In Chapter 4 of Foresight Africa 2024, our authors examine trends in regional economic integration and trade.

Essay

How to catalyze AfCFTA implementation in 2024

By Andrew Mold, Chief, Regional Integration Office for Eastern Africa, UNECA; Francis Mangeni, Coordinator of Regional Advisors on the African Continental Free Trade Area, AfCFTA Secretariat, and Senior Fellow, Nelson Mandela School of Public Governance, University of Cape Town

Progress to date

The African Continental Free Trade Area (AfCFTA) is a continental agreement that aims to create a single market for goods and services, facilitate free movement of people and capital, and promote industrial development and economic integration in Africa. Signed in Kigali at an African Union Summit in March 2018, it entered its operational phase in June 2019 and will undergo a five-year review in 2024.1 The African continent is going against the grain with this Agreement—while elsewhere faith in regional integration has generally been waning, the AfCFTA signals strongly that African member states want to address for once and for all the economic balkanisation which has plagued the continent ever since colonial times. In a forthcoming book, “Borderless Africa–A Sceptic’s Guide to the Continental Free Trade Area” from Hurst Publishers, 2024, we review the rationale behind the agreement and argue that ultimately, there is no real viable long-term strategic alternative if Africa wishes to attain its developmental goals and aspirations.

On January 1, 2021, the AfCFTA moved into its implementation stage. Yet, if you scour the data on intra-African trade, there is not yet much evidence of an upsurge in the amount of goods being traded under the new AfCFTA rules. The Guided Trade Initiative, which started in October 2022, involving seven countries in a “trial run,” demonstrated that products could indeed be exported and imported across Africa using AfCFTA documents and procedures, but exposed a number of teething problems. These include a lack of familiarization with the precise tariff schedules among customs officials,2 long periods of up to six months for consignments to arrive at their destinations,3 and high freight and transportation charges.4

At this juncture, this is understandable for several reasons. Firstly, regional agreements take time to implement—the European Union took 11 years to establish its customs union, and a further 25 years until it established its own “single market”.5 Secondly, the tariff elimination schedule of the AfCFTA is gradual, and the process will not be completed until 2034.6 Thirdly, there is general consensus that non-tariff barriers (NTBs) constitute more important impediments to intra-African trade than tariffs.7 In sum, it will take some time for the barriers to be removed and their impact felt. It is also important to remember that the AfCFTA is, in terms of number of members—55 of them—the largest trading block in the world. So, negotiations were always likely to be time-consuming and complex.

That said, from the stance of putting in place the legislative architecture for the AfCFTA, progress has been quite impressive. Phase 1 negotiations covering both goods and services and the dispute settlement mechanism have been completed, together with the establishment of oversight committees and the adoption of work programmes. Fifty-four out of the 55 African Member States have signed the Agreement, and as of December 2023, 47 have ratified it. Forty-five tariff reduction schedules and 22 services schedules have been adopted. Rules of origin have been agreed (except for vehicles and textiles and clothing).8 Negotiations on the major associated protocols on investment, intellectual property, and competition have also now been concluded and the protocols adopted.9 However, it is also the case that impatience is likely to grow if trading under AfCFTA rules does not grow rapidly soon.

The import of imports

Thus far, much of the emphasis of training workshops and sensitization about the AfCFTA have been focused on promoting intra-African exports. But it will be impossible to increase intra-African trade without increasing imports—for every dollar worth of intra-African exports, there must be a corresponding increase in imports.

