China’s goods exports in 2023 were near record levels, yet accumulation of official foreign exchange (FX) reserves was essentially zero. This combination is unusual. Ordinarily, strong exports imply a large current account surplus, which historically has meant rapid build-up in FX reserves. This blog post—the third in our new Global Economy and Markets series—examines China’s balance of payments (BoP) for clues. Conceptually, there may be at least three drivers. First, China could be stockpiling dollar-invoiced commodities to reduce the current account surplus, thereby reducing upward pressure on reserves. Second, it is possible that what in the past counted as official intervention is now being channeled through state banks (i.e., is being classified as a capital outflow rather than official intervention). Third, net foreign direct investment (FDI) may be shifting against China. Empirically, it is the third channel that is most important. Unfortunately, data transparency is poor, which means it is hard to disentangle if this shift is due to foreign businesses pulling back or China’s outbound direct investment. Our reading of the data is that it is primarily the latter, consistent with China trying to financially decouple from the U.S.

China’s export dilemma

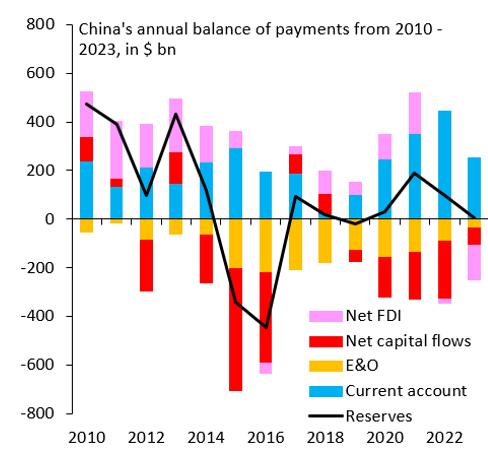

China’s continued emphasis on export-led growth poses a dilemma: Large trade surpluses mean that official FX reserves invariably rise, which in turn means that China’s financial exposure to the U.S. grows, even as geopolitical tensions are elevated. It would therefore make sense for China to look for ways to reduce this financial interdependence even as it keeps its export model going. The BoP in 2023 is interesting in this regard. China’s current account surplus was large, but official FX reserve accumulation near zero (Figure 1). While reserve accumulation has been near zero in the past, what is unusual in 2023 is the lack of capital outflows. Errors and omissions are small and net capital outflows modest. This post discusses the principal drivers behind this shift. Weak net FDI flows are the main cause. Data visibility is poor, but these flows may be consistent with China trying to financially decouple from the U.S.

Figure 1. China’s annual balance of payments from 2010-2023, in $ bn.

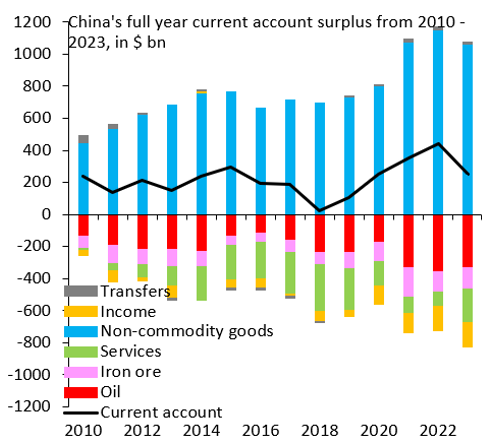

Figure 2. China’s full year current account surplus from 2010-2023, in $ bn.

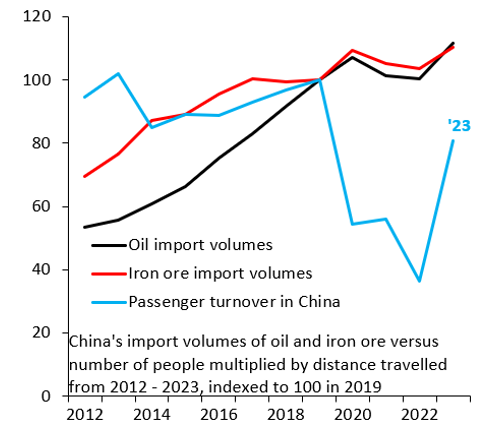

Market focus is on three factors behind China’s lack of a reserve build-up. First, there are persistent rumors China is stockpiling commodities like crude oil and metals. This would weigh on the current account surplus, reducing the need for official FX intervention. Empirically, it is true that import values of commodities have risen (Figure 2), but this is primarily a price effect, with volumes of imports relatively stable (Figure 3). There may still have been stockpiling, especially during COVID-19 lockdowns, but much of that would have been inadvertent. Second, it is possible that state banks took over from the central bank as vehicles for intervention. This “proxy” intervention would show up as a capital outflow in Chart 1. While this shift may be historically important, these outflows were small in 2023, so—again—this is an unlikely explanation.

Figure 3. China’s import volumes of oil and iron vs. number of people multiplied by distance traveled from 2012-2023, indexed to 100 in 2019.

