Executive summary

The U.S. relies on a variety of industries to drive economic growth and provide many different goods for households and other consumers across the country. However, producing and consuming these goods can leave significant climate impacts. The energy intensity and greenhouse gas (GHG) emissions resulting from several industrial processes—including the production of steel, cement, chemicals, and other goods—pose a significant climate challenge. Meanwhile, a variety of acute and chronic climate impacts, such as floods and droughts, are disrupting supply chains, destroying facilities, or leading to many other costs.

These climate challenges also negatively affect different people and places. The location of industrial facilities, such as steel mills and other emissions-intensive production sites, can jeopardize the public health of nearby communities or those farther afield. Ongoing industrial transitions, including the shift to newer technologies and processes, threaten to leave many workers behind.

This memo provides a broad overview of the climate effects of the most emissions-intensive industries in the U.S. and how private financing works to support (or often not support) needed improvements around climate mitigation and adaptation. Beyond delving into the physical investments and upgrades the U.S. needs, the memo also explores some of the most pressing climate equity concerns, including considerations for financial institutions, regulators, and policymakers aiming to better define and address such concerns. In particular, the memo identifies several larger, structural changes where private financing is vital to reduce climate impacts across the industrial sector, including barriers to scaling more equitable climate action:

- From an investor and producer perspective, corporate commitments (and spending) do not match the country’s net-zero targets, making it difficult to drive the deployment of cleaner technologies, the adoption of cleaner processes, and ultimately support for more sustainable and equitable climate outcomes.

- Consumers lack awareness and still opt for lower-cost, higher-carbon products, driving continued demand for goods that imperil the environment and communities.

- Policymakers and regulators still have more work to do to incentivize producer and consumer shifts toward lower-carbon (and lower-emitting) products; even though new funding and incentives—through the Inflation Reduction Act, for instance—hold promise, the ultimate reach and impact of such policies is unknown.

Exploring the intersection between industry and climate

The production and consumption of goods drives the U.S. economy. Whether that means manufacturing chemicals, refining oils, forging steel, or creating numerous other products, the country’s goods-producing industries contribute to more than $6 trillion in output—or gross domestic product (GDP)—each year. Supported by continued investment and innovation in different materials, equipment, and structures, this output is steadily rising—up about 3% in 2023. Even more foundational to U.S. GDP is the ultimate consumption of these goods by households and other end users, whose spending fuels more than two-thirds of the country’s economy.1

However, all this production and consumption requires a variety of industrial inputs, processes, and byproducts. The transformation of raw materials into finished products and other intermediate outputs results in physical and chemical reactions that contribute to GHG emissions. These include carbon dioxide, methane, fluorinated GHGs, and other pollutants. The climate impacts of these products and processes can jeopardize public health and lead to other economic and social equity challenges, which this memo explores more fully later.

Especially problematic are direct emissions, which result from burning fuels (typically fossil fuels) to power or heat various inputs in a range of industrial processes. These direct emissions also result from leaks or the use of fuels as inputs to create new products (such as plastics). Collectively, direct industrial emissions account for 23% of all U.S. GHG emissions, ranking only behind transportation and electricity generation. Indirect emissions—those associated with electricity generated offsite to power these industrial processes—contribute to even more climate impacts. If these indirect emissions are combined with the sector’s direct emissions, the industrial sector accounts for 30% of all GHG emissions, the second-highest of any sector nationally, slightly behind residential and commercial buildings (31%).

The most emissions-intensive industries include steel, cement, and chemical production.

- Steel production—particularly that of virgin steel made from iron ore—currently depends on coal as both an industrial input and source of heat, resulting in GHG emissions (specifically carbon dioxide). Globally, for instance, every ton of steel produced can emit 1.85 tons of carbon dioxide, adding up to a total that accounts for nearly 8% of all carbon dioxide emissions. However, steel can also be recycled and reused, a process that relies less on coal and that can be less energy- (and emissions-) intensive.

