The Great Real Estate Reset

Editor’s Note: For more info on content related to Community Ownership of Real Estate, please visit our page here.

Very few Americans live in neighborhoods that are affordable, green, close to jobs, and racially and economically integrated—to the point where it is a relatively common view that such communities are an idealistic or utopian vision rather than an achievable goal or national necessity. While most Americans agree that our economic system favors the powerful, there is no broad consensus from the white majority that integration is essential to make our country more fair. Racial integration without economic integration—also known as gentrification—has consumed the urbanist movement with controversy.

A mountain of research and a world of common sense tell us that place matters. There are so many essentials to the American dream that are geographically constrained, and the only way to ensure that Americans of all races and incomes have a fair opportunity is to build a world where good neighborhoods are not scarce, expensive, and exclusive, and where all households can put down roots and keep them. The attributes of communities of opportunity—good schools, proximate jobs, retail amenities, and parks—are tied to place. We need more good places for more people.

Today, well over half a century since the civil rights movement fought for the principle that separate is inherently unequal, real estate industry practices and local public policies have not been held accountable for making very little progress on integrating our neighborhoods. If we want to see progress on inclusion and racial justice, the industry and policymakers will have to work together to dismantle these systems and replace them with ones that nurture opportunity and connection.

The trends

Generations of economic and demographic shifts—facilitated by public policy—have produced a hyper-segregated metropolitan landscape, enabling predatory lending structures in and devaluation of minority neighborhoods.

Federally subsidized suburbs created generational wealth-building opportunities for white people.

After World War II, loans guaranteed by the Federal Housing Administration and the Department of Veterans Affairs opened up the possibility of homeownership (and wealth-building) to millions of American households. However, these loan programs were explicitly structured to exclude Black people and to favor particular places: the newly minted suburbs.

