African and international development agendas—including the African Union’s Agenda 2063, the African Development Bank’s (AfDB) High 5s, and the Global Sustainable Development Goals—all underscore the importance of industrial policy to economic development. So how can African countries and their development partners finance and fully implement the policies necessary to advance their industrial agendas? And, moreover, what opportunities and practical challenges do African policymakers encounter as they work to promote industrialization?

To shed light on these questions, the AfDB released its latest publication, Industrialize Africa: Strategies, policies, institutions and financing, on November 20—coinciding with Africa Industrialization Day. Sixteen authors contributed to the report,[1] which examines industrial strategy and policy in Africa, as well as lessons learned from other developing countries, such as China and South Korea. The foreword, written by AfDB President Akinwumi Adesina, identifies industrialization as crucial to achieving structural transformation, economic diversification, and many of the targets set by the Sustainable Development Goals.

The report provides an in-depth look at the notable case of Ethiopia, which has “experimented” with a wide array of industrial policies, according to chapter author Arkebe Oqubay, Minister and Special Advisor to the Prime Minister of Ethiopia. For example, in the capital-intensive, import-substituting cement industry, the government took an activist and strategic role in designing a vision for the sector, allocating resources to the industry, and mobilizing society and developmental partnerships to support the industry. As a result, Ethiopia was able to increase its installed cement-producing capacity fivefold between 2005 and 2016 as well as enhance employment in the construction and transport sectors, which have linkages to the cement industry.

