This chapter is part of USMCA Forward 2024.

Three decades after NAFTA’s implementation, and over three years since the USMCA took effect, Mexico’s trade and investment ties with Canada and the United States remain vital to its economic growth, industrial evolution, and job creation. Mexico has the potential to boost its growth and development as it becomes a premier investment destination within North America, attracting firms that are relocating to the region.

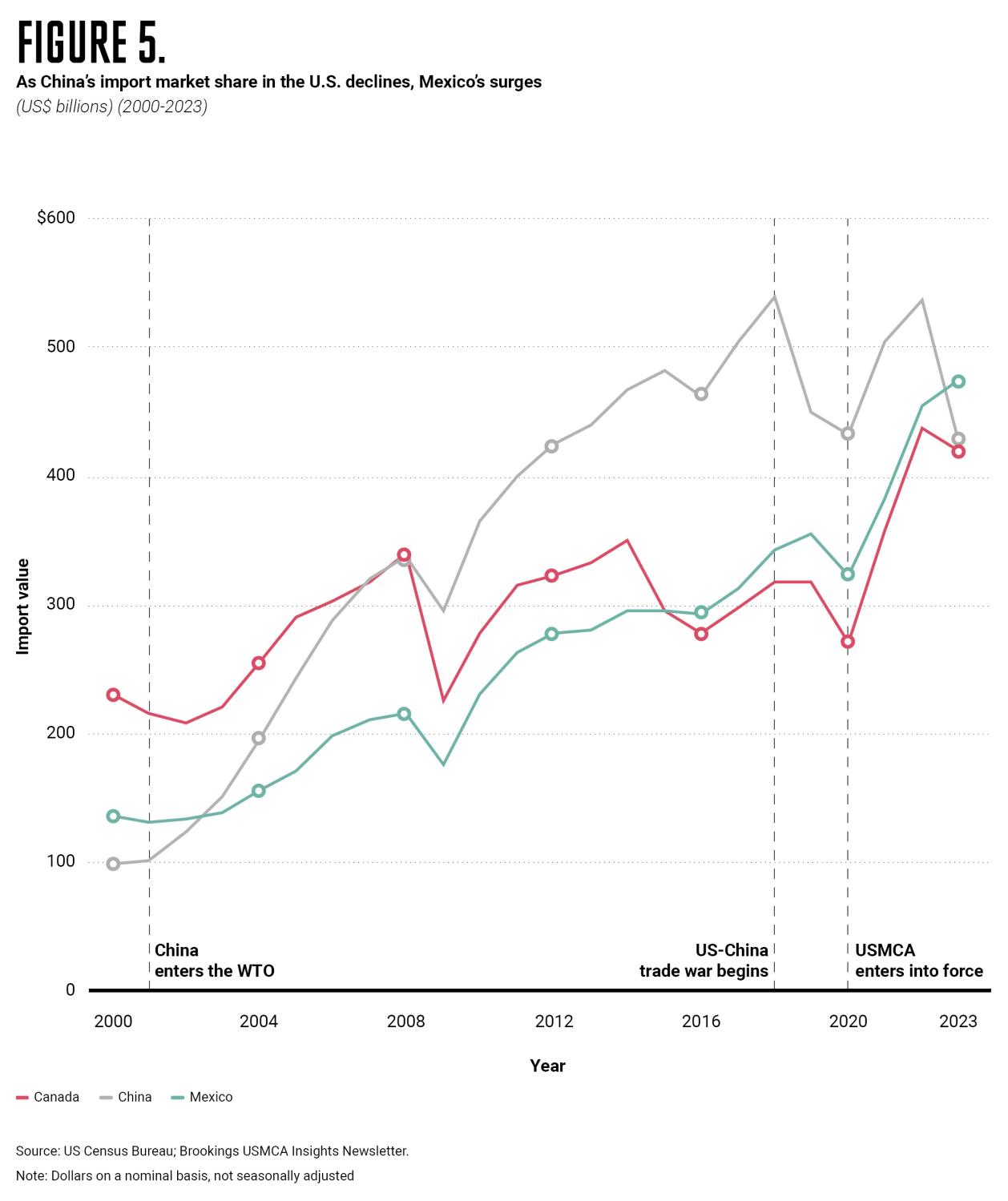

Several external factors have triggered nearshoring opportunities for Mexico. Companies are moving their production to Mexico for various strategic reasons. First, the U.S.-China trade war has diverted trade from China to countries like Mexico where USMCA offers duty-free access to the U.S. market.1 Second, the Biden administration’s strategy for nearshoring, which focuses on “creating diversified and resilient supply chains,”2 has positioned Mexico as a key player in the “China+1” supply chain diversification approach. In 2021, U.S. Commerce Secretary Gina Raimondo highlighted that “Mexico is a critical strategic ally and partner of the United States and is a top destination for U.S. exports. As neighbors, it is imperative that we leverage our partnership to build back from the pandemic together…strengthening regional supply chains.”3 Third, the country’s long-standing expertise in production sharing schemes makes it a strategically valuable partner in the evolving landscape of regional manufacturing and trade. Fourth, Mexico’s competitive advantages for nearshoring include significantly low labor costs, with average manufacturing salaries lower than those in China.

Mexico has been fortunate to be in the right place at the right time to leverage its own development by taking advantage of both USMCA and nearshoring in advanced manufacturing. However, Mexico must make sure it can offer the best business environment and fully comply with USMCA commitments since its economic growth and job opportunities are highly dependent on its trade and investment relations with its North American partners.

Deeper regional trade

The 2009 financial crisis precipitated a notable deceleration in the growth of global trade. Between 1990 and 2007, international trade grew at an average annual rate of 6%. However, since 2011 this rate moderated significantly to an average of 2.6% annually.4 This reduction in the pace of global trade diminished the share of trade relative to global GDP. In 2007, trade constituted 30% of the world’s GDP, declining to 27% by 2021. This trend underscores the long-term economic impacts of the financial crisis on international trade dynamics.

