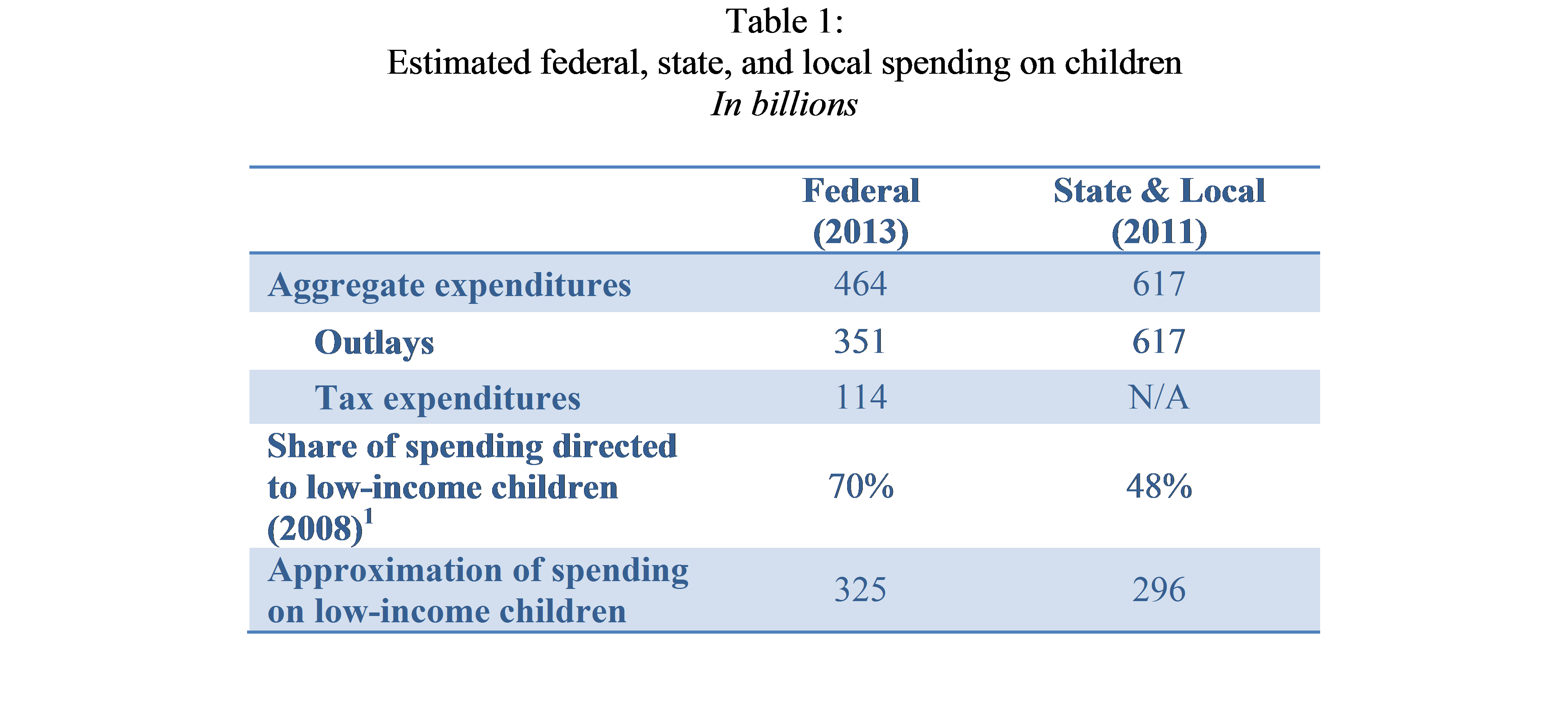

Federal expenditures on children in 2013 exceeded $450 billion. About three-quarters were in the form of outlays and the rest were tax expenditures, according to a recent Urban Institute Kids’ Share report. Nevertheless, expenditures are not evenly distributed among all children—about 84 percent of outlays went to low-income children whereas about 82 percent of tax expenditures went to higher income children in 2009. The Lee-Rubio proposal would tilt the tax scales even more in this direction.

At the state and local level, less than half (48 percent) of all spending goes to lower-income children, primarily because of the prominence of spending on K-12 education.

1 See Urban Institute report. Source: Authors’ calculations.

Government expenditures for families with kids vs. those without

Most government expenditures on children accrue directly to their parents in the form of tax breaks, health care, and education. If we make some simple assumptions, we can approximate how much the government subsidizes families with children.