- Cement production—focused on creating the main binding agent for the concrete used in roads, buildings, and other infrastructure—involves multiple chemical processes that are energy-intensive and that can also release carbon dioxide. Just 92 cement plants in the U.S. have reported 67 million tons of carbon dioxide emissions, making up 10% of all direct industrial emissions by themselves. The creation of clinker—a combination of limestone and other minerals—is central to cement production and is part of a chemical process particularly difficult to decarbonize; however, carbon capture or utilization and storage (CCUS) is among the potential options for reducing such climate impacts.

- Chemical production includes the making of organic chemicals, such as plastics and fibers, and inorganic chemicals, such as ammonia and gases like chlorine. Thousands of different chemicals and compounds that are manufactured every day require fossil fuels as part of the production process, resulting in widespread GHG emissions. Agricultural chemicals, basic chemicals, specialty chemicals, and consumer products are among the primary components of the U.S. chemical sector, which is supported by more than 11,000 different manufacturing facilities. Each year, the sector releases 180 million metric tons of carbon dioxide equivalents, including many toxic pollutants that jeopardize the health and safety of communities. For the sake of comparison, that is on par with the annual emissions of 42.8 million cars. However, replacing fossil fuels in these processes help reduce these impacts as can integrating other improvements, such as plastic recycling and circular economy solutions, which include the reuse of materials.

Beyond these three emissions-intensive sectors, dozens of other industries also contribute to GHG emissions, especially those that manufacture aluminum, glass, paper, other non-metallic mineral products (such as ceramics), and food products. In addition, the production and release of certain synthetic gases—particularly hydrofluorocarbons (HFCs), which were developed to replace other ozone-depleting substances—are leading to increasingly destructive climate impacts. HFCs are primarily produced and consumed for refrigeration and air conditioning. While they only make up 2% of GHG emissions, HFC emissions are growing at up to 10% each year and are much more destructive than carbon dioxide and other gases. For this reason, new global climate agreements have emerged to phase out the use of HFCs, including the Kigali Amendment to the Montreal Protocol, which was ratified by the U.S. Senate in 2022 and calls for an 80% reduction by 2050. However, the ultimate implementation of these agreements is still in motion and will require continued buy-in (and investment) from the industry.

Of course, continued demand for all these goods, fueled by U.S. households’ spending habits, remains a key climate challenge. Research shows that, by purchasing and using homes, vehicles, food, or other products, households are driving more than 60% of global GHG emissions, and the consumption impacts are even more significant in the U.S. A typical American generates five times as many carbon dioxide emissions compared to the average person globally, and the impacts tend to get worse for those with more income. U.S. households with more than $100,000 in annual income represent about 22% of the country’s population, but they are responsible for almost one-third of all emissions.2 Household reliance on plastics, fabrics, and other disposable goods—often intentionally designed with shorter lifespans to meet revolving consumer tastes (like in the case of fast fashion)—exacerbates these climate impacts.

This production and consumption depend on extensive global value chains—the physical and economic networks needed to manufacture and bring goods to market—which only add to industrial emissions. The fact that the U.S. depends on a variety of globally produced goods and intermediate products means that emissions tend to increase not only at home, but also abroad. Consider all the petroleum products from the Middle East, electronics from Asia, and food products from Latin America. Unlike the direct (Scope 1) and indirect (Scope 2) emissions from assets or facilities controlled by an individual industrial actor, value chain emissions (Scope 3) tend to stretch beyond a particular asset or facility; yet they represent a significant climate challenge and remain difficult to fully measure and address. Better accounting for these Scope 3 emissions and improving the environmental performance of larger global value chains is a pressing concern for many industrial actors and investors. Global climate accounting may further underscore the U.S. role in all these emissions, further stressing the need to better define and address their impacts sooner rather than later.