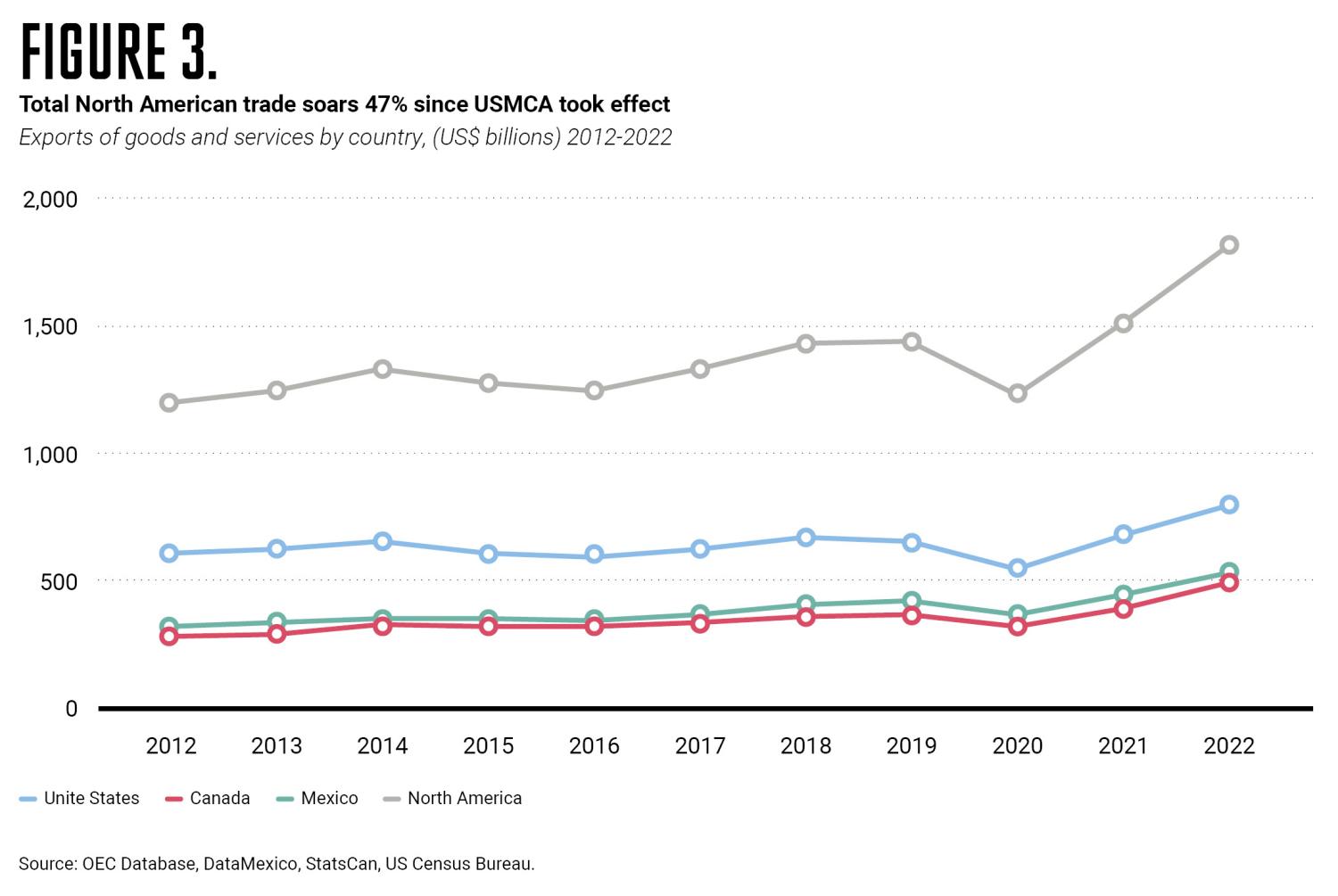

Following a marked downturn in trade among North American partners during the height of the COVID-19 pandemic, trade within the region has rebounded. In 2022, the exchange of goods among the three USMCA member countries—the United States, Mexico, and Canada—reached a milestone of $1.5 trillion.5 This resurgence has been particularly instrumental for Mexico, underpinning growth rates the country has not witnessed in recent years, underscoring the critical role of regional trade in its economic recovery and expansion. Following a -8.7% contraction in 2020 due to the pandemic, the Mexican economy has experienced a rebound, fueled by trade, registering a growth of 5.8% in 2021 and 3.9% in 2022.6 Projections suggest a continued positive trajectory with expected growth rates of 3.2% in 2023 and 2.1% in 2024.7 In fact, in November 2023, Mexico positioned itself as the U.S.’ number one trading partner with a 15.8% U.S.’ market share, which supports Mexican economic growth.8 In 2022, Mexico’s global trade reached an unprecedented figure of $1.217 trillion, equating to over 78.5% of GDP.9 This ratio is higher than that of the U.S. where trade to GDP ratio was 25.48% in 202110 or Canada’s at 61.4%.11 Trade with the U.S. and Canada accounted for $778 billion, or 63.8% of Mexico’s total international trade, marking a historic peak. During 2019- 2022, Mexico’s trade with the U.S. grew 27% and with Canada 19.5%.12 This data not only reflects the country’s robust trade dynamics but also underscores its intense partnership with North America.

