Our Global Economy and Markets blog has recently focused on ways to improve enforcement of Russia sanctions. This is critical, and not just because it is important to make it harder for the Russian war economy to function. Sanctions on Russia are also supposed to be a deterrent for other bad actors out there. The tougher the enforcement, the more effective this deterrence effect, which in turn should result in reduced geopolitical risk. A more stable global environment should be in the interest of all countries around the world, including the Global South. Elevated geopolitical risk is holding back private capital flows to emerging and frontier markets, while the rise in military spending has the potential to weigh on official aid flows. Successful implementation of sanctions—if this helps speed an end to war in Ukraine—is therefore a genuine positive for advanced and developing countries.

We have proposed two avenues for improved enforcement. First, together with Ben Harris, we have documented mounting strain on the Sovcomflot fleet of oil tankers, as the EU embargo on seaborne oil forces Sovcomflot ships to make longer trips. Sanctioning more Sovcomflot oil tankers will therefore materially impact Russia’s export capacity and force it to revert to using Western ships, improving compliance with the G7 cap. Second, transshipments of Western goods from European Union countries to Russia via Central Asia and the Caucasus are large, as we documented in our most recent blog. This week, we elaborate on that blog by digging more deeply into German export data. Transshipments are mostly cars and parts and are large enough to substantially offset the drop in Germany’s direct exports to Russia. Greater EU focus on these transshipments is needed.

The German surge in transshipments to Russia

Our most recent blog documented large transshipments from across EU countries to Russia via third countries in Central Asia and the Caucasus. We used IMF direction of trade statistics to show that exports to out-of-the-way places like Kyrgyzstan or Kazakhstan rose very sharply immediately after Russia’s invasion of Ukraine, making it likely that Russia is the ultimate destination for many of these goods. Our blog prompted many questions from readers, which basically fall into two categories: (i) what goods are being transshipped; and (ii) how material are these transshipments in aggregate when weighed against a substantial drop in direct exports from the EU to Russia. IMF direction of trade data do not provide a breakdown on what kind of goods are being shipped, so we use German data—which have much more granularity—to address both questions in this follow-up blog.