While reducing GHG emissions is a key need across multiple industries, adapting to a more extreme climate is also becoming a bigger challenge. The risks and costs are rising as more frequent and intense storms, droughts, and other chronic and acute climate impacts hit industrial facilities, supply chains, and related assets. Industries are among the central actors facing $150 billion in extreme weather costs each year across the U.S. Major storms such as Hurricane Ida and sudden disruptions, such as the deep freeze Texas weathered in 2022, caused railroad and port closures near the Gulf Coast, while also shutting down semiconductor and petrochemical plants. Even hotter daily temperatures can reduce manufacturing productivity, increase energy costs, and shift labor to other industries, with harsher impacts on smaller firms in particular. Halted or slowed production, combined with shipping delays, pose enormous risks to industries and are prompting them to invest in new risk-mitigation measures, facility upgrades, and operational improvements. Yet many industrial firms and facilities are not ready; surveys have shown that 80% of U.S. industrial sites have no business continuity plans or other alternatives ready to go if they were to get hit by these climate-related disruptions.

The need for greater climate adaptation, much like climate mitigation, is causing industries to better manage and avoid risk, while seeking ways to capitalize on the need for greater resilience. For example, collaborative research and business efforts are emerging globally—including those from PWC and the World Economic Forum—and these efforts spell out how industries can create new products and services and ultimately emerge financially stronger amid today’s unpredictable climate-related challenges. Financial firms and corporate banks, such as Bank of America, are also adapting their strategies to profit from this market opportunity, although the climate risks and impacts remain difficult to forecast in many cases.