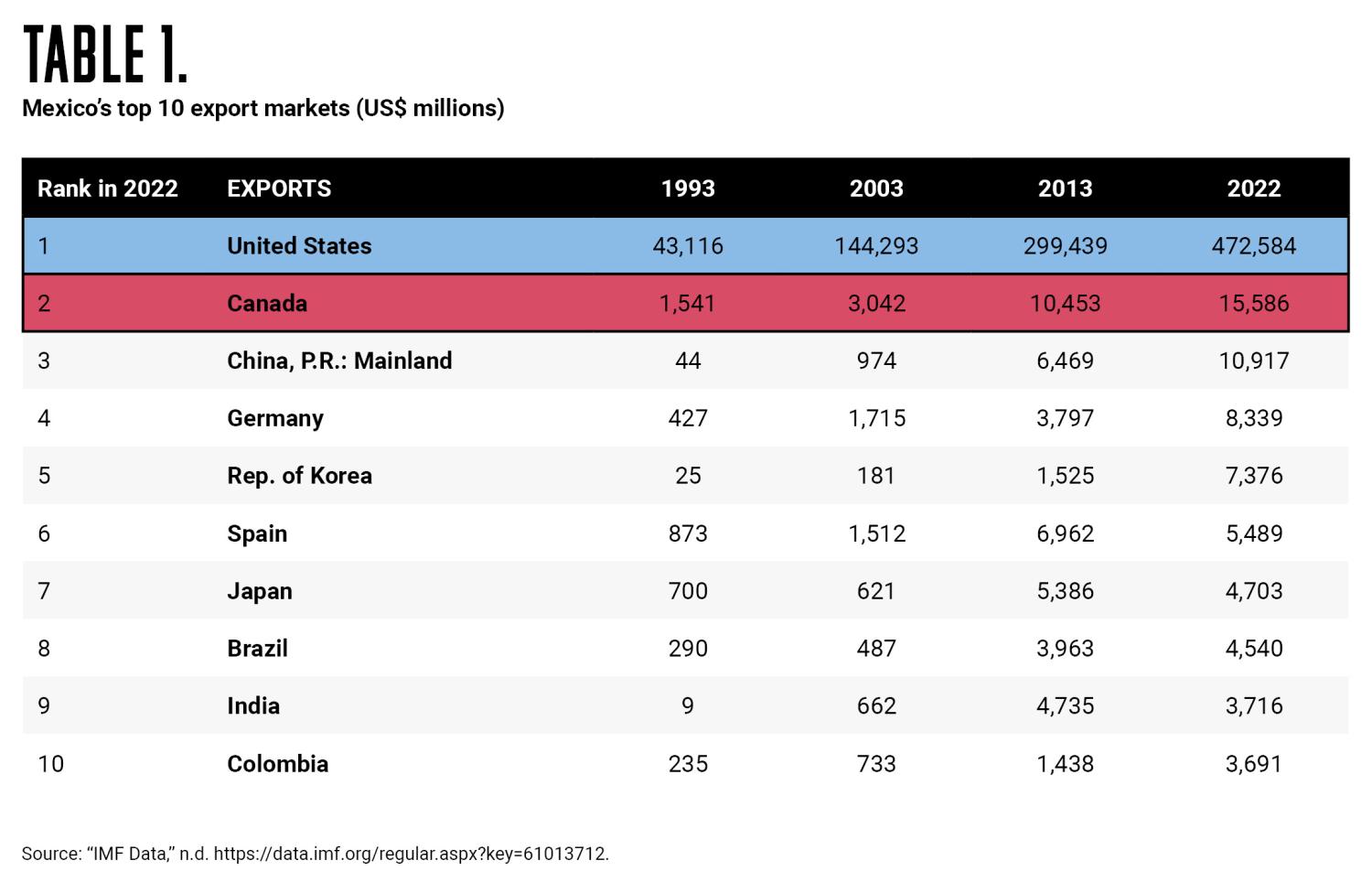

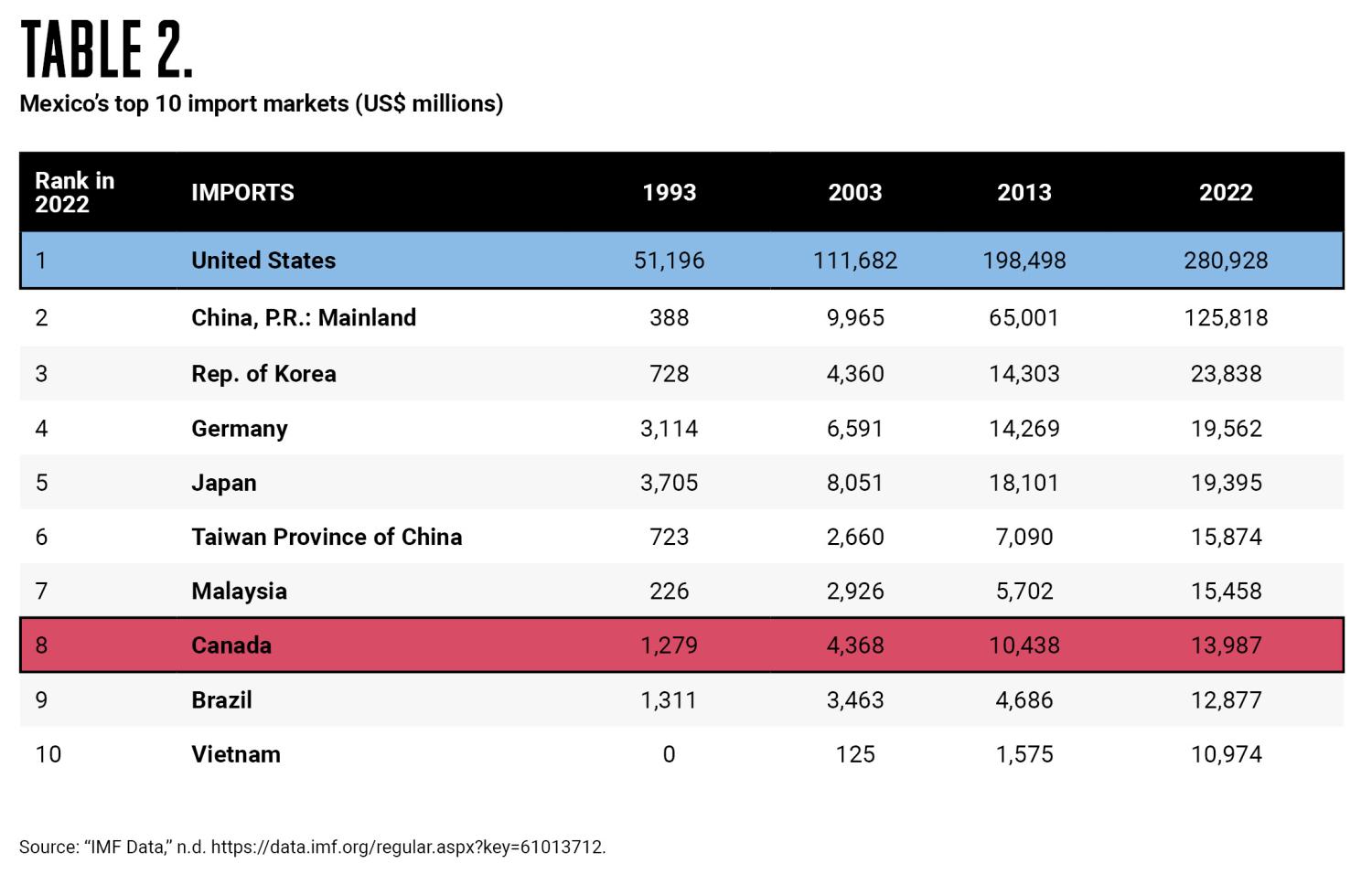

In 2022, the United States remained Mexico’s principal trading partner, its most significant export market, and the foremost source of imports. Concurrently, Canada held a notable place in Mexico’s trade landscape, ranking fifth as a trading partner, second as an export destination, and eighth as a source of imports for Mexico. Even then, trade between Mexico and Canada is often understated due to the significant impact of transshipments on trade statistics. For instance, in 2022, Mexico reported exports to Canada valued at $15.6 billion, whereas Statistics Canada recorded imports from Mexico at a value of $18.5 billion.13 Throughout this period, the United States and Canada have steadfastly occupied the top two positions as Mexico’s export market. This trade architecture has exhibited remarkable consistency since the 1990s, following the NAFTA implementation.

