Russia’s use of the shadow fleet to circumvent sanctions

The G7 (plus Australia) imposed a price cap on Russian oil in December 2022 to limit Russian revenue from energy exports. The sanctioning coalition enforced this cap by requiring Western companies providing key oil trade services—including shipping, insurance, financing, and flagging—to verify that the trades in question complied with various caps on oil exports. In response, Russia heightened its efforts to amass a “shadow fleet” of tankers that could be used to move oil without depending on Western companies and thus avoiding the imposed price ceilings.

A focal point of the shadow fleet strategy is to obscure the ownership of the fleets’ tankers and to mask the origin of the Russian oil those ships carry. To do this, Russia employs a host of deceptive maneuvers, such as repeated ship-to-ship transfers of liquid cargo, blending oil from multiple countries, spoofing ships’ location data, and automatic identification system blackouts. Russia has also devoted unprecedented resources to purchasing aging ships from Western companies, obscuring the Russian ownership of those vessels through complex schemes involving shell companies and frequent reflagging of ships, among other measures.

Russia’s shadow fleet buildup has been a double-edged sword. On one hand, amassing such a large fleet has been costly, especially for a country with a deteriorating economy—the Kyiv School of Economics estimates that Russia has spent roughly $10 billion purchasing various tankers for its fleet since 2022. But the proliferation of the shadow fleet has also enabled Russia to trade around the price cap, maintaining revenues and preventing its economy from a full-scale collapse. And since most of the Russian shadow fleet is very old by typical tanker standards and insured by disreputable companies, the fleet also presents serious environmental and fiscal risks for the jurisdictions through which it passes—particularly in the event of a spill.

In the following section, we document the ownership history of a spate of recently sanctioned tankers, finding that almost 60% were sold to the shadow fleet by Western European owners, with operators in Greece being by far the most frequent sellers.

Tracing the ownership history of Russia’s shadow fleet

On January 10, the United States sanctioned 183 Russian-controlled vessels, the vast majority of which are oil tankers, including 75 ships which were identified as belonging to the shadow fleet. (Although various jurisdictions disagree on the precise definition of a shadow tanker, common characteristics are that the vessels regularly employ evasive tactics and belong to entities in non-Western countries).

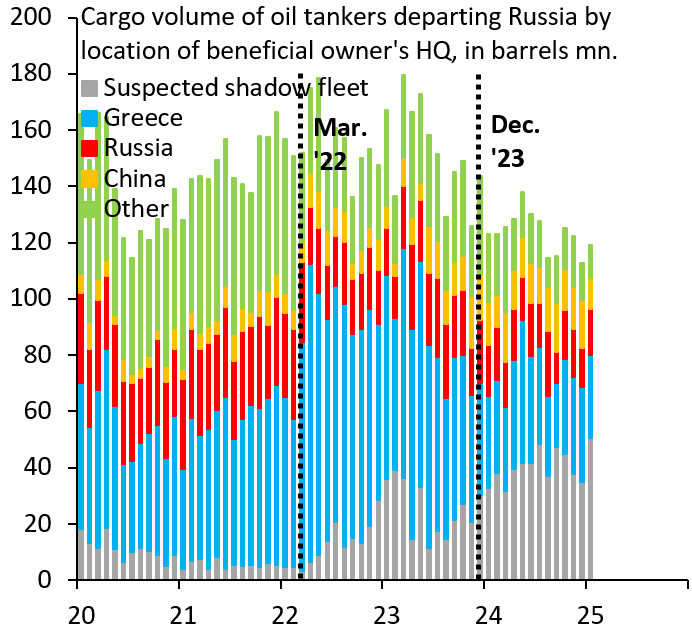

We have been tracking oil tanker traffic out of Russian ports since Russia’s invasion of Ukraine. Those data are taken from the Bloomberg AHOY database, where—for purposes of exposition—we define the shadow fleet as ships without a clear (beneficial) owner. The importance of such ships has risen sharply in the wake of the invasion, reaching 35% on average over the past three months, up from an average of roughly 6% in the years before the invasion.