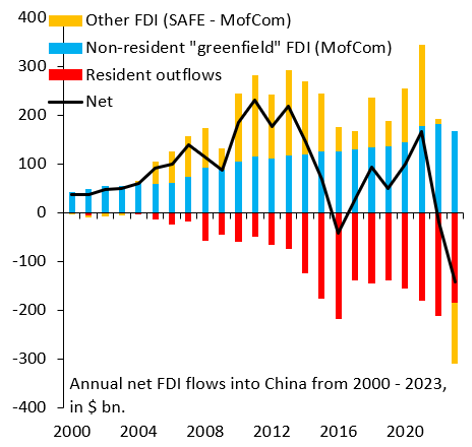

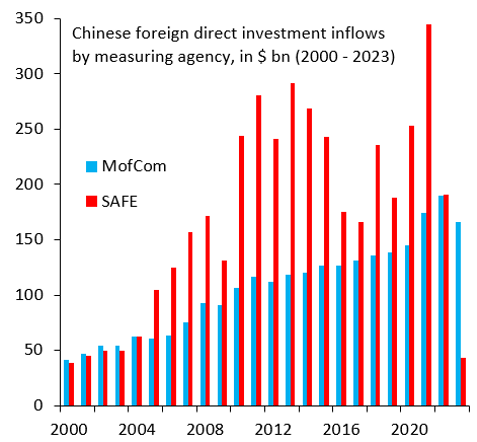

Figure 4. Annual net FDI flows into China from 2000-2023, in $ bn.

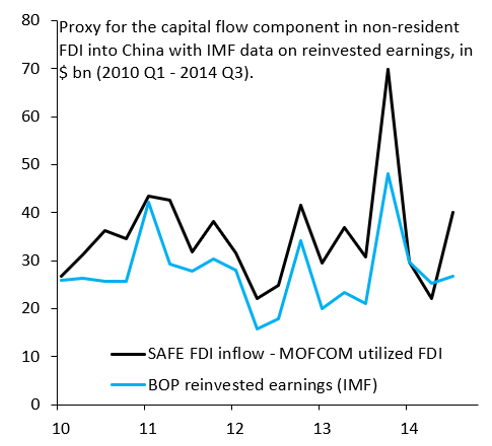

Third, net FDI flows deteriorated sharply and were the main offset to China’s 2023 current account surplus (Figure 4). What exactly is going on here is difficult to ascertain because data transparency is low. Nick Lardy at the Peterson Institute has flagged that the difference between non-resident FDI flows from SAFE versus FDI data from the Ministry of Commerce (MofCom) implies large asset sales in 2023, as MofCom data proxy for “greenfield” FDI while SAFE data are broader (Figure 5). However, for the few years in which data on reinvested earnings are available—a big thanks to Homin Lee at Lombard Odier for these—reinvested earnings accounted for 80% of the gap between SAFE and MofCom data (Figure 6). As reinvested earnings are not an actual capital flow—they are booked as an offsetting dividend payment in the current account and an FDI inflow in the financial account—it is possible that a big part of the 2023 outflow reflects losses at foreign-owned subsidiaries, consistent with lingering effects from China’s COVID lockdowns, and thus has nothing to do with asset sales by foreigners. As such, the evidence points to China’s outward FDI as the main driver behind the shift to lower reserve accumulation.

Figure 5. Chinese foreign direct investment inflows by measuring agency, in $ bn. (2000-2023)

Figure 6. Proxy for the capital flow component in non-resident FDI into China with IMF data on reinvested earnings, in $ bn (2010 Q1-2014 Q3).

China’s outward direct investment

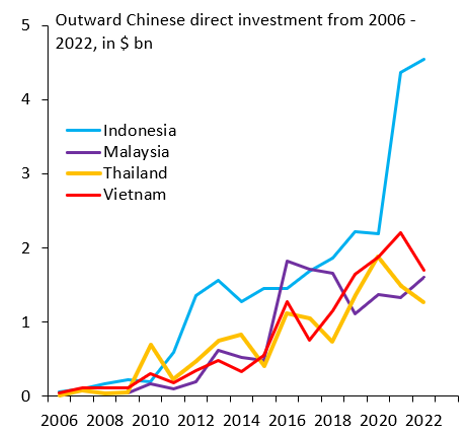

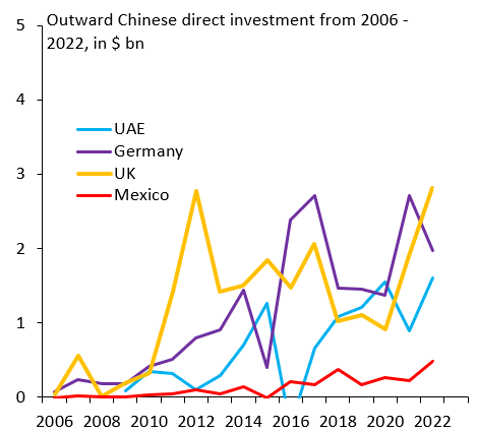

China’s outward direct investment straddles the nexus between financial interdependence and rising trade tensions. This is because China is likely diversifying its manufacturing base, shifting production to third countries where exports will not automatically be subject to U.S. tariffs. This is apparent in China’s outward investment flows, which show a rise in outflows to countries across Asia (Figure 7) and—on a smaller scale—to countries in Europe (Figure 8). This shift is consistent with China financially decoupling from the U.S. and diversifying manufacturing supply chains at the same time. It is worth reiterating that data visibility is poor, as outward investment data are not yet available for 2023. However, it is our judgement that these outflows are the principal reason behind China’s lower reserve accumulation over time.

Figure 7. Outward Chinese direct investment from 2006-2022, in $ bn.

Figure 8. Outward Chinese direct investment from 2006-2022, in $ bn.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Is China financially decoupling?

May 9, 2024