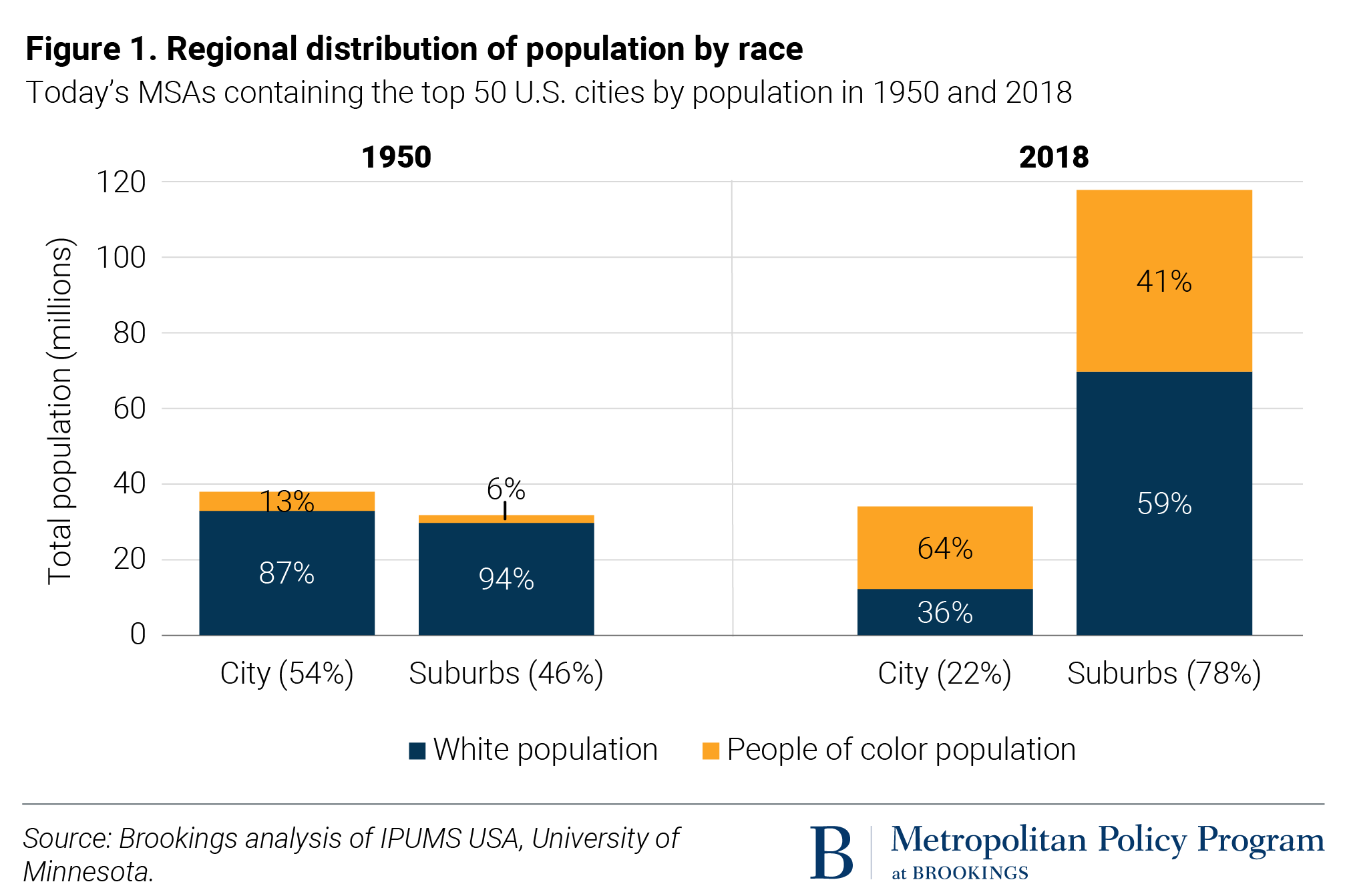

In 1950, the 50 largest U.S. metro areas contained almost half of the country’s population. These areas in aggregate were 90% white in that year (matching the nation as a whole), but the suburbs were even whiter, at 94%. As the civil rights movement opened up the prospect of integration, white flight to the suburbs only intensified, significantly increasing the spatial scale of racial segregation. Jurisdictional boundaries reinforced this segregation: Even as Black and immigrant populations began to move into suburban areas, they encountered the same exclusionary and segregationist zoning policies that created segregated cities and the first white suburbs years prior. The upshot of all this is that today, the vast majority of white people live in suburbs—and white people and people of color largely do not live in the same suburbs.

Even after decades of growing diversity and spatial mobility, most Americans still live in racially segregated neighborhoods.

From 1950 to 2018, the United States went from 90% white to 60% white. The U.S. has been becoming more multiracial rapidly in recent decades, with the total population of people of color increasing by 51% between 2000 and 2018, compared to a 1% increase in the white population.

