This op-ed originally appeared in Politico on April 27, 2020.

In four weeks, Congress has dedicated over $650 billion dollars to help small businesses, a linchpin of the $2 trillion national recovery effort from the Covid-induced recession.

Though well-intentioned and important, the small-business program — known as the Paycheck Protection Program — has been troubled from the start: It ran out of money in 14 days, in part because a huge amount of the money went to businesses that few people would consider “small.” National chains such as Potbelly’s, Shake Shack, and Ruth’s Chris Steakhouse received initial money, as did some hotels like the Ritz Carlton in Atlanta. Some loans were so embarrassing, and public, that the firms actually returned the money; many more have not.

This happened because of a combination of loopholes and oversights in the original law that allowed medium and large businesses to be eligible for money, and decisions by the Treasury Department and Small Business Administration that created incentives for banks to prefer making larger loans to existing customers.

The bad news is that Congress didn’t manage to fix these problems last week when it passed the next funding round of $310 billion. Without some important changes, many genuine small businesses will continue to fall through the cracks.

The good news, however, is that it’s not too late to fix the program. The Treasury Department has the ability to correct many of these problems through changing how it administers the program. Read the full article for several ways to that end.

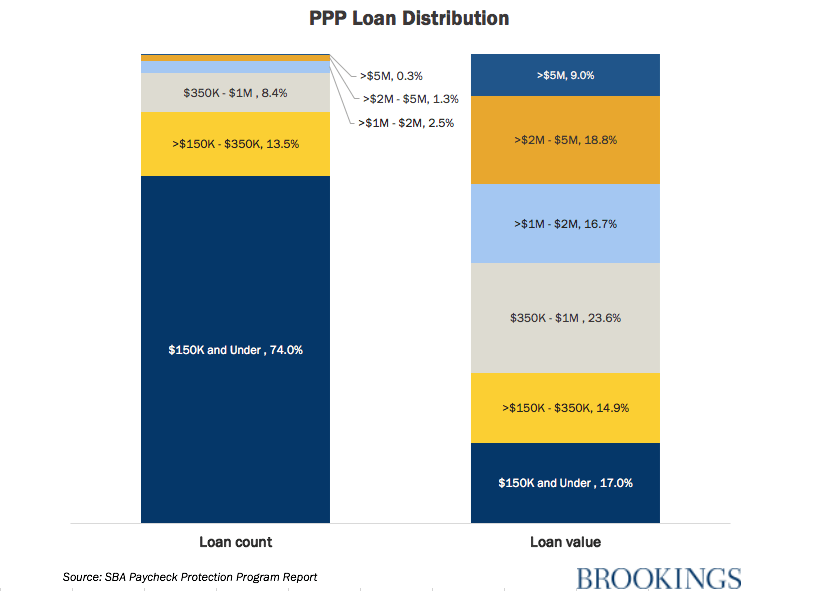

As the chart above shows, the loans that made it to what most consider small businesses accounted for only about a third of the actual money.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Op-edThe small business relief program is still broken

April 27, 2020