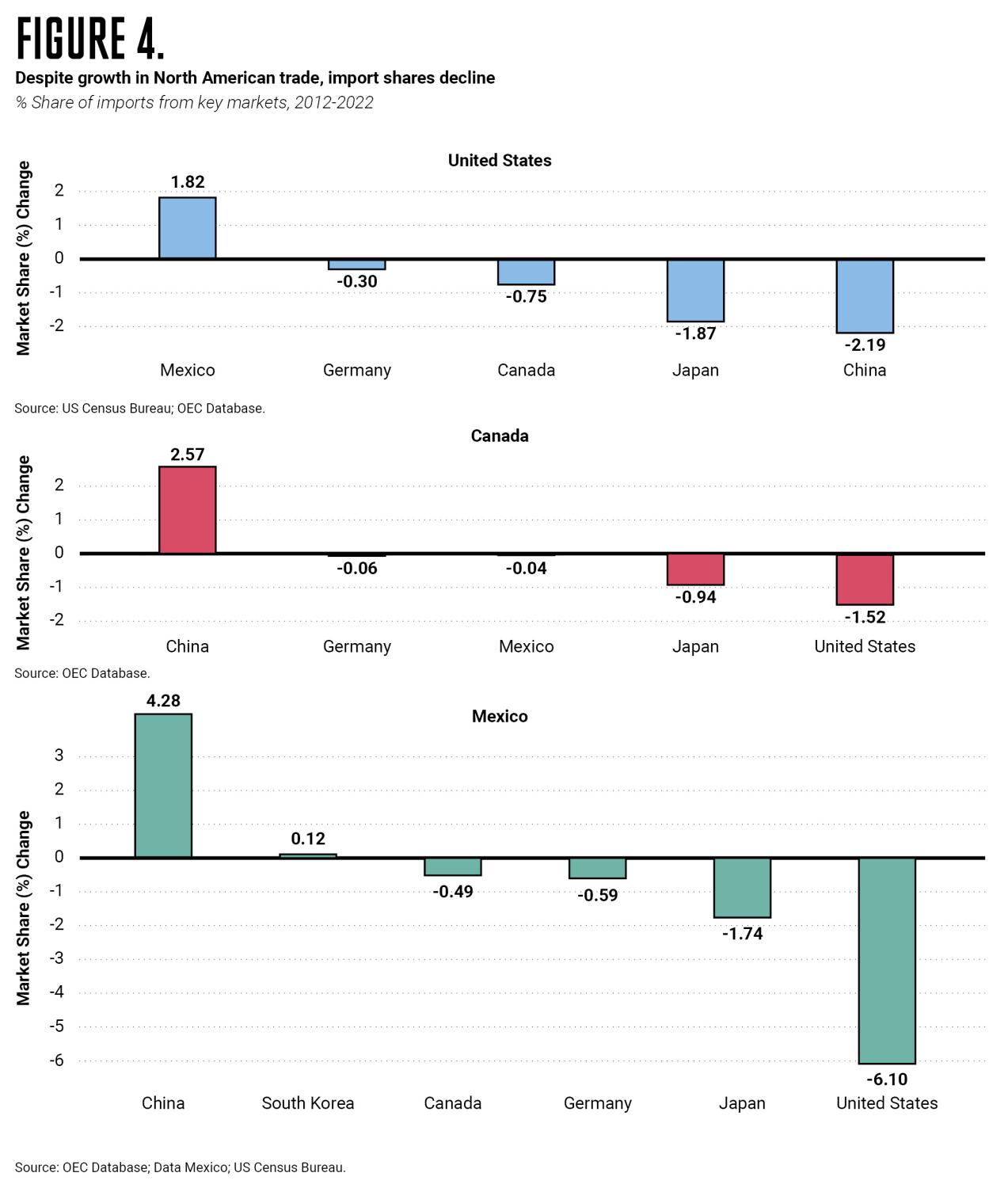

For decades, the United States has been Mexico’s primary source of imports, though its share has seen a gradual decline, from 71.8% in 1994 to 43.8% in 2022. The gap in imports has been filled by China, where global companies, including from U.S. origin, produce and supply to Mexico equipment, parts, and components integral to its export value chain. Consequently, Mexican exports to the United States have been bolstered by access to these critical imports from China that in 2022 reached $125.8 billion, more than 12 times the value in 2003 as shown in Table 2. On the other hand, Canada, which was the fourth largest contributor to Mexico’s imports in 1994 with a 2.02% share, fell to eighth position by 2022, albeit with a slightly increased share of 2.18%.

The United States also is the main supplier of intermediate goods to Mexico, accounting for 46.7% of Mexico’s imports, which reveals an enduring production-sharing framework that has been a hallmark of North American trade for decades. Mexican exports incorporate inputs with U.S. origin, which are subsequently exported to North America and to other markets in the world. Trade-in-value-added data reveals that, in 2018, Mexican gross exports to the world incorporated 14% of value added originating from the United States; in 2020, this number was 12.7%.14 This underscores the role the U.S. has in Mexican manufacturing.