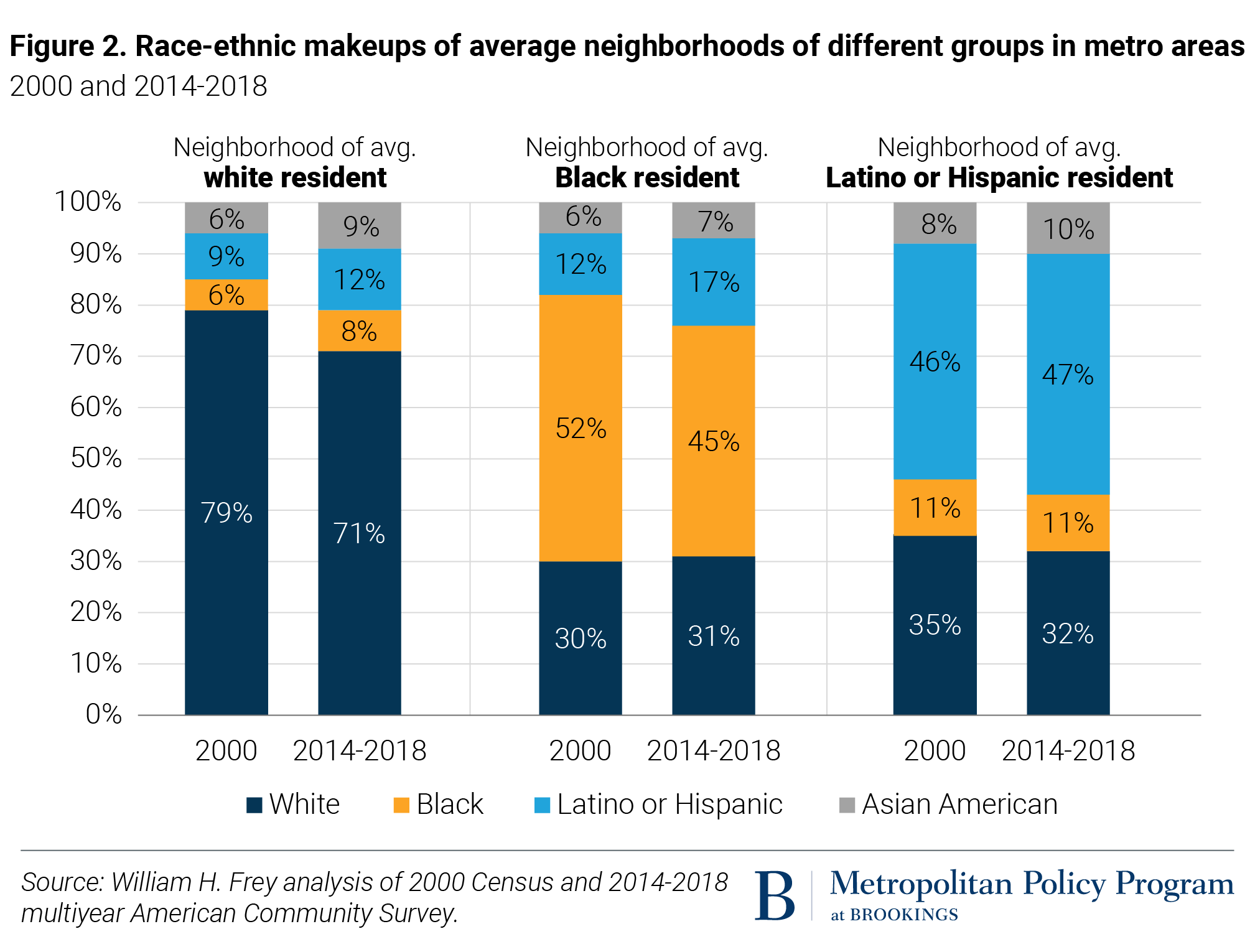

All this change has yielded some progress on racial integration. As Figure 2 shows, the neighborhood of an average white resident in the 100 largest metropolitan areas became slightly less white between 2000 and 2018, decreasing from 79% white to 71%. More notably during this period, the neighborhood of the average Black resident crossed the threshold from majority-Black to a diverse plurality because of Latino or Hispanic population growth. Still, while our cities and regions are becoming far more racially and ethnically diverse, segregation has remained persistent.

Suburbanization has also segregated the nation’s neighborhoods by income.

By enormously expanding the footprint of the American metropolitan settlement, suburbanization created a patchwork of communities built by design to be spatially sorted by income. Both modern zoning and the scale of modern housing industry production have channeled a century of growth into different types of housing rigidly segregated in space. Growth at the subdivision scale, instead of by parcel or by block, created and catapulted to dominance an unprecedented urban form: communities where detached single-family homes do not share a property line or road access with anything but other single-family homes. Thus, those who can afford those homes do not see or share space with households outside their real estate market bracket. The allocation of low-income housing tax credits, housing vouchers, and the siting of public housing also contribute to today’s unprecedented isolation of low-income people of color.