How private financing can address climate impacts across the industrial sector

Areas of needed climate investment across the industrial sector

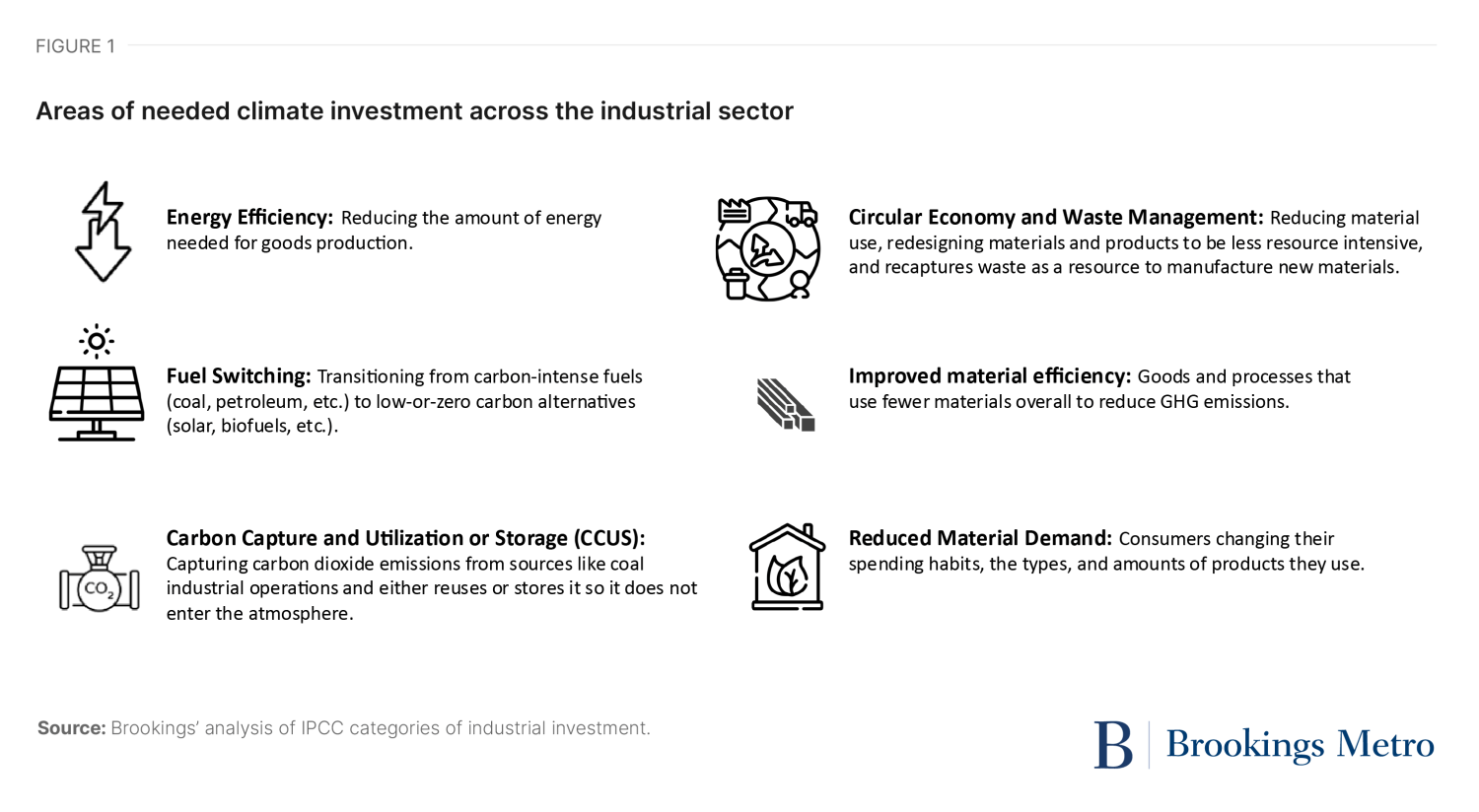

Reducing GHG emissions represents the biggest climate priority for many industries, with mitigation-focused investments taking precedence. The private sector—including industrial firms and portfolio companies—lead the financing of facility and operational improvements needed to reduce GHG emissions. These improvements span a variety of direct investments in the form of more efficient equipment, technologies, and processes to phase out high-emitting assets, typically via a combination of upstream and downstream investments throughout the production process. While climate equity considerations are not typically top of mind in such process improvements, the resulting reductions in GHG emissions and other byproducts can benefit communities. According to the Intergovernmental Panel on Climate Change (IPCC), some of the major categories of industrial investment globally and in the U.S. are summarized in Figure 1.

- Energy efficiency: Reducing the amount of energy needed to produce goods remains one of the leading ways that industrial firms can limit their GHG emissions. Doing so often entails investing in the best available technologies (BATs) during an industry facility’s installation to limit site-specific environmental impacts, but such efforts can also emerge during other parts of the production process (up and down value chains) and can be integrated over time during the facility’s entire lifecycle. For instance, various carbon-dioxide absorption technologies are among the BATs that can help reduce energy demand in steel and cement plants. In the U.S., the Clean Air Act is the main policy and regulatory vehicle to drive improved emissions standards, although the act does not mandate any specific BATs.

- Fuel switching: In addition to limiting the amount of energy required during production processes, industrial firms can also invest in fuel sources beyond coal, petroleum, or natural gas by instead using more renewable and sustainable sources, including solar heating, biofuels, or hydrogen. Investments in electrifying industrial facilities for heating can reduce GHG emissions, as can the use of hydrogen as both a fuel and a material input during production. However, the use and storage of these fuel sources is not always cost-effective for firms, which may need to retrofit buildings and rethink existing processes. These shifts also do not necessarily account for other impacts on the environment, including the potential for additional mining to extract the resources necessary to use these fuels (for things such as batteries).

- CCUS: While carbon is typically a pollutant from one production process, it can also be a versatile building block if reused to help produce other goods, including many chemicals. Capturing and compressing carbon dioxide can lead to emission reductions and long-term cost advantages for industrial firms; for instance, in blast furnaces during steel production, retrofits can reduce emissions by up to 75% at a cost of $50 to $90 per ton of carbon dioxide removed. However, the financial viability for such retrofits and projects is often lacking, given high upfront capital costs and the complexity of lifecycle cost accounting. The continued lack of a nationally consistent carbon pricing scheme in the U.S. also creates uncertainty for firms as they plan future investments.