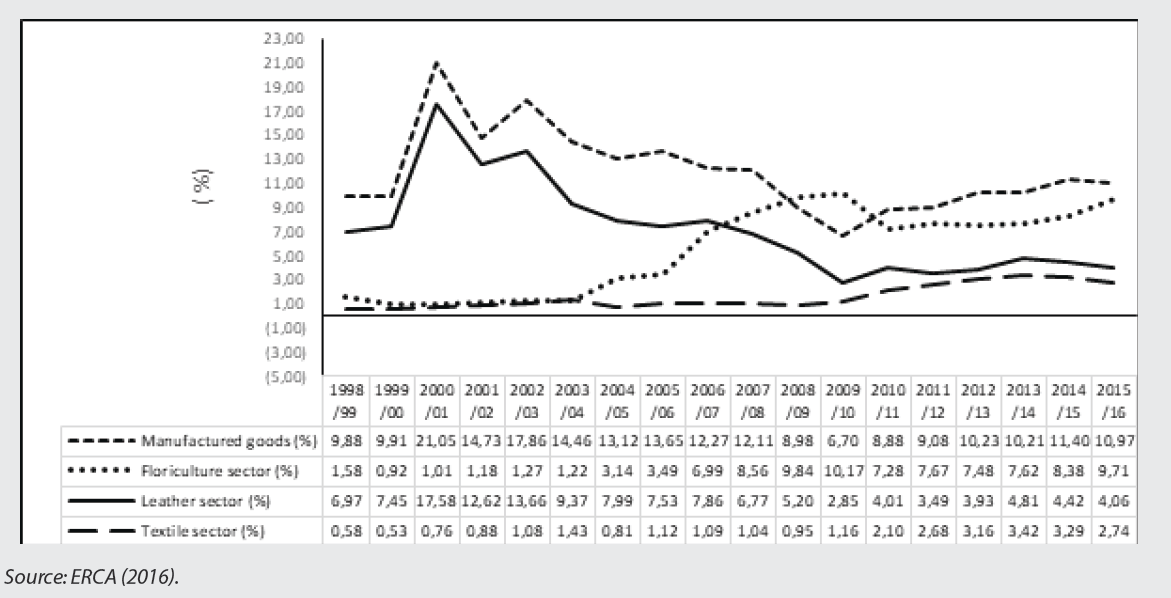

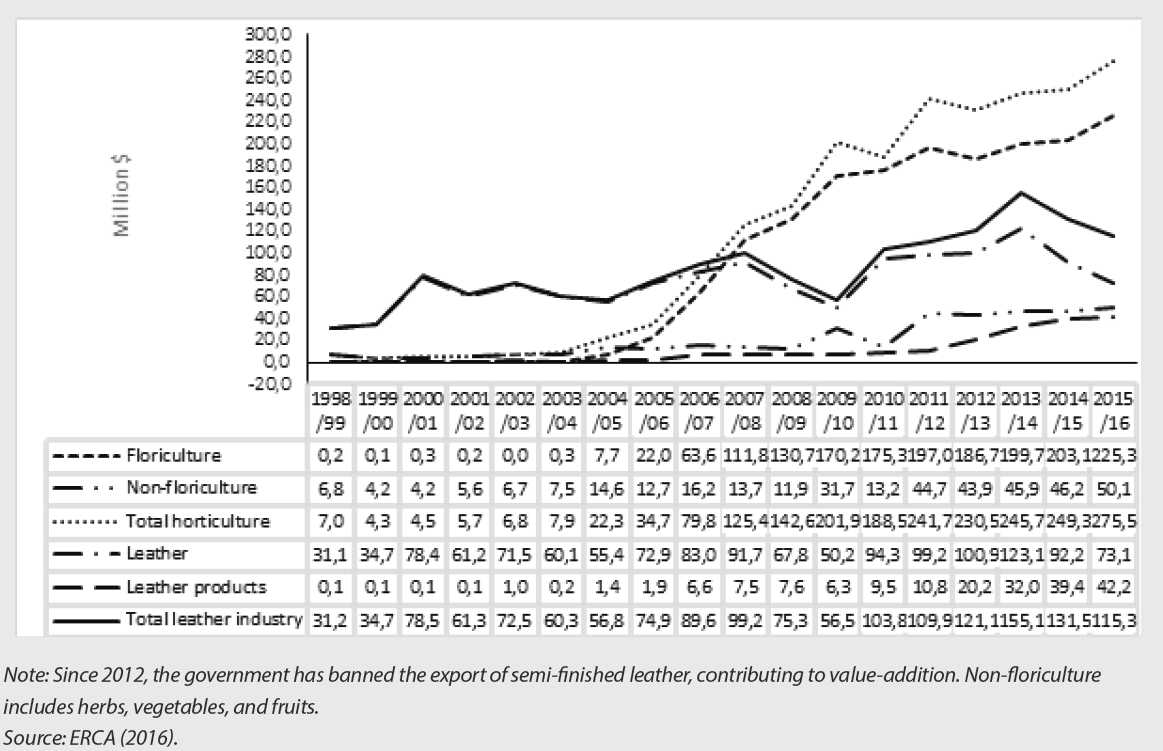

Two export-oriented industries—the labor-intensive leather/leather products industry and the floriculture industry—have also both been among the government’s long-standing priority industries. However, the two industries have diverged in their outcomes in terms of employment, output, export, and value addition, according to Oqubay. Figures 1 and 2 below illustrate that, while floriculture has seen dramatic growth in exports in the past decade, exports of leather and leather goods have experienced more volatile growth owing to insufficient backward linkages with small-holder livestock farmers and weak government engagement with the industry due to the fragmentation of firms. “This highlights the importance for policymakers of understanding and engaging with the interactions and dynamics of specific industries and global value chains, maximizing linkage effects, and having a deep understanding of politics/political economy,” Oqubay notes.

Figure 1. Export shares of manufacturing sector by export value (percent)

Figure 2. Exports of floriculture and leather/leather products (million $)

The report further elaborates on the relationships between industrialization and global value chains, the digitized global economy, infrastructure development, building economic complexity, industrial parks, as well as trade and other important topics.

To learn more about the linkages between industrialization and regional trade, please see the latest post by AGI David M. Rubenstein Fellow Landry Signé: 3 things to know about Africa’s industrialization and the Continental Free Trade Area.

end notes

[1] Authors include Brookings Global Economy and Development Senior Fellow John Page and AGI Non-resident Senior Fellow Haroon Bhorat, among other famous economists.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Figures of the week: Implementing African industrialization strategies

December 1, 2017