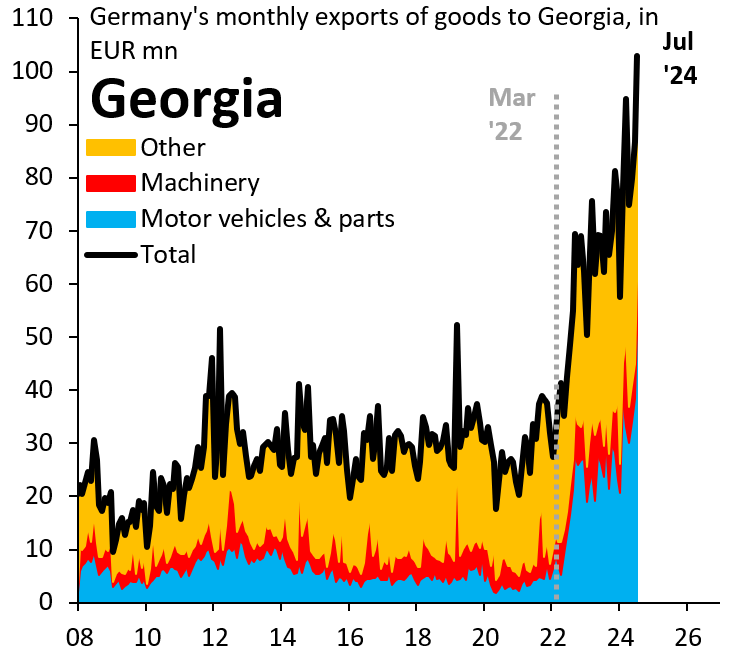

Figure 1. Germany’s monthly exports of goods to Georgia, in millions of euros

Source: German Statistical Office

Figure 2. Germany’s monthly exports of goods to Kyrgyzstan, in millions of euros

Source: German Statistical Office

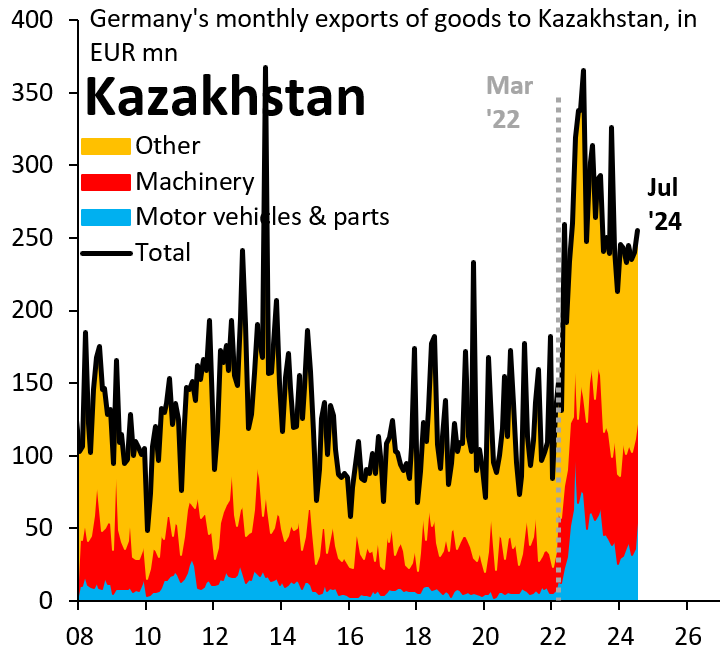

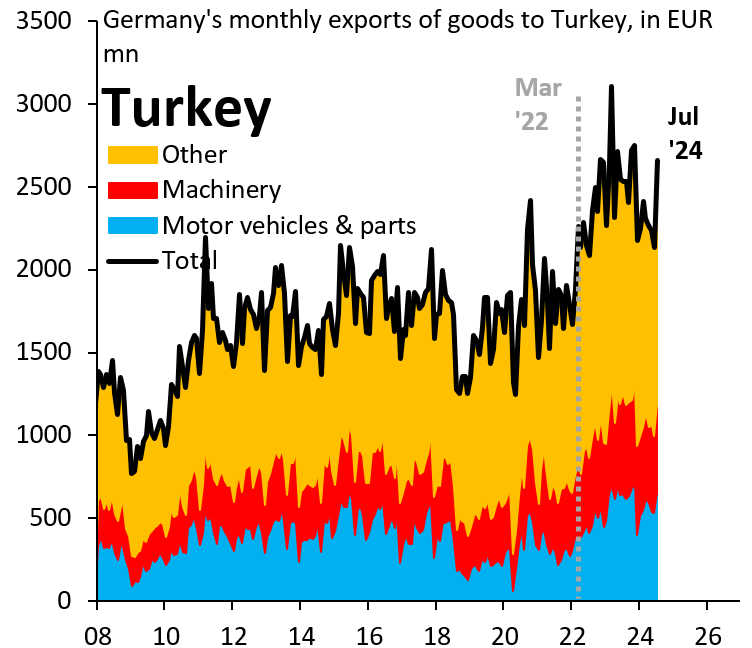

Figures 1 through 4 show German exports to Georgia, Kyrgyzstan, Kazakhstan, and Turkey, respectively, and provide a breakdown of these exports into motor vehicles and parts, machinery, and a residual category we call “other.” As before, these data capture values, not volumes, so it is possible that price effects overstate the magnitude of transshipments, but we think this effect is negligible. Vehicles and parts account for the bulk of the export boom to these countries, though machinery also plays a big role. In all cases, exports rise immediately after Russia’s invasion of Ukraine. In absolute terms, this rise is biggest for Turkey, given its proximity to Europe and the size of its economy.

Figure 3. Germany’s monthly exports of goods to Kazakhstan, in millions of euros

Source: German Statistical Office

Figure 4. Germany’s monthly exports of goods to Turkey, in millions of euros

Source: German Statistical Office

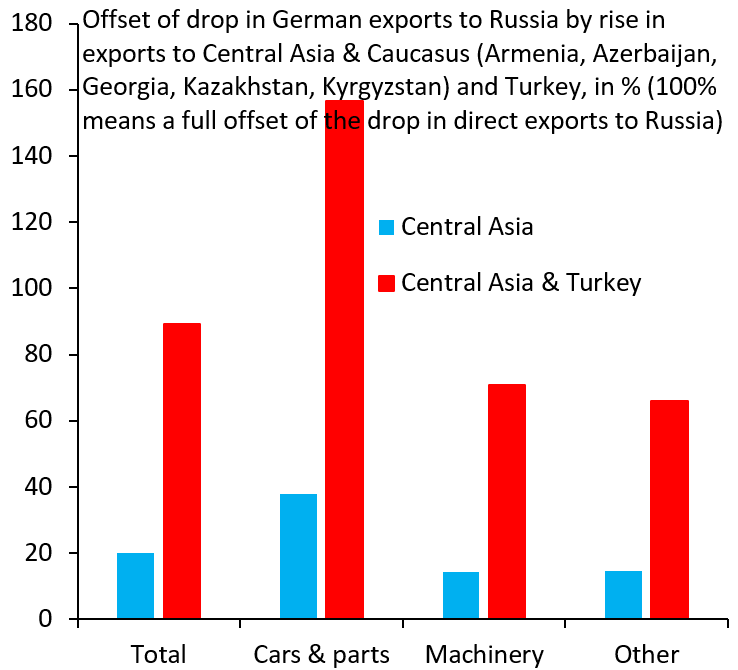

Evaluating the size of German transshipments

We compare the drop in Germany’s direct exports to Russia to the rise in transshipments to Central Asia, the Caucasus and Turkey. Figure 5 gives the example of motor vehicles and parts exports from Germany. It shows direct exports to Russia (black), exports to five countries (blue) in Central Asia and the Caucasus (Armenia, Azerbaijan, Georgia, Kazakhstan, Kyrgyzstan), and exports to the previous list of five countries plus Turkey (orange). Looking at Central Asia and the Caucasus only, the rise in exports offsets about 40% of the drop in direct exports to Russia. Adding Turkey to this picture changes this completely, with more than a full offset (160%) after the invasion. Figure 6 shows this offset for total exports, for cars and parts, for machinery, and for the residual “other” category. Overall, the offset is around 90% including Turkey. On the one hand, this may overstate the offset, because some of Germany’s exports to Turkey may genuinely target domestic demand. On the other hand, this understates the importance of transshipments, given that many other countries besides Turkey act as material transit points. Overall, it is likely that transshipments to Russia are substantial. Greater EU focus on these transshipments is needed.

Figure 5. German exports of cars and parts to Russia, Central Asia, and Turkey, in millions of euros

Source: German Statistical Office

Figure 6. Offset of drop in German exports to Russia by rise in exports to Central Asia & Caucasus and Turkey

Source: German Statistical Office

Commentary

Transshipments from Germany to Russia

September 26, 2024