This piece is the first in a two-part series by David M. Rubenstein Fellow Lindsey Ford discussing the dominant China debates in U.S. policy circles today. Read the accompanying piece here.

The common wisdom in Washington is that policymakers and experts have settled into a new consensus about China. Engagement is dead, long live strategic competition!

But ongoing policy debates suggest this consensus may not be as well-formed as it first appears. Beyond the desire for a new approach toward Beijing, there is still relatively little agreement on where to go from here. How should U.S. policymakers turn a relatively vague concept of “competition” into a more coherent set of policies? What objectives and assumptions should drive U.S. strategy? And what role are U.S. allies and partners willing to play in this new approach?

Unfortunately, many of the past year’s China debates provided few answers to these questions. Instead, the U.S.-China narrative has often mired down in increasingly stark disagreements over history, ideology, grand strategy, and geoeconomics. The flaw of many of these debates is that they miss the center of gravity when it comes to managing China’s rise. “Competition” does not necessarily require a unified vision of the sources of Chinese conduct, but it does require a deeper consensus on how the United States will define its own role in the Indo-Pacific region and a firmer consensus with allies and partners about how to align our political and economic strategies.

To advance the China debate in 2020, the focus of the conversation needs to move away from Beijing. It needs to move back to the United States, its allies, and the complex policy decisions they face to build a more unified coalition. Here and in an accompanying piece, I explore how to refocus 2019’s key debates in a new direction for 2020.

An “us or them” choice for U.S. partners?

Few topics merited as much coverage in 2019 as the Trump administration’s wide-ranging push to keep Huawei out of U.S. and allied 5G networks. For many foreign partners, the 5G debate underscores a growing concern: Deteriorating U.S.-China relations will force smaller nations to “choose” between relations with Washington and Beijing. As Singaporean Prime Minister Lee argued: “If you ask them to choose and say ‘I therefore must cut off my links with my biggest trading partner’…you will put them in a very difficult position.”

Publicly, U.S. officials have worked to assuage partners’ concerns, repeatedly emphasizing that the United States is not issuing an “us or them” partnership ultimatum. Privately, some have expressed exasperation, arguing there is no evidence to substantiate these repeated complaints. After all, U.S. allies and partners continue to maintain trading relationships, political dialogues, and even some military cooperation with Beijing.

However, the underlying sentiment behind not wanting to “choose” has far less to do with overarching strategic alignment and more to do with day-to-day policy choices. The fear for many countries is that the tension around the Huawei 5G debate is only the tip of the iceberg. Growing divergence between the United States and China is likely to present smaller nations with a more difficult choice set on a range of issues. Which countries should be able to invest in your critical infrastructure? Which U.N. resolutions merit your support? And what types of trade agreements or loans do you want to pursue?

In a world in which the United States and China increasingly disagree on such questions, smaller partners find themselves in a tough spot. The United Kingdom’s recent attempt to split-the-baby on their 5G decision, and the U.S. response, highlights why U.S. partners remain concerned. Despite a relatively muted official response from the Trump administration, further statements from U.S. officials indicated Washington’s displeasure, even suggesting: “our special relationship is less special now.” Such reactions only reinforce partners’ worst fears about zero sum dynamics between Washington and Beijing.

To shift the conversation for 2020, the policy debate needs to move beyond an unhelpful focus on binary alignment choices toward a deeper dialogue about the practical challenges that China’s influence poses for alliance management. Building a more resilient coalition between the U.S. and its allies and partners will certainly require renewed efforts to align the building blocks of our China policies. But it will be just as important to more proactively manage the times when we disagree. Given the often sizable differences in allied threat perceptions and economic interests, such disagreements will be a frequent fact of life. Public and visible discord between allies is also an opportunity Beijing has proven willing and eager to exploit.

The policy debate needs to move beyond an unhelpful focus on binary alignment choices toward a deeper dialogue about the practical challenges that China’s influence poses for alliance management.

To address this problem, the U.S. and its partners need to candidly assess the range of bilateral friction points they are likely to encounter. How are respective governments delineating between the competitive and cooperative aspects of relations with Beijing in areas such as trade and technology? What principles are countries employing to guide these choices and what risks will divergent policies pose for the bilateral relationship? For example, if universities in Australia or Germany partner with Chinese entities on high-tech research projects the United States deems as sensitive, what implications does this have for allied research and development? Engaging in these conversations much earlier, more frequently, and more quietly may help avoid some of the allied discord that has undermined the administration’s 5G narrative.

Beyond these questions, the United States also needs to think more creatively about how to help smaller allies and partners offset the risks they are likely to face when they do align with the United States on sensitive issues. As Australia, the Republic of Korea, and Canada have all been painfully reminded in recent years, China is far more likely to retaliate against weaker allies than directly against the United States.

While Beijing hasn’t done itself any favors with its bullying behavior, U.S. policymakers can’t reasonably expect partners to take on significant risk without an assurance they won’t be left flapping in the wind. Collectively, the United States and other partners should begin discussing not only how to reduce economic vulnerabilities in the long term, but also consider new coordination mechanisms that would facilitate a more unified response to China’s use of coercion in a crisis.

The great “decoupling” debate

The prospect of a looming “de-coupling” between the United States and China, a topic that would have once been deemed too fringe for mainstream analysis, emerged as one of the hottest narratives of 2019. Major newspapers and journals, former officials, and think tanks all debated the prospect of an economic unwinding between Washington and Beijing. The Trump administration has pushed back against accusations of a forced decoupling, with Vice President Mike Pence arguing: “People sometimes ask whether the Trump administration seeks to ‘de-couple’ from China. The answer is a resounding ‘no.’” Chinese officials have decried the idea as well, with former Minister of Commerce Chen Deming proclaiming, “To hell with decoupling!”