- Circular economy and waste management: Circular economy investments focus on the recycling, reuse, or remanufacturing of material inputs during the production process, helping slow, close, or narrow existing material loops. Since many current industrial practices are linear—extracting raw materials, using them, and then discarding them—firms can realize energy and cost savings by investing in more regenerative processes. In the cement industry, for instance, recycling waste—such as scrap tires or waste oils—can reduce fossil fuel emissions during production. The National Institute of Standards and Technology is among the federal bodies seeking to promote and develop guidance on these types of circular economy solutions.

- Improved material efficiency: Closely related to circular economy improvements, investing in goods and processes that use fewer materials overall can reduce GHG emissions as well. Investing in more durable product designs, lower waste manufacturing processes, more extended product lifecycles, and more product reuse and recycling can all drive additional efficiency. For example, using advanced catalysts in the production of plastics, textiles, and other goods allows the chemical reactions to occur faster with lower temperatures, improving energy efficiency.

- Shifting material demand: In developed economies like the U.S., the reality is that consumer demand continues to drive the need and production for all types of goods, including cement, steel, chemicals, and other energy- and emission-intensive products. Investments in production processes can help reduce climate impacts, but ultimately households and other consumers may need to change their spending habits and the types (and amounts) of products they use. State and local departments of transportation, for instance, continue to rely on the same types of unsustainable cement for road projects, yet they could invest in more sustainable options, such as green concrete or an aggregate replacement (such as recycled rubber or plastic).

