What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want to receive the Hutchins Roundup as an email? Sign up here to get it in your inbox every Thursday.

Children exposed to more generous Earned Income Tax Credits experienced lower poverty as adults

The Earned Income Tax Credit (EITC) is one of the largest anti-poverty programs in the United States, reaching about half of all households with children. Using data from 1968 to 2017, Nicardo McInnis of California State, Northridge, and Katherine Michelmore and Natasha Pilkauskas of the University of Michigan examine how variations in the generosity of the EITC across states and time affected children’s outcomes as adults. Children whose families were exposed to an extra $1,000 in EITC each year were 7 percentage points less likely to be in poverty as adults and 4 percentage points more likely to be employed. Those in the bottom half of the earnings distribution earned 10%-30% more. The effects were especially pronounced among children exposed before age 8, Black children, and those who grew up in the second quartile of the income distribution, rather than those the lowest quartile. This last finding is likely explained by the fact that the EITC is contingent on work and may do less to help families with limited household earned income, the authors say.

Low-wage workers lose earnings after labor demand shocks

Low-wage workers experience substantial long-run earnings losses because of shocks to labor demand, find Evan K. Rose of the University of Chicago and Yotam Shem-Tov of UCLA. Combining administrative earnings records with household surveys from 2001 to 2008, they find that, for low-wage workers earning up to $15 per hour, reductions in labor demand led to a 13% reduction in earnings and over $40,000 in cumulative lost earnings six years after job loss. The losses were mostly the result of decreased hours worked rather than lower wages. The results contradict the view that low-wage workers who lose their job easily find identical replacement jobs, the authors say.

Uneven cross-industry innovation slows aggregate productivity growth

Although the past few decades have seen rapid advancements in technology and electronics, productivity growth in industrialized nations has been disappointing. Daron Acemoglu and David Autor of MIT and Christina Patterson of the University of Chicago argue that advancements in a sector depend on simultaneous advancement in that sector’s suppliers. When innovation is concentrated in certain industries, the laggards create bottlenecks, and aggregate productivity gains are not realized. For instance, breakthroughs in making cars cannot be achieved solely with improvements in engine-management software and sensors, but also require improvements in energy storage, drivetrains, and tires. Using data on patents, total factor productivity growth, and input-output linkages across industries, the authors find that when the variance of input-supplier productivity growth doubles in an industry, productivity growth in that sector slows by 0.9 percentage point. The authors conclude that a more balanced distribution of innovation could improve aggregate productivity performance.

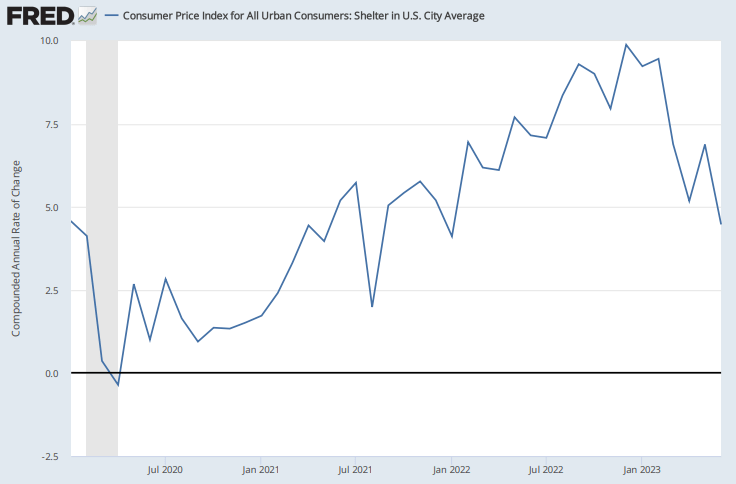

Chart of the week: Shelter inflation declining steadily

Chart courtesy of FRED

Note: Monthly change at an annual rate

Quote of the week

“I have been intent on speaking about this relationship plainly and honestly: to address the challenges and opportunities that face us based on sober realities. The U.S. and China have significant disagreements. Those disagreements need to be communicated clearly and directly. But President Biden and I do not see the relationship between the U.S. and China through the frame of great power conflict. We believe that the world is big enough for both of our countries to thrive. Both nations have an obligation to responsibly manage this relationship: to find a way to live together and share in global prosperity,” said Janet Yellen, U.S. Secretary of the Treasury.

“…President Biden and I seek a future of healthy economic competition between our countries. We believe it is possible to achieve an economic relationship that is mutually beneficial in the long term – one that supports growth and innovation on both sides. Indeed, I noted that China’s growth has lifted hundreds of millions out of poverty and made clear that the United States is not seeking to decouple from China. There is an important distinction between decoupling, on the one hand, and on the other hand, diversifying critical supply chains or taking targeted national security actions. We know that a decoupling of the world’s two largest economies would be disastrous for both countries and destabilizing for the world. And it would be virtually impossible to undertake. We want a dynamic and healthy global economy that is open, free, and fair – not one that is fragmented or forces countries to take sides.”

-

Acknowledgements and disclosures

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: Earned Income Tax Credit, labor demand shocks, and more

July 13, 2023