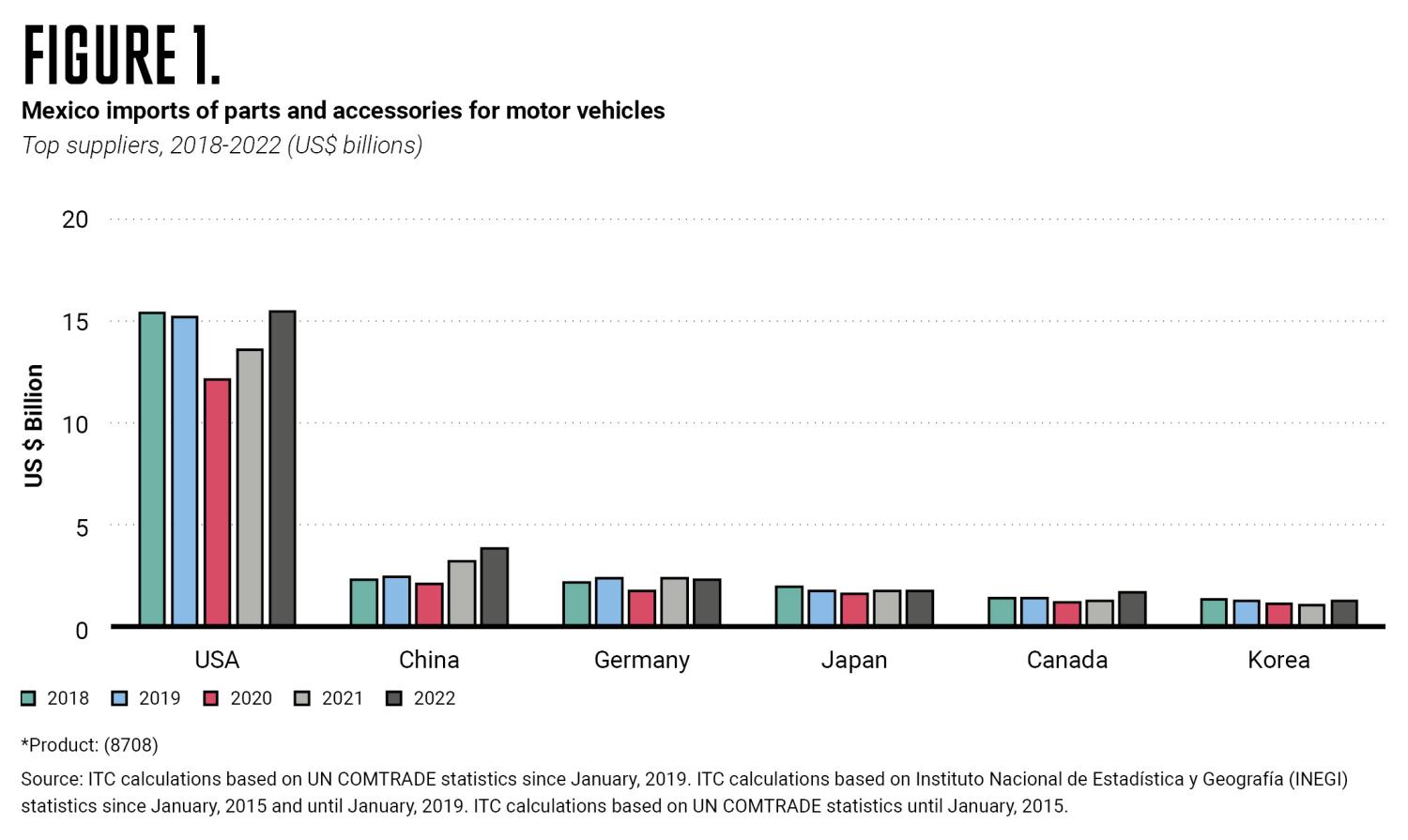

The automotive industry is a key driver of North American trade and investment, and its production is deeply integrated across the three North American countries. For example, in 2022, 52.5% of Mexico’s imports of parts and accessories for motor vehicles came from the U.S., while Canada supplied approximately 5.9%.15

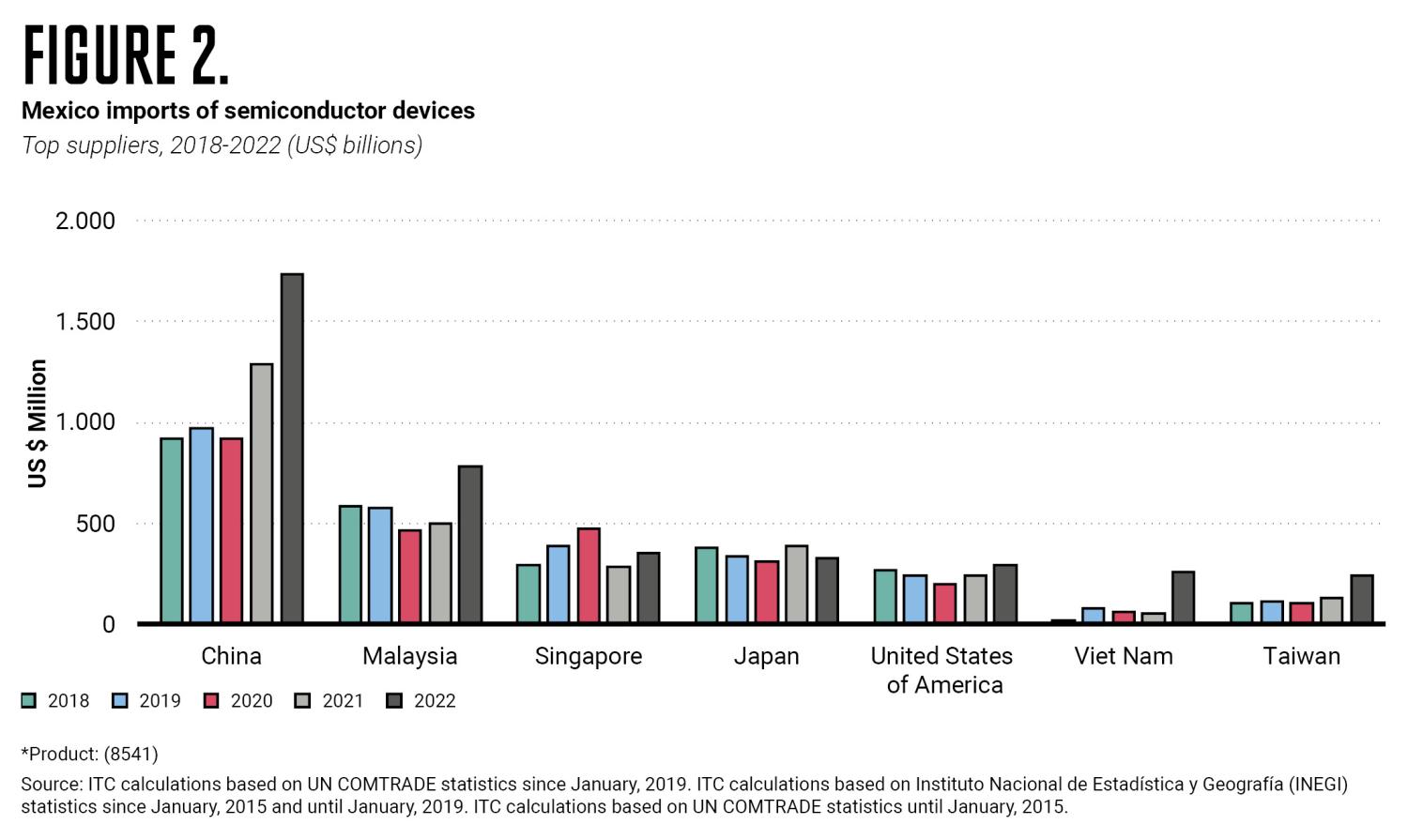

So-called “Factory Asia” also plays a growing role in North American supply chains. Indeed, strategic sourcing from Asia has increased the competitiveness of Mexican industry. By 2022, approximately one-third of Mexico’s total imports originated from six Asian countries: China, South Korea, Japan, Malaysia, Taiwan, and Vietnam.16 This is particularly evident in the electronics sector where six Asian suppliers accounted for 80% of semiconductor devices, which are inputs throughout the manufacturing sector, including in auto manufacturing (see Figure 2).