Actors and instruments involved in climate finance across the industrial sector

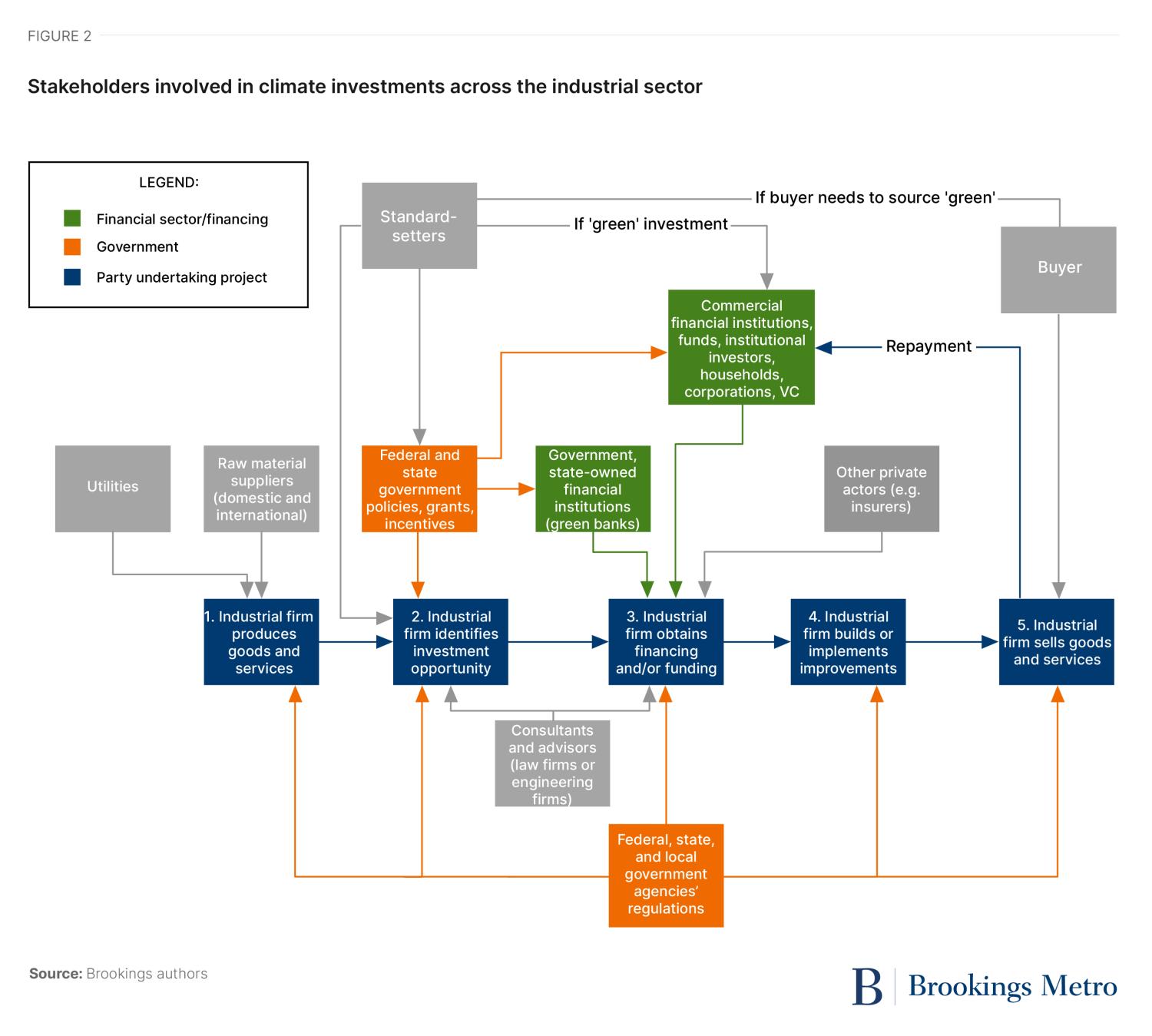

As industrial firms increasingly look to implement different technological and process improvements, they must also weigh a variety of different financial instruments and approaches—and they must operate within a larger landscape of actors, including government agencies and private investors. Figure 2 below illustrates some of the general steps that industrial firms follow when pursuing potential climate investments and the junctures at which these other actors may be more involved.

For example, industrial firms may identify a potential investment opportunity related to existing production processes, perhaps driven by a government regulation or incentive. They may also receive input from consultants and follow guidance from other standard-setting bodies. Ordinarily, industrial firms may use their own revenues to cover equipment maintenance and other costs, but for larger or new improvements, they may obtain additional funding or financing. Incorporating new climate-related technologies is not only an eligible expense for some government grants but may also attract interest from different private investors (such as financial firms or venture capital). Industrial firms that demonstrate profitability and efficiency—relative to their assets and costs—can be in a better position to obtain this needed upfront capital, implement improvements, and ultimately deliver goods with a lower carbon footprint to end users.

Ongoing large capital expenditures in these climate-related improvements will be necessary, and financing can come in many different forms.

- Sustainable funds, offered by private equity firms and corporate banks, give investors an opportunity to target support for some of these emission-reduction upgrades across industries. Typically structured around a set of environmental, social, and governance (ESG) criteria, these funds provide a more accountable way to track the returns and performance of climate-related investments, including offerings by BlackRock, Goldman Sachs, and other large firms. In the U.S., uptake has surged over the past decade, with sustainable funds now including $300 billion in assets; however, demand has cooled slightly over the past couple years. Other sustainable funds can also be aimed specifically at small and medium enterprises (SMEs), providing vital financing for upgrades for industrial firms that might not otherwise have the capacity.

- Private debt, including sustainability-linked bonds (SLBs) and sustainability-linked loans (SLLs), is another option also targeted around ESG criteria; the ultimate performance and returns of SLBs and SLLs can vary depending on whether the issuer (the industrial firm in question) meets certain carbon-reduction and ESG targets, and the use of these instruments has increased across the cement industry in particular. Still, increased regulatory pressure and transparency around the use of these instruments is pressuring banks to create more rigid ESG criteria, and the labeling of these instruments—similar to other ESG issues—has attracted controversy among some industry observers and policymakers.

- Venture capital, particularly around the development and deployment of more efficient technologies, also provides financing for industrial firms, including start-ups. The marketplace for these technologies is still evolving in real time, including a combination of pilot, demonstration-stage, and deployable upgrades that may not always get the flexible, reliable levels of investment needed to scale nationally. However, with increased support, these technologies can overcome adoption hurdles, accelerate testing, and drive continued improvements in design and ultimately implementation.

