The Vitals

Democratic presidential candidates are proposing using a financial transaction tax (FTT), a tax on buying and selling a stock, bond, or other financial contract like options and derivatives. Taxing stock trading is not new. In fact, America already has an FTT, albeit extremely small: currently set at roughly 2 cents per $1,000 traded. Dozens of countries impose FTTs at varying levels covering not just stocks, bonds, and derivatives, but sometimes real estate.

FTT proponents highlight its progressivity (the rich pay more), its voluntary nature (don’t want to pay? don’t trade), and its ability to discourage unproductive high frequency trading. Critics argue the tax harms savers and investors, reduces economic growth, and fails to raise promised revenue by driving activities to lower taxed areas overseas. Recent stock market volatility due to the coronavirus has roughly doubled the amount of stock trading on a daily basis.

-

The Congressional Budget Office predicts a 0.1% financial transaction tax, equivalent to $1 per $1,000 traded, will generate $777 billion of new revenue over 10 years. This is the rate proposed by many Democratic candidates and in Congress.

-

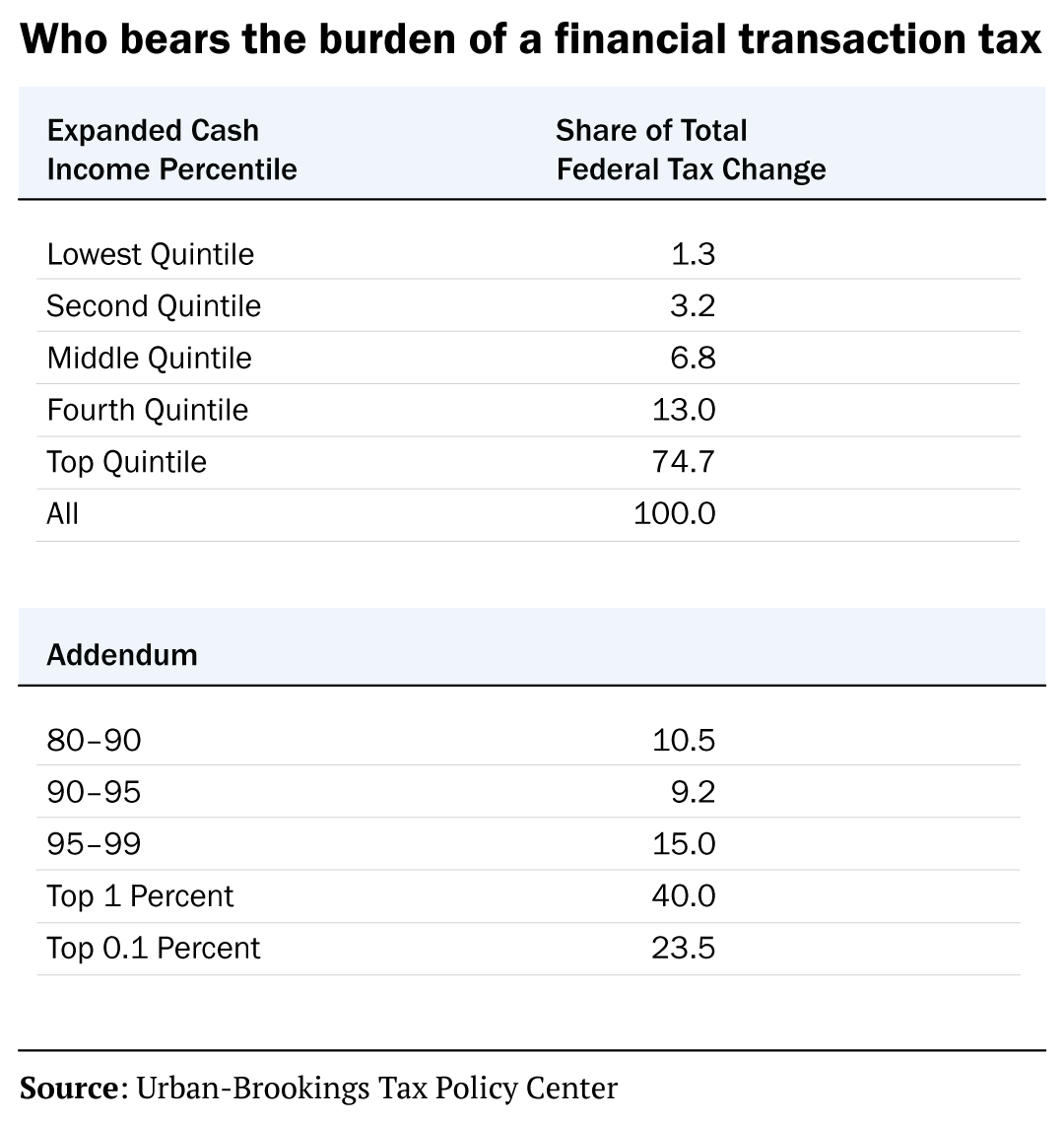

The Urban-Brookings Tax Policy Center predicts that top 1% of American households would pay 40% of the total amount of the tax. The bottom 60% would pay just over 11% of total revenue.