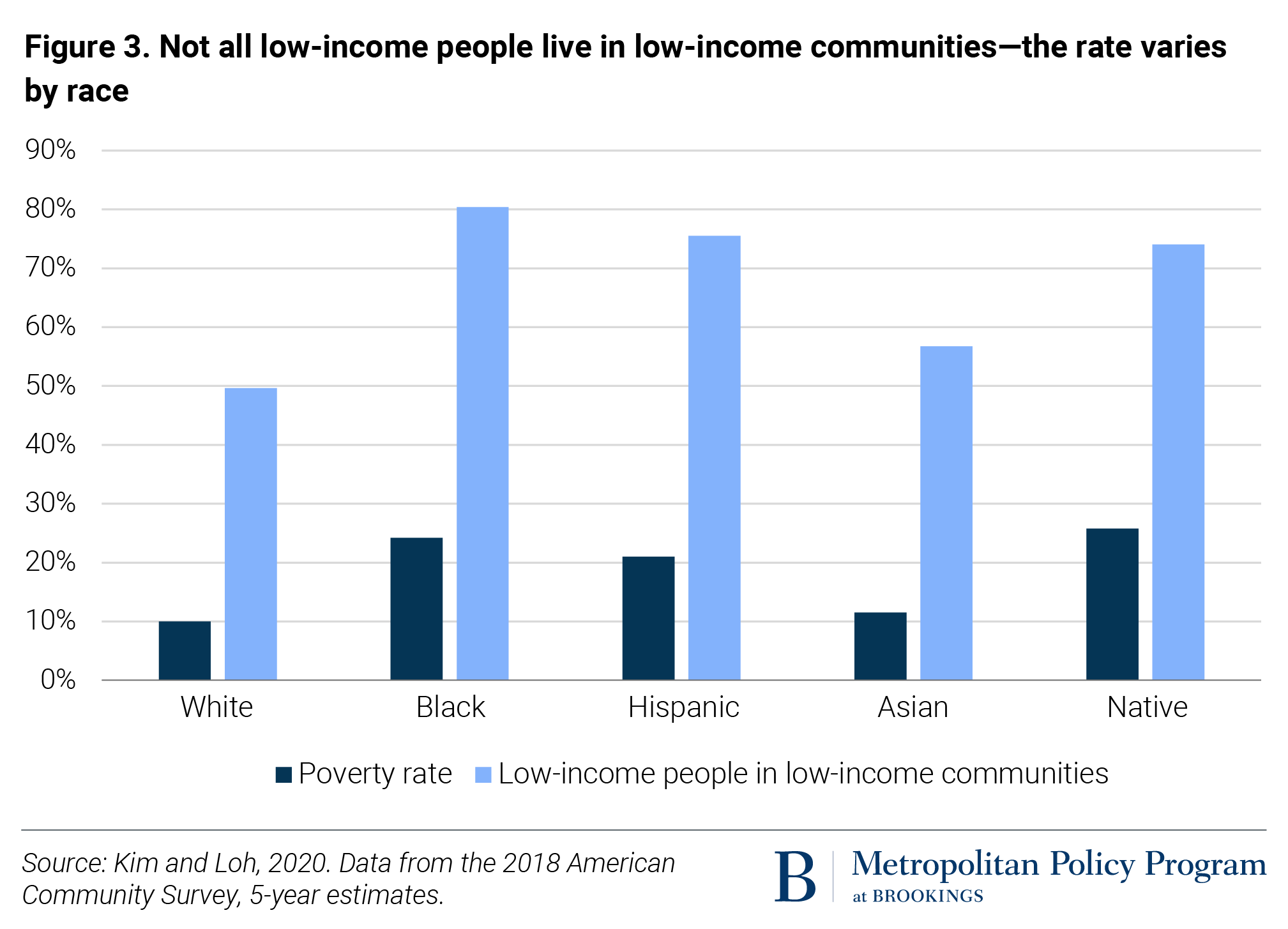

Nationwide, over 80% of low-income Black people and three-quarters of low-income Latino or Hispanic people live in communities that meet the federal statutory definition for “low-income” communities. This is in contrast to just under half of low-income white people. These patterns have long been evident in center cities, fueling tremendous political tension between a small number of very wealthy, mostly white neighborhoods and low-income communities of color with their own needs and priorities. But such patterns are repeating themselves in suburbs, too, with the increasing concentration and isolation of low-income residents now the most common form of neighborhood change in these jurisdictions as well.

Segregation enables the real estate finance industry’s predatory targeting of Black and brown neighborhoods.