Nearshoring triggers investment

More recently, Mexico has benefited from increased foreign direct investment (FDI) as companies respond to geopolitical tensions by reducing their exposure to China and taking advantage of the investment under the U.S. Inflation Reduction Act and the Chips and Science Act to nearshore their manufacturing operations.

In the first nine months of 2023, FDI flowing into Mexico predominantly focused on manufacturing, services, and mining sectors. The United States and Canada emerged as the first and sixth largest investors, contributing $13.5 billion and $2.2 billion, respectively, together accounting for 48% of the total FDI.17

A strong indicator of nearshoring in Mexico is the substantial domestic investments in construction, particularly of industrial facilities and office spaces, paralleling the peak in the U.S. In August 2023, construction in manufacturing facilities in Mexico surged by 47.4% compared to the previous year. Concurrently, in the U.S., “real spending on construction for manufacturing” increased almost fourfold since early 2022, further emphasizing the growing trend of nearshoring.18

A recent report from Mexico’s central bank highlights industries where nearshoring is most prevalent, including transportation equipment and auto parts, electronics, machinery and equipment, furniture, household appliances, medical devices, among others.19 Since the 1990s, Mexico has developed a productive network and expertise in these export sectors making them a natural fit for nearshoring.

While precise predictions about the scale of future investments into Mexico are speculative, there is a consistent stream of investment announcements, especially in northern and central Mexico. For example, TC Energy is developing a $4.5 billion natural gas pipeline, Southeast Gateway Pipeline, that will supply natural gas to states in central and southeast Mexico.20 To boost those investments, in October 2023, Mexico’s Ministry of Finance launched a tax incentive program that expires in December 2024 and targets companies seeking to capitalize on the nearshoring trend. The ministry has registered 174 announcements, which could potentially bring an additional $74 billion in FDI; a figure 60% higher than expected FDI in 2023.21

Trade and investment drive job creation

The USMCA placed workers at the center of the agenda to ensure they benefit from the agreement. While labor markets in the three countries were hard hit by the pandemic, they have fully recovered. In October 2023, the U.S.’ unemployment rate was at 3.9%,22 Canada’s was 5.7%,23 and Mexico boasted a historically low rate of 2.7%.24

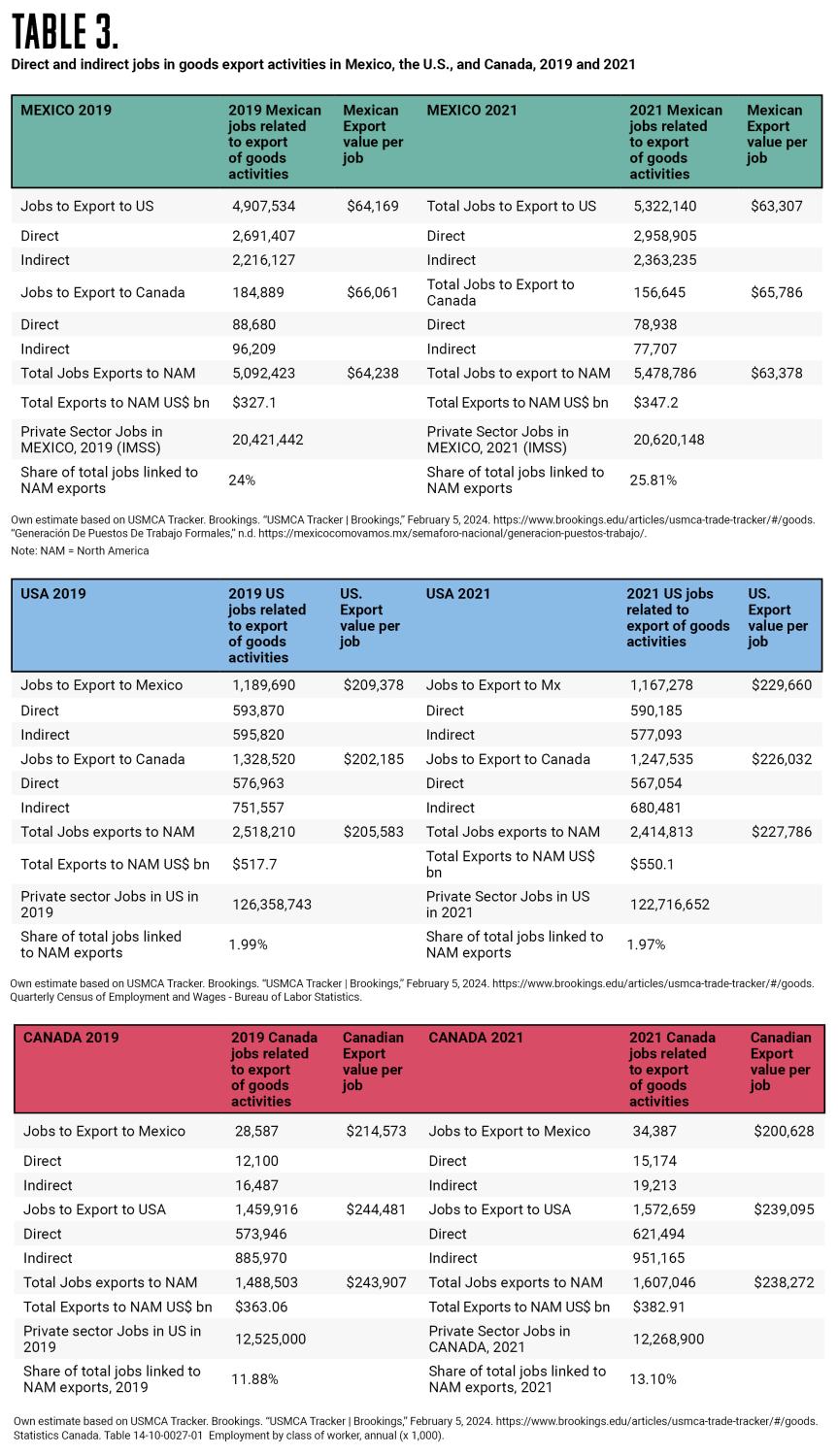

Trade dynamics have significantly influenced job creation in the North American region, albeit with varying impacts across countries. In 2021, Mexico’s workforce exceeded 59.4 million people, but only approximately 26.5 million belonged in the formal economy so the pool of workers that could benefit from trade and investment only covered 44.6% of the workforce.25 In 2021, Mexico saw a substantial portion of its labor force in the formal sector engaged in activities related to exports to the U.S. and Canada. Considering jobs directly and indirectly linked to export of goods, in 2021, Mexico registered 5.4 million jobs that accounted for 25.81% of all private sector jobs registered in the Mexican Social Security Institute (IMSS) were directly linked to these export activities. This figure is nearly double that of Canada, where 13.1% of jobs are connected to exports of goods to the U.S. and Mexico. In contrast, the United States displayed a comparatively lower percentage; only 1.97% of jobs in 2021 were either directly or indirectly associated with exports of goods to Mexico or Canada (see Table 3). Mexico is by far the most dependent on goods exports and USMCA to create formal jobs at home.

