Like elsewhere across the globe, in an effort to curb the spread of the COVID-19 pandemic, South Africa imposed restrictions on social mobility and interaction, with a five-week national lockdown between March 27 and May 1, followed by a risk-adjusted, phased reopening of the economy. Such a lockdown policy, however, was always going to induce substantial welfare losses to individuals and households. These pandemic-related shocks to employment, working hours, and earnings among low-wage and vulnerable workers exacerbated the already high levels of poverty and inequality in South Africa. With these welfare losses in mind, last month, President Cyril Ramaphosa presented the government’s Economic Reconstruction and Recovery Plan (ERRP) to restore the South African economy following the devastation caused by the pandemic.

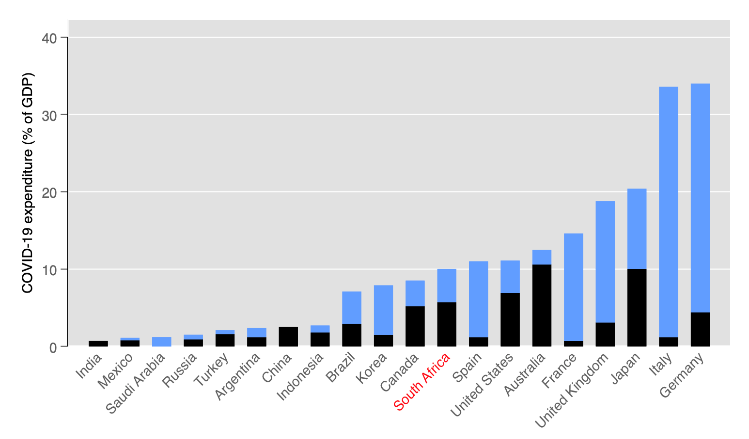

The Ramaphosa COVID-19 stimulus package, originally announced on April 21, is huge, amounting to approximately $26 billion, or 10 percent of the economy’s GDP (Figure 1). As a share of GDP, South Africa’s package represents the largest in the emerging markets; notably larger than several high-income countries, including South Korea and Canada. Even when only examining “above-the-line” expenditures by government, South Africa is spending enormous amounts of money to get the country back on its feet.

Figure 1. COVID-19 stimulus expenditure, by country (% of GDP)

Source: Bhorat et al. (2020). Authors’ own calculations.

Approximately 90 percent of the stimulus package was allocated to additional health support, assistance to municipalities for the provision of basic services, wage protection through the Unemployment Insurance Fund (UIF), further income support through the tax system, financial support for small and informal businesses, and—the largest component—the credit guarantee scheme.

Notably, about 10 percent of the stimulus package, or $3.2 billion, was allocated to social assistance, including an expansion of cash transfers or social grants at both the intensive (the amount of every existing social grant was increased) and extensive (a new, special COVID-19 Social Relief of Distress grant was introduced) margins, for six months from May to October 2020. The COVID-19 grant is targeted at individuals above the age of 18, unemployed, and neither receiving any income nor any other social grant or support from the UIF. The president’s October announcement included a further extension of the availability of the COVID-19 grant, given its impressive reach (4.2 million previously unreached individuals) in just four months (equivalent to the growth of the grants system in the last 10 years) and subsequent poverty-reducing effects. Indeed, in previous research, we have shown that the distribution of the COVID-19 grant has been relatively pro-poor: For every grant recipient in the richest quintile of households, more than five other recipients live in the poorest.

Table 1. COVID-19-induced changes to social assistance in South Africa, by grant type

Source: NIDS (2017), GHS (2018), and Department of Social Development (2020). Authors’ own calculations.

Notes: *The assumptions around eligibility and takeup for the COVID-19 grant are discussed in Bhorat, Oosthuizen & Stanwix, 2020.

As of mid-October, 18.5 million COVID-19 grants were distributed to 6 million unique individuals since May, resulting from more than 9 million applications. Given the eligibility criteria for the COVID-19 grant and a few assumptions pertaining to takeup, we estimate that the grant has the potential to reach up to 10 million individuals. Together, with the existing Child Support Grant that already reaches 13 million children and 8 million caregivers along with other grants reaching about 5 million recipients, President Ramaphosa’s package has the potential to provide much-needed support to about 36 million people, or 61 percent of the South African population. The significant reach of the social assistance component—at just under two-thirds of the country’s population—is to be commended.

Ultimately, the South African government’s stimulus package has been large by global standards and the reach in terms of support to the poor and vulnerable has been impressive. The credit guarantee scheme, which constitutes two-fifths of the stimulus package, requires the private banking system to extend loans to firms in distress. While it is a key component of the stimulus package linking government support through banks to the private sector, its disbursement has been slow and subject to the strict credit criteria of South Africa’s financial institutions. In addition, such support has come at the expense of a massive rise in the fiscal deficit. Any further stimulus packages are likely to prove fiscally unsustainable. The challenge now—for government and policymakers—shifts to finding instruments on both the revenue collection and expenditure sides to place the country onto a measured and optimal fiscal consolidation path.

Read more

Baskaran, G., Bhorat, H. and Köhler, T. (2020). South Africa’s Special COVID-19 Grant: A Brief Assessment of Coverage and Expenditure Dynamics. DPRU PB 2020/55. Development Policy Research Unit policy brief, November 2020. University of Cape Town.

Bhorat, H., Oosthuizen, M. and Stanwix, B. (2020). Social Assistance Amidst the Covid-19 Epidemic in South Africa: An Impact Assessment. Development Policy Research Unit Working Paper 202006. DPRU, University of Cape Town.

Köhler, T. and Bhorat, H. (2020). COVID-19, social protection, and the labour market in South Africa: Are social grants being targeted at the most vulnerable?. Development Policy Research Unit Working Paper 202008. DPRU, University of Cape Town.

Bhorat, H. and Köhler, T. (2020). Social assistance during South Africa’s national lockdown: Examining the COVID-19 grant, changes to the Child Support Grant, and post-October policy options. Development Policy Research Unit Working Paper 202009. DPRU, University of Cape Town.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Lockdown economics in South Africa: Social assistance and the Ramaphosa stimulus package

November 20, 2020