The real estate finance industry has consistently exploited and exacerbated segregation since World War II, beginning with excluding Black neighborhoods from eligibility for homeownership or rehabilitation loans—a practice known as redlining. And throughout the civil rights era, the industry exploited, reinforced, and worsened segregation through other racist lending practices.

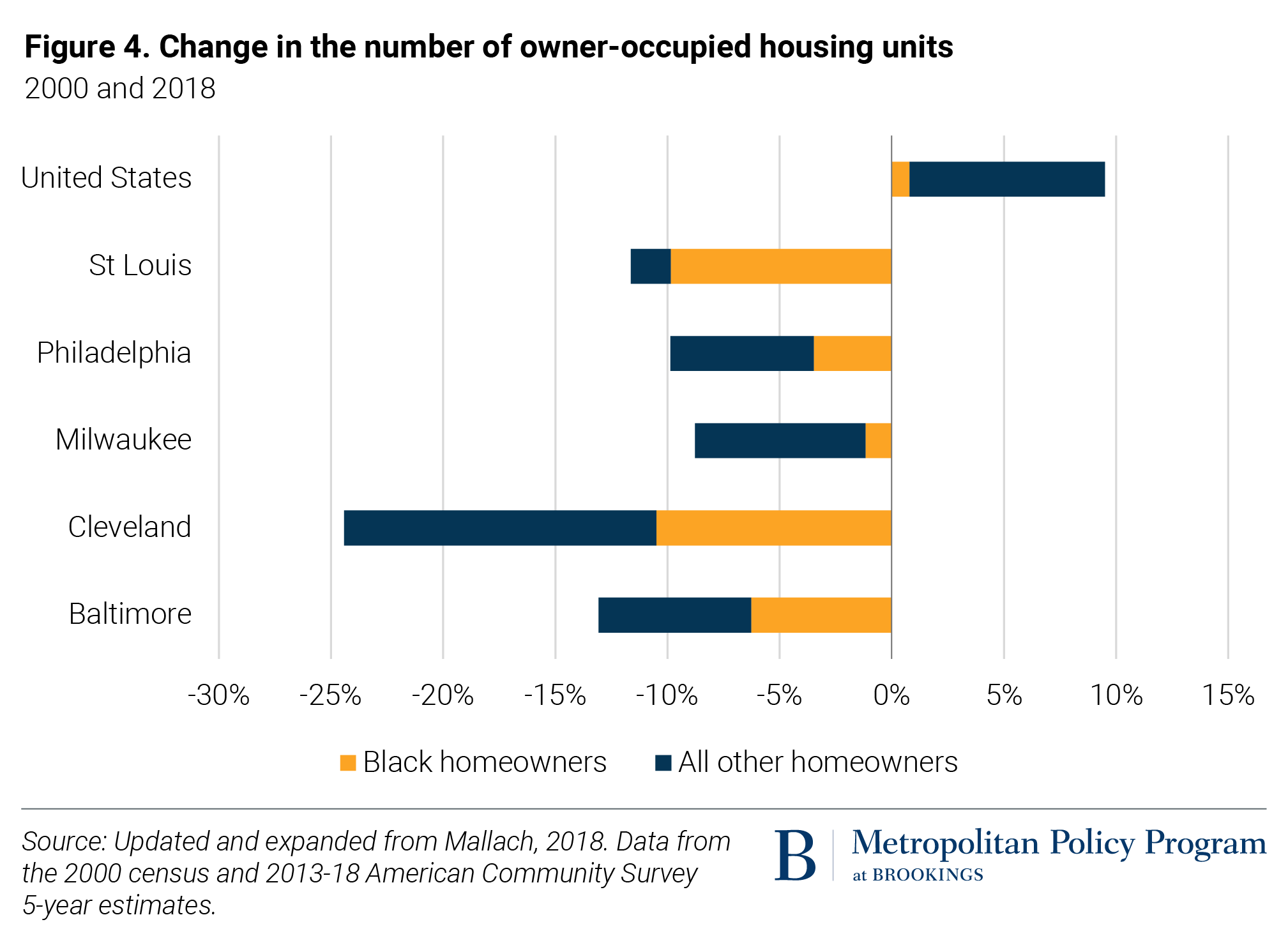

Most recently, there is widespread evidence that the real estate finance industry targeted Black and Latino or Hispanic neighborhoods with subprime loan products, committing “reverse redlining” in the years leading up to the 2008 financial crisis. As a result, foreclosure rates between 2005 and 2009 were an estimated 3.5 times higher in Black neighborhoods than in white neighborhoods, and 2.7 times higher in Latino or Hispanic neighborhoods. The cumulative outcome of decades of predatory lending practices—in combination with other economic trends—is a dramatic erosion of homeownership, concentrated in “middle neighborhoods” and legacy cities (Figure 4).

Suburbanization, particularly in slow-growth regions, has had a destabilizing effect on housing values in predominantly Black neighborhoods. But undervaluation is not only a function of low demand. Rather, systemic bias in lending and appraisals are among the reasons that Black neighborhoods are significantly devalued relative to predominantly white neighborhoods. Analysis by Andre M. Perry, Jonathan Rothwell, and David Harshbarger revealed that after controlling for differences in housing quality and various neighborhood characteristics, homes in majority-Black neighborhoods were valued 23% lower than homes in neighborhoods with few or no Black residents.

Why these trends matter

Public policy and industry practice have produced a separate and unequal landscape of American neighborhoods, propagating multigenerational negative impacts on health, social mobility, and wealth for people of color as well as harmful divisions in our economy and society.

These systemic inequities have most recently been exposed by COVID-19’s disparate impacts along lines of race and ethnicity. Nationwide, Black people are dying at 2.4 times the rate of white people—the result of the inequitable living conditions, work circumstances, underlying conditions, and lower access to health care that characterize segregated neighborhoods.

But the impacts of segregation extend much further than COVID-19. Segregation has made it possible to geographically target—as well as withhold resources from—minority communities through a host of negative policies and practices, including overpolicing, underinvestment, and devaluation. These are forces that impede wealth accumulation and halt social mobility. As of 2016, the median net worth among white families was 10 times that of Black families, and more than eight times that of Latino or Hispanic families.