Figure 1. Cargo volume of oil tankers departing Russia by location of beneficial owner’s headquarters, in millions of barrels

Source: Bloomberg

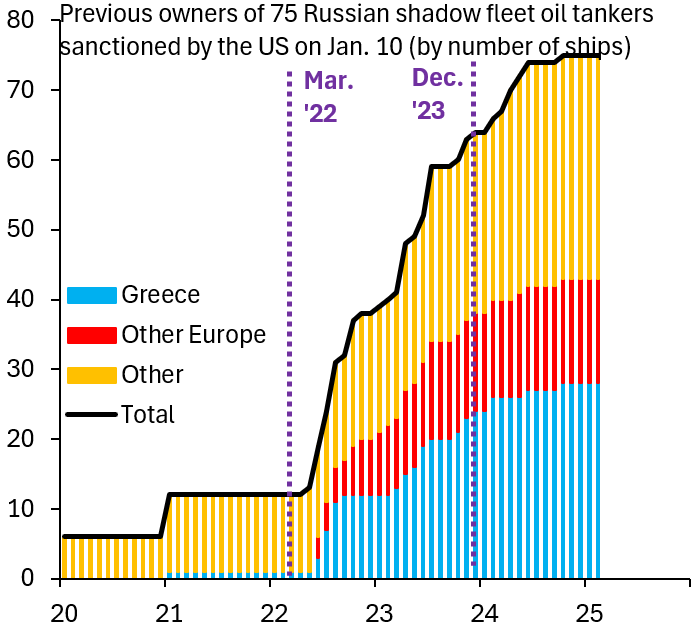

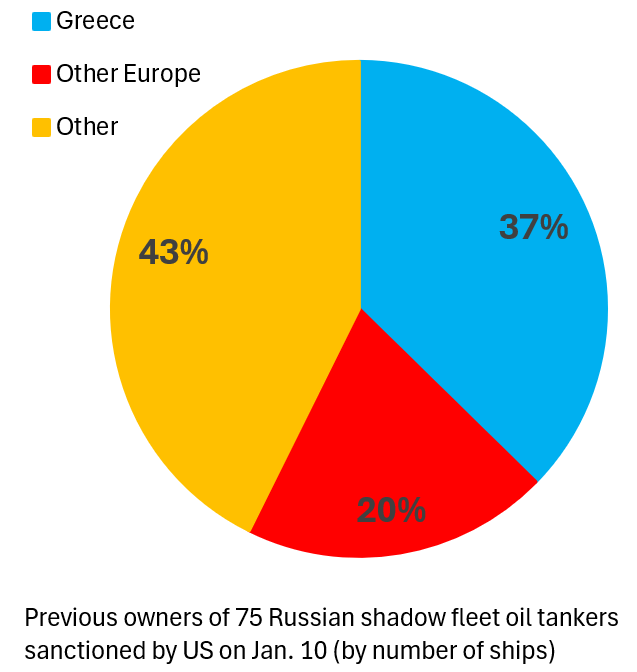

Unlike Figure 1, which proxies for the shadow fleet, the January 10 U.S. treasury announcement actually identifies 75 shadow fleet ships by their International Maritime Organization (IMO) codes. We now use Bloomberg data and these IMO codes to trace the ownership history of these vessels, identifying when and by whom these ships were sold to the shadow fleet. Figure 2 shows how the 75 ships were accumulated over time, with a flurry of transactions starting immediately after the invasion of Ukraine and continuing well into 2024. Just under 60% of these ships were sold by owners in Western Europe (Figure 3), with Greek owners by far the single biggest seller (consistent with a recent report by the European Parliament that finds a similarly large role for Greek ship owners). The remaining 40% are spread across a number of countries including India, Indonesia, Malaysia, Singapore, and Vietnam. The pattern contrasts with the fleet’s pre-invasion composition, in which virtually none of its tankers originated from European countries.