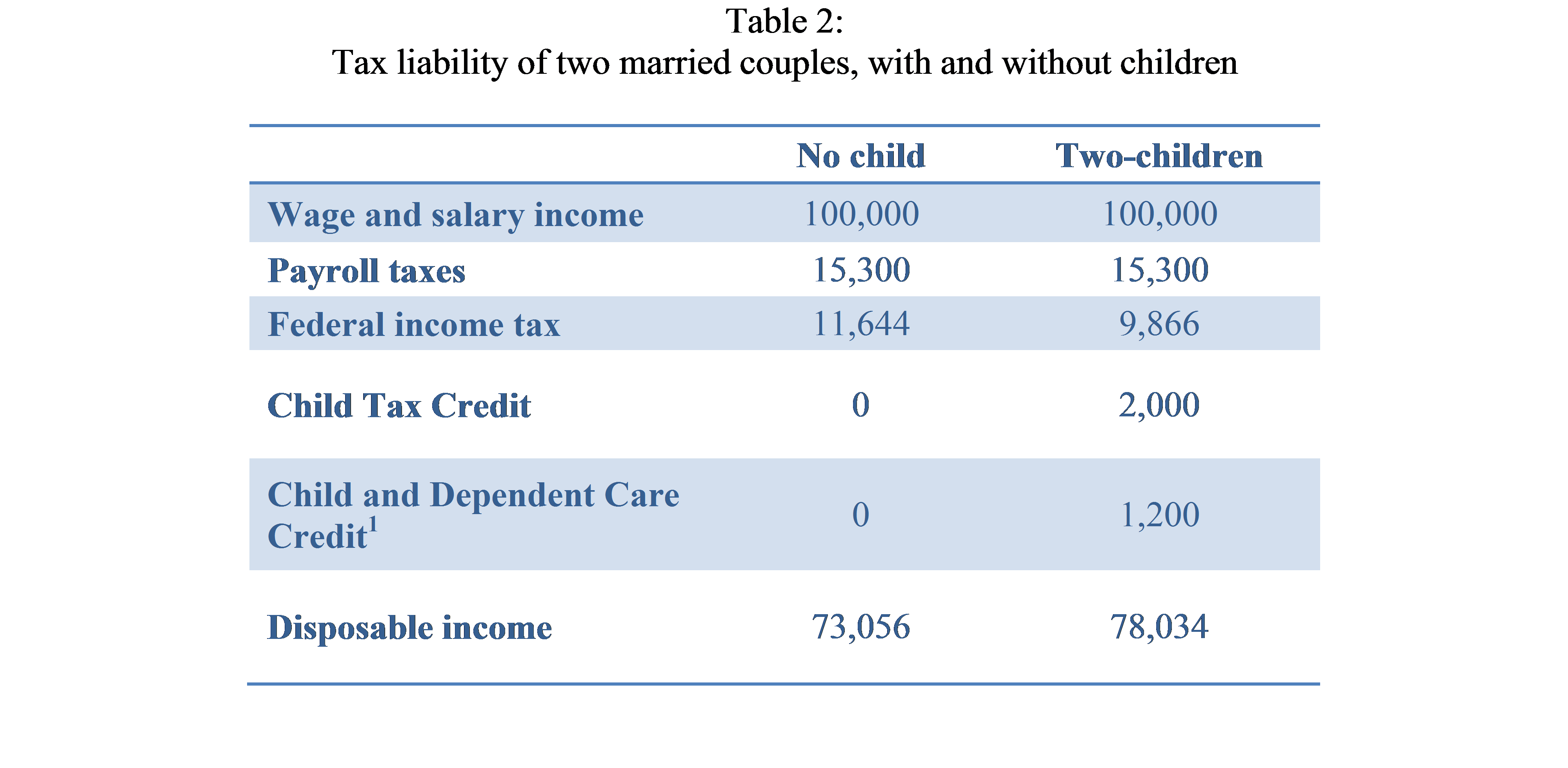

Imagine two, well-off married couples—one without children and one with two children—with annual combined earnings of $100,000. The parents received a $3,950 tax exemption in 2014 for each child, a $1,000 tax credit per child, and a child and dependent care credit as well (if they have child care expenses).

The bottom line is that the married couple with two children is left with about $5,000 more in disposable income than their childless counterparts (See table 2).

1 Note that this calculation assumes that the family spends at least $6,000 on child care and that both of their children are under the age of 13. Source: Authors’ calculations.

1 Note that this calculation assumes that the family spends at least $6,000 on child care and that both of their children are under the age of 13. Source: Authors’ calculations.

Up to this point, we have ignored one of the largest subsidies to parents: education. To the extent that our two married couples live in the same area and have largely the same earnings profile, they likely contribute about the same amount to education. And yet, only parents get to take advantage of public K-12 education.

Assuming our married parent couple sends their children to public schools, they are subsidized to the tune of about $10,000 per child, or $20,000 per year. If we added higher education spending, that would further inflate this number.

An expensive fix to an unclear problem

As even our simple example shows, the government does a lot to counter any alleged parent penalty. Even back-of-the-envelope calculations like those above suggest that parents receive thousands of dollars in assistance each year. For low-income families, it does even more through EITC payments, free and subsidized health care through Medicaid and the ACA, and a variety of safety net programs. These programs help to provide low-income children a stronger start in life. Whether the government should do more for relatively well-off families as Senators Lee and Rubio argue is less clear. What is clear is that someone else would have to pay for these very expensive benefits.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Is there a parent penalty?

April 17, 2015