Despite recent efforts to elevate wages, Mexico continues to be a low-wage economy, particularly when contrasted with China. As of January 2022, Mexico’s monthly minimum wage stood at $256.3, lower than China’s $390.26 This persists even in the face of President López Obrador’s minimum wage increase policy, a cornerstone of his campaign promises. Under NAFTA, Mexican wage levels experienced stagnation, primarily attributed to low productivity levels and a diminished demand for workers with advanced educational qualifications.27 Since 2019, Mexico has witnessed significant, double-digit annual increases in minimum wages, rising from $4.40 per day in 2018 to $13 per day in 2024. In Mexico’s northern border regions, this growth is even more pronounced, with the minimum wage reaching $20 per day starting in 2024.28 Additionally, there have been noticeable improvements in ancillary benefits such as pensions and paid holidays. While these increases are significant and represent a deviation from the trends observed during the NAFTA era, wages in Mexico are far from converging with those in the United States and Canada. Levy and Fentanes (2022) find that unless Mexico implements deep reforms in its labor market regulations, USMCA labor commitments “could lead to small wage increases in firms engaged in trade with the U.S., but with limited impact on overall wages in Mexico.”29

Mexican exports of goods remain labor intensive, and those jobs show low productivity compared to the U.S. and Canada. This is evident in the lower export value they generate compared to its North American partners.

Mexican exports of goods remain labor intensive, and those jobs show low productivity compared to the U.S. and Canada. This is evident in the lower export value they generate compared to its North American partners (see Table 3). In 2021, 25.8% of workers in Mexico (5,478,786) were, directly or indirectly, involved in the production of goods exported to the U.S. and Canada. Each Mexican worker contributed $63,378, around 28% of the export value that a U.S. or a Canadian worker contributes in goods exports to their USMCA partners.

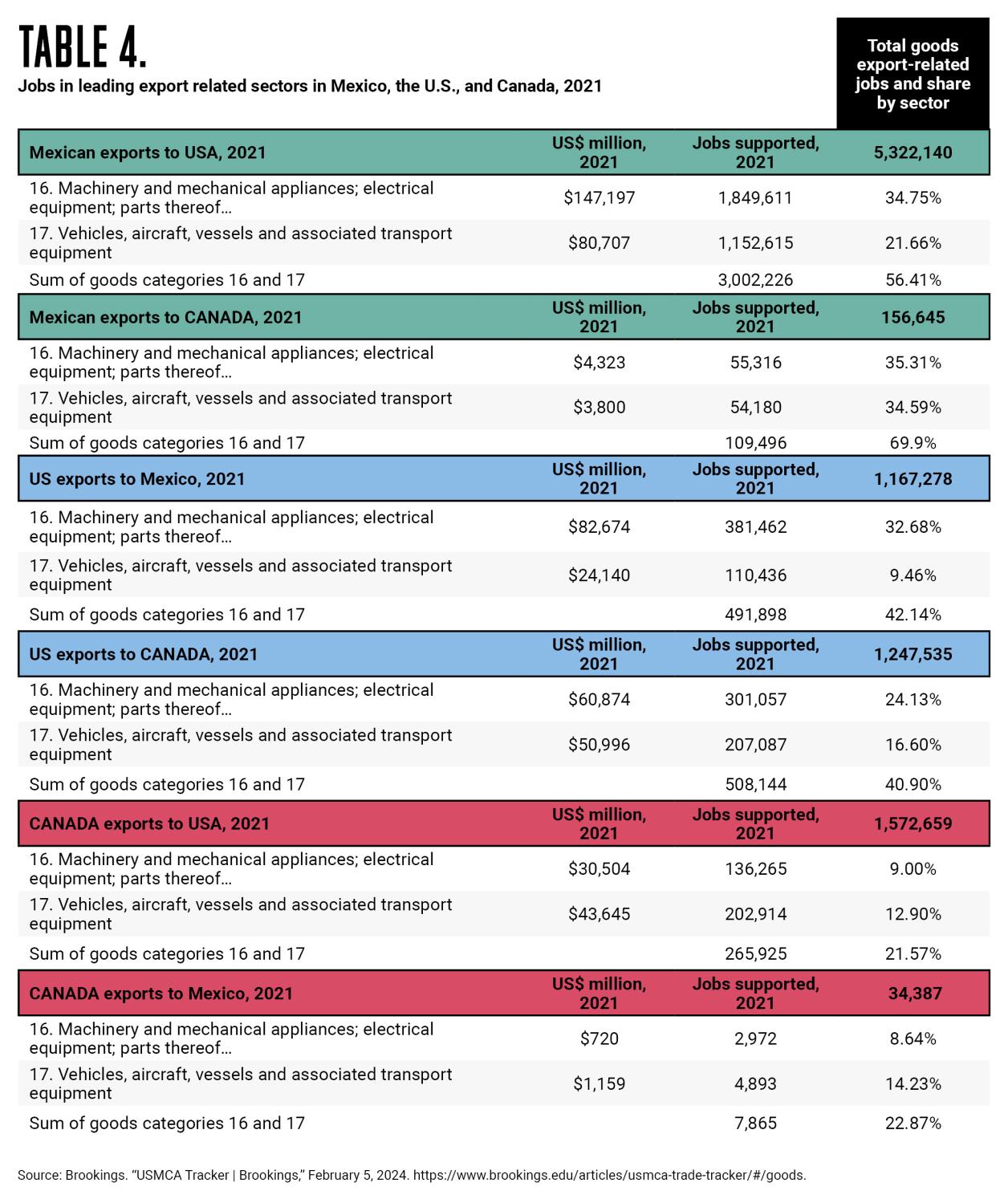

The distribution of export-related employment is concentrated in the leading export sectors of the three countries, particularly in vehicles and associated transportation equipment and machinery. In Mexico, the combined direct and indirect jobs in both export sectors surpassed 3 million, representing approximately 56% of all jobs related to exports of goods to the U.S. and nearly 70% of those associated with exports of goods to Canada. In the United States, exports in these sectors collectively account for over 40% of the jobs linked to exports of goods to each partner. In Canada, the vehicle and transportation equipment sector is responsible for 12.9% of jobs connected to goods exports to the U.S. market, and 14.23% of those destined for Mexico (see Table 4).