Figure 2. Previous owners of 75 Russian shadow fleet oil tankers sanctioned by the US on January 20, 2025; by number of ships

Source: Bloomberg

Figure 3. Previous owners of 75 Russian shadow fleet oil tankers sanctioned by the US on January 20, 2025; by percentage of ships

Source: Bloomberg

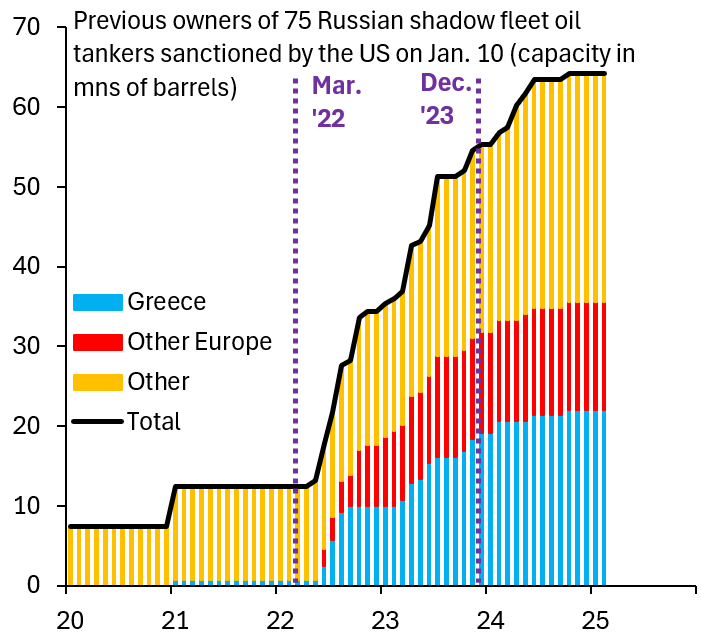

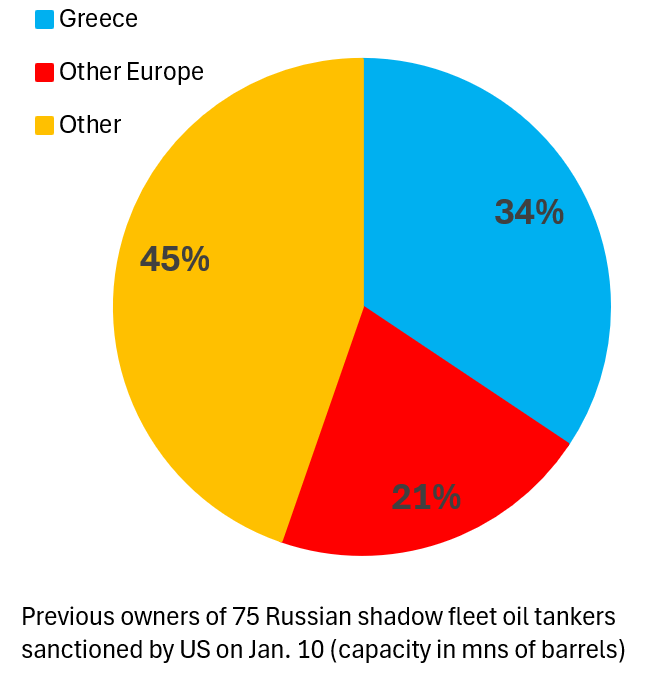

We also collect data on the capacity of each of these ships. Overall, their total capacity amounts to 64 million barrels of oil, with most of this capacity deriving from tankers previously owned by Greek or other European entities (Figure 4). Greek shipping companies remain the single biggest supplier of ships to the shadow fleet, and operators from Western Europe as a whole supply two-thirds of the shadow fleet shipping capacity (Figure 5).

Figure 4. Previous owners of 75 Russian shadow fleet oil tankers sanctioned by the US on January 20, 2025; capacity, in millions of barrels

Source: Bloomberg

Figure 5. Previous owners of 75 Russian shadow fleet oil tankers sanctioned by the US on January 20, 2025; by percentage of capacity

Source: Bloomberg

The frequent sale of Western-owned oil tankers—especially by Greek companies—has materially undercut the price cap on Russian oil. As a result, the price cap coalition should consider banning the sale of tankers to Russian-owned entities, as well as entities whose provenance cannot be verified. Such a move would be a natural evolution of the European Union’s 12th sanctions package, passed in December 2023, which pledged to “monitor” oil tanker sales to third countries. By limiting the size of the shadow fleet, the coalition will markedly improve sanctions’ efficacy and further destabilize the Russian economy. And—with the future of the price cap coalition now in doubt—unilateral EU measures to curb the shadow fleet in the Baltic may be a way to gain leverage over any peace negotiations in Ukraine.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Where did Russia’s shadow fleet come from?

February 27, 2025