-

Over half of Americans own an IRA at a median value of $60K, and just under half of those assets are in mutual funds. As portfolios adjust, they pay FTTs and investors, even those who don’t own individual stock directly, would be impacted.

A closer look

How much revenue could an FTT raise?

It depends. The CBO revenue projection predicts that a 0.1% tax raises $777 billion over 10 years, accounting for 0.5% of GDP. That’s significant, about equal to the revenue generated by all excise taxes including gas, tobacco, and alcohol. Critics believe that these projections are overly optimistic, and do not taking into account reductions in trading or the potential for activity to move overseas to escape the tax. Exactly what trading would be reduced, and by how much, is critical. It is difficult to believe that investors changing their opinion on the fundamentals of a company or the economy would alter behavior on the basis of such a small tax. However, a lot of trades are made by extremely short-term traders, some guided by algorithms.

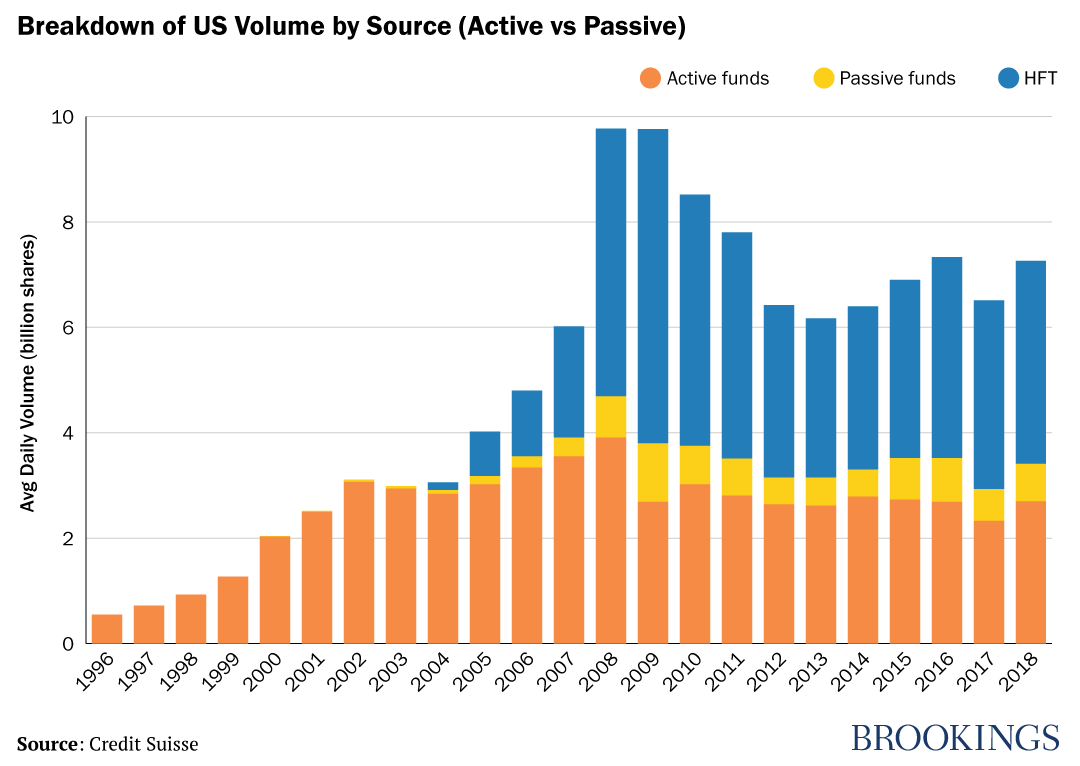

Supporters of the tax believe it will discourage market activities that

are unproductive and rent seeking. For instance, the tax should eliminate certain high frequency trading (HFT) for trades that would not be profitable paying taxes

at this rate. HFT requires both a purchase and a sale, in very rapid

succession, so they would pay the tax twice (buying and selling). Thus,

anything that produces less profit than $2 per $1,000 traded would cease to be

profitable under a 10- basis point FTT. High frequency trades account for a

large share of financial transactions, a trend that has grown substantially.

Some argue that HFT increases market volatility without contributing meaningful price discovery and

that discouraging this trading is a good thing. Others argue that HFT provides meaningful

liquidity to markets, lowering trading costs for everyone.

An FTT encourages longer-term investments by emplacing a higher cost of trading. Indeed, this was the rationale that the late James Tobin, a Nobel laureate, used back in the 1970s when he proposed a transaction tax on currency trades that he called “sand in the gears.”

Some argue this would be a

helpful counterbalance to the rise in short-term trading and promote the

incentives of longer-term equity investment.

Others, like the Securities Industry and Financial Markets Association (SIFMA),

argue that it causes capital to

become less productive by discouraging trading.

Everyone agrees that America’s capital markets are essential to connect

savers and investors to uses of capital and underpin our economy’s ability to

grow. America is more reliant on capital markets like stocks and debt, as

opposed to bank lending. According to SIFMA,

capital markets fund 65% of economic activity in the United States. As a share

of GDP, the U.S.’s value of listed equities is 2.5 times larger than Europe’s,

which relies more on bank lending. If debt and equities become more expensive,

the cost of this funding source rises, and in the extreme, some companies may

be unable to fund economic projects, or turn to bank loans which would not be

subject to this tax.