These racial wealth differences are not simply due to familial or inheritable differences—they are the result of a community context with worse access to education, employment opportunities, health care, and open space. For example, Black students are seven times more likely than white students to attend high-poverty schools with a high share of students of color, which have been consistently linked to lower academic achievement levels. Black urban neighborhoods are literally hotter, sometimes by 10 degrees Fahrenheit or more. And Black entrepreneurs—including those in real estate—have less access to capital (such as the Paycheck Protection Program) in part due to racial prejudice and ongoing redlining by business lenders and the appraisal industry. Because of that, Black small businesses owners are more likely than their white counterparts to use personal savings and finances (including home equity) to start businesses—repeating segregation’s loop of exclusion and discrimination, where Black people face barriers to homeownership and wealth-building in communities of opportunity.

Beyond the direct effects on individuals and families, race- and income-based segregation has long-term, negative impacts that affect all residents of a community. A 2017 report from the Urban Institute and Chicago’s Metropolitan Planning Council found that higher levels of racial segregation are associated not only with lower income levels for Black people, but also lower educational attainment for both white and Black people, as well as lower levels of public safety for all residents of an area. Similarly, Perry and his colleagues document a $156 billion cumulative loss from the devaluation of homes in Black neighborhoods—money that would otherwise be circulating in local economies. As law professor Sheryll Cashin observed, this “segregation tax” is also costly to white people, who pay extreme price premiums to live in exclusive neighborhoods. McKinsey & Company estimates that continued racial and economic segregation will cost the U.S. 4% to 6% of its GDP by 2028 due to its dampening effect on consumption and investment.

Whatever the calculations, policymakers and industry leaders need to take heed of these impacts and use their power to divest from the exploitation and exclusion of communities of color. Instead, they should actively invest in new policies and practices that will advance connection, integration, and prosperity for Black and brown people and places.

The authors thank David Edmondson for contributing the original concept design for Figure 1, DW Rowlands for assistance in creating Figure 1, and Andre M. Perry and Alan Mallach for their insightful reviews and feedback.