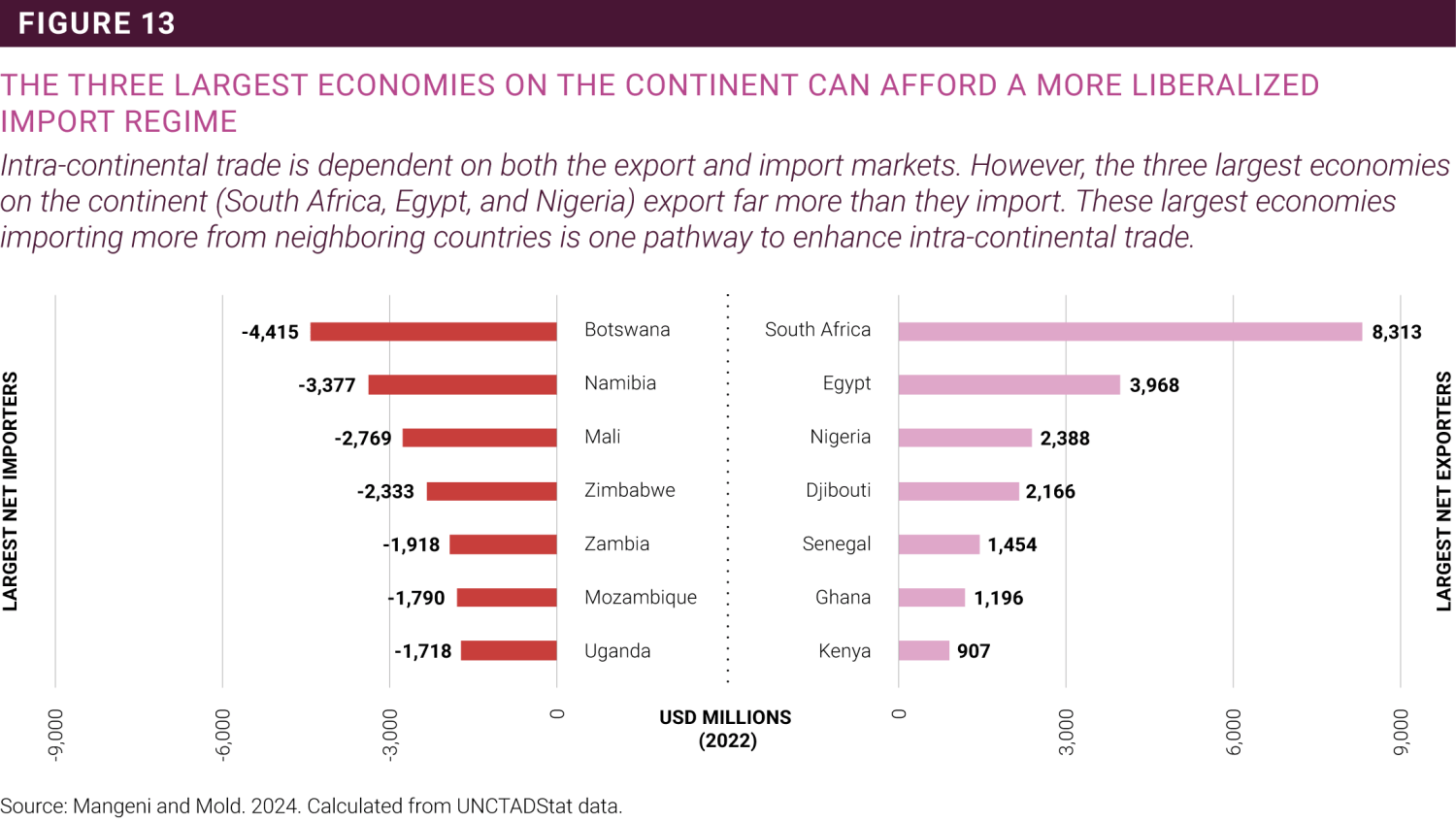

A compelling case could be made that countries with large positive trade balances with their continental partners should make special efforts to increase their openness to imports from African countries.

A compelling case could be made that countries with large positive trade balances with their continental partners should make special efforts to increase their openness to imports from African countries. This could entail a more rapid elimination of barriers to intra-African imports than the tariff schedules dictate, just as Kenya did when the East African Community (EAC) Customs Union was established in 2005, and it immediately allowed duty-free imports from its neighbors while permitting its own exports to be progressively liberalized over a longer five-year period.10 This is linked to an idea in our book—what is required at this juncture is leadership on this front by the regional hegemons. In this sense it is quite striking that the three largest economies on the continent—Nigeria, South Africa, and Egypt—all enjoy large positive trade balances with their continental partners, so in principle, they can afford to adopt a liberal import regime for intra-African imports.

The good news is that it is much easier to remove import barriers than promote exports. Some countries are making efforts to identify new markets on the African continent for their export products. This is a positive development, but as any trade economist will tell you, boosting exports takes time and may require technological upgrading, enhancing quality standards, and adapting products to customer needs. It might also require broader measures in terms of mobilizing domestic and foreign capital, fostering innovation and entrepreneurship, developing human capital and skills, and building physical and digital infrastructure. None of these can be undertaken quickly.

By contrast, tariffs can in principle be removed at the stroke of a finance minister’s pen. The non-tariff barriers will prove more intractable—but by leveraging the tools put in place, such as the Continental Non-Tariff Barriers Mechanism, governments can respond quickly once NTBs have been identified. Granted, the widespread use of the tool has yet to materialize since meaningful trade under the AfCFTA is only just starting. As of January 2023, only a handful of claims, six to be exact, had been registered. Yet it is expected that as preferential trade flows under the terms of the AfCFTA increase, so will usage of the tool.