Increases in the current FTT have not impacted trading. Congress

altered the FTT in 2001 from a fixed level to one that varies with the required

budget for the Securities and Exchange Commission, which is approximately $1.75

billion. In the almost two decades there has been no observed impact on stock

trading as a result of changes in the FTT. That said, the fee has always been

so small that changes may not be relevant to what would occur at a higher

level.

International experience

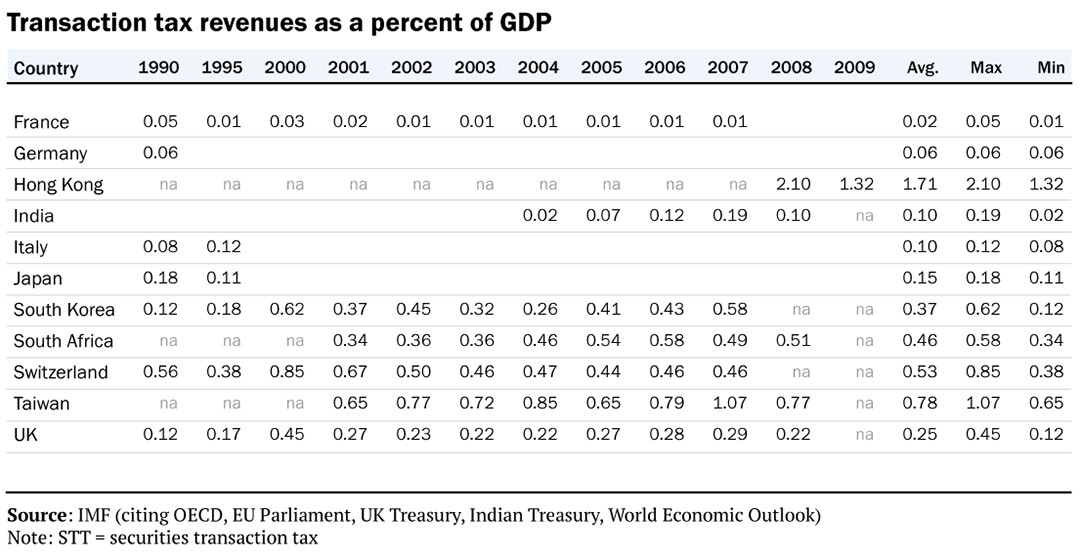

Many countries have FTTs at varying rates. Hong Kong’s raises over 1.7% of GDP in revenue (that would be roughly equal to 10% of total federal taxation in the U.S. based on current revenue as a share GDP). Several countries attempted large FTTs in the past and experienced significant capital migration as this SIFMA report documents. Notably, Sweden’s tax in the 1980s resulted in half of all equity volumes migrating by 1990. By 1991, it repealed all FTTs. Germany had a similar experience; its briefly-imposed FTT resulted in a one-third decrease in trading of public companies. Because capital and trading can migrate, there has been talk among major global economies at the G7 and G20 level of coordinating the imposition of a larger tax, although that has not yet happened.

Is the tax progressive?

Yes. The tax targets active investors who are concentrated in the

wealthiest segments of the population. In 2016, the

top 10% of Americans by wealth owned

93% of the total wealth of the stock market, with more than half of all stocks

(directly and indirectly through mutual funds) owned by the top 1%. However,

the middle class may feel the indirect effects of the tax through investment in

their investment or retirement plans (e.g., a 401(k)). Mutual funds, even

indexed funds, adjust their investment portfolios and hence would incur the

tax. Critics of the tax, like SIFMA, say

this would rack up taxes that would be passed on to middle class investors.

Proponents

say that the tax would discourage overactive fund management and potentially be

absorbed by fund management fees given market competition for higher returning funds. Taking these various effects into account, the Urban-Brookings

Tax Policy Center predicts that the top 5% of income earners would bear 65% of the tax.

Who supports what?

Senator Bernie Sanders (I-Vt.) has been a longstanding advocate of the financial transaction tax. His Inclusive Prosperity Act of 2019 calls for a 0.5% tax on stocks, 0.1% on bonds, and 0.005% on payments made under derivative contracts. Former Vice President Joe Biden has indicated that he is open to levying a financial transaction tax but has yet to elaborate on specifics. Although they are no longer presidential candidates, Senators Elizabeth Warren (D-Mass.) and Kirsten Gillibrand (D-N.Y.), and former mayors Pete Buttigieg and Mike Bloomberg all proposed FTTs of 0.1%. Senators Schatz (D-Hawaii), Van Hollen (D-Md.) and others have proposed legislation at that rate as well. There were some slight differences on which assets, but generally they included stocks, bonds, and derivatives. This represents a change from the position held by President Obama who resisted European leaders’ calls for a coordinated FTT in the wake of the financial crisis. President Trump has never proposed this tax and generally has been skeptical of any new taxes on corporations or on the stock market.

I would like to thank Anita Zirngibl for providing valuable research assistance.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

What is a financial transaction tax?

March 27, 2020