Yet for many analysts, these statements ignore reality. Various metrics suggest that some degree of decoupling is in fact underway. Analysis by the Rhodium Group shows Chinese foreign direct investment in the United States plummeted 88% between 2016 and 2018. Similarly, in a 2018 survey of U.S. colleges, nearly 50% reported falling numbers of new incoming students from China.

And it is hard to examine policies such as the Trump administration’s tariffs or the U.S. Foreign Investment Risk Review Modernization Act (FIRRMA) of 2018 and argue that some amount of selective decoupling is not the obvious result. For many U.S. national security experts, this is in fact the intended result, as part of a broader effort to protect America’s innovation base and national security interests. However, limited decoupling in certain sectors is not equivalent to alarmist headlines decrying an unwinding of the American and Chinese economies. It’s also far less than a wholesale retreat from relations with Beijing that some have advocated.

How can we best advance a more productive discussion about decoupling moving forward? First, we should focus on how best to manage targeted decoupling in a way that protects U.S. advantages without unnecessarily undermining its openness. This should include further efforts to reduce vulnerabilities in U.S. supply chains and diversify U.S. economic ties. But it must also be accompanied by a robust debate about the steps needed to forge a new consensus with allies and partners around high-standard international trade. Without a better plan to build meaningful new agreements and technical standards alongside allies and partners, “decoupling” will leave the United States less competitive and more isolated.

Relatedly, it’s necessary to further assess the potential for China’s growing influence to dilute the effectiveness of America’s economic deterrence tools, such as sanctions policy. This too has the potential to emerge as a wedge issue between the United States and its allies. Two years of an economic pressure campaign have produced few signs of meaningful reforms from Beijing. In the meantime, U.S. sanctions policy has unnecessarily put it at odds with some of its closest friends. Close allies in Europe have explored potential workarounds to circumvent Washington’s sanctions on Iran, though these efforts have largely failed. India, a close U.S. partner, and Russia recently agreed to a new mechanism for arms deals using national currencies in a similar effort to avoid U.S. sanctions. In a world in which China is actively developing mechanisms aimed at providing countries with an alternative to the U.S. dollar, the Trump administration’s penchant for strong-arm sanctions tactics will become a growing liability. Even if China’s efforts to circumvent the dollar do not bear fruit right away, Washington’s unilateralism helps Beijing advance its narrative that new alternatives are needed. It’s important to begin working more closely with U.S. allies to reckon with this challenge and avoid weakening the coalition the U.S. will need to preserve its financial influence.

Finally, we need more analysis of the risks of reduced interdependence in certain sectors. In the short-term, this will require careful thought about the pace at which U.S. companies can alter existing suppliers, investments, and markets without damaging their own competitiveness. The Department of Defense’s recent pushback against proposed rules further limiting U.S. sales to Huawei highlights the challenge policymakers face in this respect. Secretary of Defense Mark Esper recently acknowledged the difficulty of striking the right balance, stating: “You have to be very conscious of not just your first-order effect — that’s the easy thing — it’s the second- and third-order effects.”

Some second-order effects to consider are the potential long-term risks of super-charging Chinese “self reliance” and innovation. Beijing has already surprised U.S. policymakers on more than one occasion with its ability to generate indigenous technology advancements more quickly than expected. And over the past year, the calls for ziligengsheng, or “self reliance” have been growing. It may be necessary to reduce reliance on Beijing in certain areas, but the United States and its allies must carefully explore the risks of a future in which they have less leverage against a more capable, less interdependent competitor.

Alliance adjustments

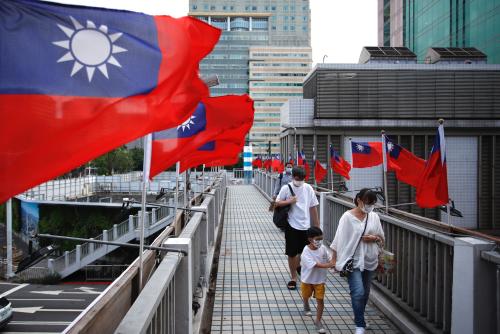

Much attention has been given — rightly — to the enormous structural changes that have occurred in the U.S.-China relationship over the past decade. It’s just as important to remember, however, that China’s relationships with close U.S. allies and partners have shifted just as dramatically.

For example, European exports to China have more than doubled over the past 10 years, increasing from 78 billion euros in 2008 to 210 billion euros in 2018. In spite of its lack of formal alliance relationships, China has moved assertively to ink strategic partnership agreements with almost all of its immediate neighbors in the Indo-Pacific region. And in the security sphere, it is U.S. ally Thailand that now conducts more military exercises with China than any other Southeast Asian nation.

Recent polls suggest many allies and partners have deep concerns about Beijing’s behavior and its potential influence on the global system. But the fact that some of these same partners also express deep-seated concerns about U.S. reliability is a problem. The U.S. alliance network was designed at a different moment in time, with a different competitor in mind. It will now need to be adapted to better contend with the new realities of Chinese global influence. The past three years have put a glaring spotlight on the potential for China’s rise to create wedges and expose weak points in America’s alliance networks. Focusing on how to better manage these challenges is the de-coupling conversation we need to be focused on in 2020.

Commentary

Refocusing the China debate: American allies and the question of US-China “decoupling”

February 7, 2020