Sticks and carrots

What if African state parties refuse to comply with their obligations under the AfCFTA? One of the perpetual complaints of past experiences at African integration is that the results have been undermined by a lack of compliance. In this sense, in 2024 it will become increasingly important to think more deeply about compliance issues. The Annex to the AfCFTA describes all the procedures for reporting, monitoring, and eliminating NTBs, from reporting to arbitration. It is encouraging to note that the NTB mechanism of the tripartite agreement between the Common Market for Eastern and Southern Africa (COMESA), EAC, and Southern African Development Community (SADC), from which the AfCFTA one was cloned, has been very successful. And in case of non-implementation by member states, the Dispute Settlement Mechanism is clearly defined.11

Within the context of the agreement, these are the big sticks, but there are also carrots, such as the newly established Adjustment Fund. The facility, headquartered in Rwanda, is reportedly worth $10 billion and will start operations in the second quarter of 2024, benefiting countries, public institutions, and private sector. It consists of three sub-funds: the Base Fund, General Fund, and Credit Fund. The funds will use contributions from AfCFTA state parties as well as grants and technical assistance to address tariff revenue losses, infrastructure deficits, and possible supply chain disruptions that could result from the implementation of the AfCFTA.12 But it is important to make access to the fund conditional on beneficiary states fully complying with the agreed tariff schedules and providing proof that their domestic markets are now more open to intra-African trade and investment.

Final words

If the objective is to accelerate implementation of this path-making Agreement, there first needs to be an unrelenting focus on removing the impediments to greater intra-African imports. By being more open to continental imports, regional value chains will inevitably emerge, not by government diktat, but as a result of the private sector taking advantage of the new opportunities.

The AfCFTA agenda will inevitably shift over the course of time as the implementation process advances. Right now, the main goal must be to eliminate the trade barriers that hinder intra-African trade. However, other aspects of the agreement will also become relevant soon, such as the enforcement of the rules on competition and investment, the alignment of standards, and the protection of intellectual property rights. The African continental market will not be created overnight—as the saying goes: “Rome was not built in a day.” The legal dimensions of the AfCFTA will take on a heightened importance, as mere good intentions will not suffice. The continental market will only be realized through the incorporation of the agreed rules and protocols into national laws and through the resolution of disputes and legal claims.

Viewpoints

More from Foresight Africa 2024

In Chapter 1, our authors share policy options to address economic challenges facing Africa.

In Chapter 2, our authors tackle the existential climate change crisis.

In Chapter 3, our authors focus on policies to support Africa’s entrepreneurs and small businesses.

In Chapter 5, our authors consider policy options to unlock the potential of the digital economy.

In Chapter 6, our authors explore the ways Africa’s women and girls are increasing opportunity for all.

In Chapter 7, our authors delve into ways African leaders can regain the trust of their citizens.

-

Footnotes

- African Union. The African Continental Free Trade Area: Article 28 of the AfCFTA agreement.

- Trade Law Centre (tralac). 2023 “What have we learned from the AfCFTA guided trade initiative?” *It should be noted though that some consignments by air took much a shorter time.

- Hair sine, Kate. 2022. “Africa’s AfCFTA free trade agreement takes baby steps.” DW

- Nation. 2023. “Border checks, varied rules choke intra-Africa trade plan.”

- Mold, Andrew. 2021. “Proving Hegel wrong: learning the right lessons from European integration for the African Continental Free Trade Area.” Journal of African Trade 8.2: 115-132.

- African Union (AU). 2024. “Operational Phase of The African Continental Free Trade Area Launched.”

- International Trade Administration (ITA). 2022. Market Intelligence: African Continental Free Trade Area.

- African Union. 2019. Tenth Meeting of the African Continental Free Trade Area AU Ministers of Trade (AMOT).

- African Union. Decision no. Assembly/AU/Dec.854(XXXVI) of the Thirty-Sixth Ordinary Session of the African Union Assembly held on 18 – 19 February 2023, paragraphs 12 to 14.

- Macleod, Jaime, Luke, David and Guepie, Geoffroy. 2023 “The AfCFTA and regional trade,’ in: Luke, David “How Africa Trades,” London: LSE Press, pp. 23–50.

- Many legal experts would have preferred the approach adopted in the EAC, COMESA, and ECOWAS Courts whereby both individuals and companies can bring cases. Instead, a State-to-State mechanism was instituted, whereby complaints of non-implementation must be made through the relevant national authorities. Nevertheless, inter-State dispute settlement can also be successful, as shown by the record of the WTO Dispute Settlement Mechanism, and in terms of number of cases heard and compliance with rulings by Members, etc.

- AFREXIMBANK. 2023. “Inaugural Board Meeting of the AfCFTA Adjustment Fund Corporation Holds in the Republic of Rwanda.