The current window for federal infrastructure investment—via the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and beyond—is also offering unprecedented government grants and other incentives (such as tax credits) to support industrial upgrades.

The IIJA’s emphasis on energy efficiency, reliability, and more—through dozens of different grants, particularly at the U.S. Department of Energy (DOE)—is promoting broader climate investment and innovation nationally. Targeted grants, including a recent $254 million announcement from the DOE, are also specifically seeking to decarbonize industrial emissions, tied in with the agency’s Industrial Heat Shot and Clean Fuels and Products Shot efforts. The fact that many of these grants also emphasize environmental justice (EJ) and climate equity concerns is also shifting how firms are viewing potential investments, as described more extensively later in this memo.

However, the IRA’s various tax credits and other incentives are likely to be even more transformative for the industrial sector—including the Advanced Manufacturing Production Credit and the Qualifying Advanced Energy Product Credit. So far, nearly 300 major projects have attracted nearly $118 billion in private financing as a result of the IRA’s tax credits, including firms that have prioritized cleaner manufacturing. These incentives, in turn, have also supported additional jobs and spurred local economic development opportunities. While the industries supported go beyond the steel, cement, and chemical firms highlighted in this memo, the point remains: current federal incentives are having an unprecedented and potentially transformative impact on the extent and pace at which industrial firms are launching climate investments.

Struggles to scale needed climate investment across the industrial sector

Even with all this potential financing and funding available, industrial firms are not just focused on individual projects or facility upgrades. Transition planning efforts—those aimed at facilitating the move away from high-emitting assets and operations—outline the commitments, strategies, and actionable steps that firms can take to pursue investments to lower carbon emissions over time; global guidance provided by organizations such as the Task Force on Climate-Related Financial Disclosures has aimed to support stronger, more consistent transition plans. In addition, the Glasgow Financial Alliance for Net Zero outlines several points of guidance for net-zero transition planning, including various accountability mechanisms and steps that regulators and other actors can take to accelerate these efforts. In this way, firms can embrace more strategic asset management; better quantify reduction measures and targets; and adopt more cost-effective, efficient processes.

The need for more systematic, sector-wide improvements reflects the magnitude of the investment challenge at hand. Although emissions from the industrial sector have declined over the last few decades due to continued innovations and investments—by about 16% since 1990, according to the Environmental Protection Agency (EPA)—the reality is that much more investment must happen to reach bolder net-zero goals. Projections from the Energy Information Administration (EIA) actually show a potential 33% increase in energy consumption by the industry sector through 2050—with likely rises in emissions—caused by economic growth and lower energy prices. While no single estimate exists to capture the full range of needed capital expenditures to decarbonize high-emitting industries—including cement, steel, and chemical production—the DOE puts the cost needed to reach relevant net-zero targets at close to $1.1 trillion through 2050, “with most project development and financing falling on the private sector.”

As the IPCC has echoed in its global need assessments for industries, switching to new processes, adjusting fuel sources, and upgrading facilities will “require substantial scaling up of electricity, hydrogen, recycling, CO2, and other infrastructure.” There will need to be a fundamental “reorientation from . . . incremental improvements” to “transformational changes” in energy sourcing, materials efficiency, and more. The same proves true for related climate adaptation investments, where industrial firms need to integrate costs and accelerate improvements across broader project lifecycles, alongside communities, and as part of more holistic strategies. In other words, there is a need to change prevailing approaches (and habits) among producers, consumers, and regulators, which will require large-scale private investment.

It is these larger, structural changes where private financing is vital for reducing climate impacts across the industrial sector—and there are several immense barriers to scaling and driving such action.