To maintain its attractiveness for new investments, Mexico needs to improve the quality of its labor force in line with the requirements of companies engaged in regional value chains. Nearshoring investments involve advanced manufacturing and automation, so embracing advanced manufacturing requires training the Mexican workforce with the necessary knowledge and skills to actively participate and reap the benefits of nearshoring opportunities.30

The road ahead

The USMCA, along with nearshoring, have significantly influenced North America’s trade and investment dynamics, which have been particularly key for Mexico’s growth, industrial evolution, and job creation. The shift in global trade patterns, especially in the context of the U.S.-China trade war, the “China+1” diversification strategy, and the Biden administration’s nearshoring strategies, has positioned Mexico as the U.S.’ number one trading partner and a crucial investment hub within North America.

While relocation has been advantageous for Mexico, allowing it to capitalize on its lower labor costs, youthful workforce, and strategic geographical location, Mexico’s true challenge is to improve labor productivity and develop a local supply chain that could help reduce its imports from Asia and particularly from China.

The USMCA and nearshoring have opened new doors for Mexico but sustaining and expanding these gains requires a conducive environment to do business, policy reforms, and a commitment to enhancing the nation’s competitive edge in a rapidly evolving global economy. The effective leveraging of these opportunities will be crucial for Mexico’s continued economic growth and development in the years to come.

Related viewpoints

More from USMCA Forward 2024

-

Footnotes

- Banco de México https://www.banxico.org.mx/TablasWeb/reportes-economias-regionales/abril-junio-2022/401EC828-D8C9-4421-8491-C70377B0E4BE.html

- https://www.whitehouse.gov/briefing-room/speeches-remarks/2023/04/27/remarks-by-national-security-advisor-jake-sullivan-on-renewingamerican-economic-leadership-at-the-brookings-institution/

- https://www.commerce.gov/news/press-releases/2021/09/secretary-commerce-gina-m-raimondo-co-chairs-us-mexico-high-level

- CEPAL. https://www.cepal.org/es/publicaciones/67989-estudio-economico-america-latina-caribe-2023-financiamiento-transicion

- Own estimates based on import data for Canada, Mexico and the US with USMCA partners. https://data.imf.org/regular.aspx?key=61013712

- IMF. https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/MEX?zoom=MEX&highlight=MEX

- IMF. https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/MEX?zoom=MEX&highlight=MEX

- https://www.census.gov/foreign-trade/statistics/highlights/topyr.html

- https://fred.stlouisfed.org/series/MKTGDPMXA646NWDB

- https://www.macrotrends.net/countries/USA/united-states/trade-gdp-ratio

- https://www.international.gc.ca/transparency-transparence/assets/pdfs/state-trade-commerce-international/2022/sot-2022-eng.pdf

- https://data.imf.org/regular.aspx?key=61013712

- https://www150.statcan.gc.ca/n1/pub/13-609-x/13-609-x2018003-eng.htm

- OECD Statistics on Trade in Value Added. https://stats.oecd.org/BrandedView.aspx?oecd_bv_id=36ad4f20-en&doi=data-00826-en

- International Trade Centre (ITC), “Trade Map – List of Supplying Markets for a Product Imported by Mexico,” Copyright ©2008-2014 International Trade Centre. All Rights Reserved., n.d., https://www.trademap.org/Country_SelProductCountry_TS.aspx?nvpm=1%7c484%7c%7c%7c%7c8708%7c%7c%7c4%7c1%7c1%7c1%7c2%7c1%7c2%7c1%7c1%7c1.

- “Mexico | Imports and Exports | World | ALL COMMODITIES | Value (US$) and Value Growth, YoY (%) | 2011 – 2022,” n.d., https://trendeconomy.com/data/h2/Mexico/TOTAL.

- https://www.gob.mx/se/prensa/de-enero-a-septiembre-de-2023-mexico-recibio-32-mil-926-millones-de-dolares-de-inversion-extranjera-directa

- México Cómo Vamos. https://mexicocomovamos.mx/semaforo-nacional/inversion/ and INEGI. https://www.inegi.org.mx/contenidos/saladeprensa/boletines/2023/ouab/ouab2023_09.pdf https://home.treasury.gov/news/featured-stories/unpacking-the-boom-in-usconstruction-of-manufacturing-facilities

- Banco de México. https://www.banxico.org.mx/publicaciones-y-prensa/reportes-sobre-las-economias-regionales/%7BFA5C5275-7140-2B71-FC26-F0F82AA999B5%7D.pdf p. 12.

- https://www.reuters.com/business/energy/tc-energy-inks-deal-with-mexican-utility-develop-45-bln-gas-pipeline-2022-08-04/

- México. SHCP. https://www.gob.mx/shcp/prensa/comunicado-no-68-gobierno-de-mexico-fortalece-inversiones-por-nearshoring-en-todo-elpais?idiom=es

- https://www.bls.gov/news.release/pdf/empsit.pdf

- https://www150.statcan.gc.ca/n1/daily-quotidien/231103/dq231103a-eng.htm

- INEGI does not use the term unemployment but non-occupied people that means people who do not have a job but are actively looking for one. https://www.inegi.org.mx/contenidos/saladeprensa/boletines/2023/enoen/enoen2023_11.pdf

- https://www.inegi.org.mx/contenidos/saladeprensa/boletines/2023/enoent/enoent2023_11.pdf

- Data for China. https://ilostat.ilo.org/topics/wages/# Data for Mexico. Datosmacro.com https://datosmacro.com Data for China. https://ilostat.ilo.org/topics/wages/# Data for Mexico. Datosmacro.com https://datosmacro.expansion.com/paises/comparar/mexico/china?sc=XE0H.expansion.com/paises/comparar/mexico/china?sc=XE0H

- Santiago Levy and Oscar Fentanes (2022). NAFTA-USMCA and wages in Mexico. In USMCA Forward: Building a more competitive, inclusive, and sustainable North American economy, p. 70.

- https://www.gob.mx/conasami/articulos/incremento-a-los-salarios-minimos-para-2024?idiom=es

- Santiago Levy and Oscar Fentanes. NAFTA-USMCA and wages in Mexico. Building a more competitive, inclusive, and sustainable North American economy, p. 11.

- WWBanco de México. https://www.banxico.org.mx/publicaciones-y-prensa/reportes-sobre-las-economias-regionales/%7BFA5C5275-7140-2B71-FC26-F0F82AA999B5%7D.pdf p. 2.