Executive Summary

This research looks at how the financial sector has evolved over the periods both before and after the financial crisis of 2007-8. This paper is the first in a series, examining the balance sheets of the four largest banks; it will be followed by papers on the regional banks, the smaller banks and the shadow financial sector. The assets and liabilities of the big four banks grew very rapidly for years prior to the financial crisis as a result of deregulation, particularly through the Riegle-Neal Act in 1994, but also from the Gramm-Leach-Bliley Act of 1999.

These laws gave banks the ability to consolidate and expand both across geographic and service lines, and they continued to do until the crisis hit years later. Paired with generally robust economic growth, the deregulation of the financial sector enabled the largest banks to post double-digit growth rates right up to the onset of the crisis.

The theme of consolidation continued, in a way, into 2008 as the U.S. government encouraged acquisitions of troubled financial institutions by stronger ones during the worst moments of the crisis. With no clear precedents or protocols for managing the failures of such large and interconnected institutions like Lehman Brothers, Merrill Lynch, and Bear Stearns before the crisis, the U.S. government took was forced to take an ad hoc approach, pushing these major investment banks into mergers with or acquisitions by other, stronger private institutions. Likewise, to deal with failing depository institutions, the U.S. government encouraged mergers with stronger banks or dispositions of bank subsidiaries by troubled institutions to other banks, with support provided by the FDIC as required. As a result, today, the four biggest banks (“Big Four”) are JP Morgan Chase, Bank of America, Citigroup and Wells Fargo.

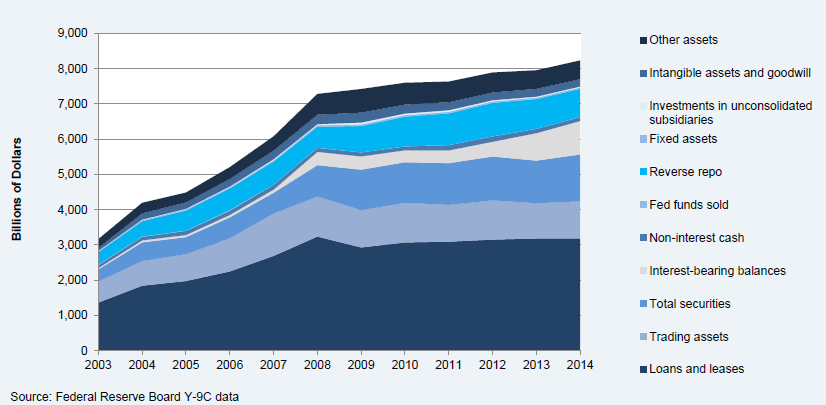

Big Four Asset Composition in Dollars

Introduction

This report is the first in a series on the evolution of the financial sector. The series aims to retrace the major trends that have shaped the banking sector since the crisis and to orient the public as to where industry stands today. This first installment focuses on the “Big Four” banks: JP Morgan Chase, Bank of America, Citi, and Wells Fargo.

The financial crisis of 2007-2009 revealed a widespread lack of understanding of how the modern banking system operated. In the decades prior to the crisis, the traditional banking model of taking deposits and extending loans to regionally-based customers evolved into one characterized by global reach, new technology, and a diverse range of complex services. With the passage of the Riegle-Neal Interstate Banking and Branching Efficiency Act in 1994 and the Gramm-Leach-Bliley Act in 1999, commercial banks became free to expand first across state lines and then across service lines. Although securitized loans had been around for many years, the housing boom encouraged the creation of complex securities that sliced and diced risk and returns and made it hard to assess their risks correctly. Many of these securities were sold to domestic and foreign investors and many were held by the banks on their own portfolios, or in special investment vehicles (SIVs).1 Even those market participants who sensed the riskiness of the new securities felt obliged to purchase them in order to remain competitive.

Further, the financial crisis exposed the importance of a “parallel” system of credit intermediation. The so-called “shadow sector” or “shadow banks” that transformed short-term funding obtained in the money markets into long-term investments had grown rapidly in the years leading up to the crisis. Without being subject to the kind of regulatory and reporting standards as those of traditional banks, these the activities of some of the shadow banks largely flew – and in some cases continue to fly – under the radar of regulators and policymakers until it was too late. Unlike historical bank crises where there were runs on deposits at banks, the post-2007 financial crisis was characterized by runs on a different source of funding for financial institutions, namely commercial paper and other short-term wholesale funding often used for securitized loans, and it became apparent just how vital the shadow banking sector had become to financial intermediation and the business of traditional banking.

The banking system has continued to evolve since the crisis. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 ushered in sweeping new regulations that would profoundly change the operational environment for the banking industry. New rules and regulations intended to improve the safety and soundness of the financial system would affect nearly every aspect of the banking business, from lending to trading to funding. In addition, pressures from inside the market contributed to change in the banking industry. As these new rules, regulations, and norms have begun to take effect, the banking model continues to evolve.

The “Big Four”

This first report is meant to be a factual exploration of the balance sheets of the four largest banks. We will follow this with a report on the regional banks and then a sample of smaller banks. While we give some commentary on the data, the purpose at this stage is to allow readers access to a picture of the largest banks and form their own judgments about why the banks have changed. Putting together the balance sheets of the big four seemed at first as if it would be a straightforward task, but the reality has been different and more difficult. We have aimed to present an accurate picture in the following pages but we would welcome comments.

* On June 1st, 2015, revisions were made to Figures 1, 5, 6, and 7.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).