- From an investor and producer perspective, corporate commitments (and spending) do not match the country’s net-zero targets. As described throughout this memo, the scale of needed investment often outweighs current investment levels, particularly among industrial firms and other private investors. For instance, while the steel industry is already achieving a 70% recycling rate, there is still a limit on how effectively industries can become energy efficient and decarbonized due to a lack of supplies and financing. Moving toward net-zero across the broader industrial sector will require more investments in technologies such as low-emissions, ore-based primary steel; low-carbon cement; and sustainable catalysts and solvents for chemical processes. The higher costs associated with new technologies and other capital upgrades can represent a barrier to investment, compared to more familiar, business-as-usual projects and processes. Even with new federal incentives, including from the IRA, implementing and scaling various technologies will be capital-intensive and carry more financial risk, whether those investments involve high-temperature heat electrification or alternative chemistries for cement production. The challenges of pursuing such upgrades and obtaining needed funding and financing could be especially challenging for smaller industrial firms.

- Consumers lack awareness and still opt for lower-cost, higher-carbon products. Even with increased investment in new technologies, new production processes, and ultimately new goods, the reality is that most U.S. consumers rely on widely available and emissions-intensive goods that tend to be cheaper. From single-use plastic goods to less durable fabrics, consumers do not internalize the climate costs associated with such products, especially with the lack of consistent carbon pricing schemes (not just in the U.S., but globally too). Inconsistent verification of the quality and greenness of different products can also lead to confusion. A lack of consumer education and outreach remains a factor as well. Large-scale consumption of some of these goods by government agencies and businesses is perhaps even more troubling, including when it comes to existing procurement processes. For example, departments of transportation traditionally rely on cement products that are unsustainable and carbon-intensive, yet some agencies, such as the California Department of Transportation, are trying to shift to lower-carbon alternatives like Portland limestone cement. These shifts, though, remain largely ad-hoc despite the short- and long-term climate impacts of adjusting prevailing consumption habits and approaches.

- Policymakers and regulators still have more work to do to incentivize producer and consumer shifts toward lower-carbon (and lower-emitting) products. The IRA represents a giant step forward in terms of incentivizing the deployment of more efficient technologies across different industries, but additional carrots and sticks can accelerate progress in the years (and decades) to come. An estimated $5.8 billion in the IRA can help offset some of the higher costs associated with new heating and fueling technologies, among other industrial improvements, through such programs as the Advanced Industrial Facilities Deployment Program. The DOE and other federal agencies are also spelling out clearer guidance on industrial decarbonization pathways, including specific technologies and process improvements. Yet these resources and guidance have limits, without durable, long-term funding or clear accountability mechanisms. Proposals from the Securities and Exchange Commission and different companies, for instance, continue to leave much uncertainty around climate disclosure rules, and additional legal challenges to these rules are likely forthcoming.

Examining climate equity needs across the industrial sector

Missing in many of these needed climate investments is a focus on addressing—or even accounting for—issues of climate equity. Concerns around social and economic equity are not usually a primary or driving reason for private financing, particularly for facility upgrades or broader industrial investments. Operational cost savings, enhanced production, regulatory compliance, or other desired outcomes tend to take precedence, which more directly affect the return on investment and balance sheets for investors, industrial firms, and other owners and operators of different assets.

Two areas of climate equity, however, are gaining more importance among these industrial actors and policymakers: (1) neighborhood-level EJ concerns linked to particular facilities and (2) workforce challenges resulting from the transition to a cleaner and more resilient economy.

Investing in EJ for local communities

When it comes to more localized equity concerns, certain regulatory levers directly or indirectly require industries to measure and minimize environmental impacts—and, by extension, require them to measure and minimize GHG emissions and other associated climate impacts. The Clean Air Act, for instance, is the main federal law that seeks to limit major air pollutants and sets technology-based emissions standards, including a consideration of emissions that “may reasonably be anticipated to endanger public health or welfare.” As a result, the act has helped the EPA as well as state and local actors reduce impacts for all types of communities, creating up to $3.9 trillion in estimated economic benefits, including avoided mortality, morbidity, and other health concerns. Together with other federal laws such as the National Environmental Policy Act and the Clean Water Act, the Clean Air Act is a foundational part of U.S. climate policy—and it comes alongside many other state and local regulations (such as zoning codes) that can limit pollution and various equity impacts.

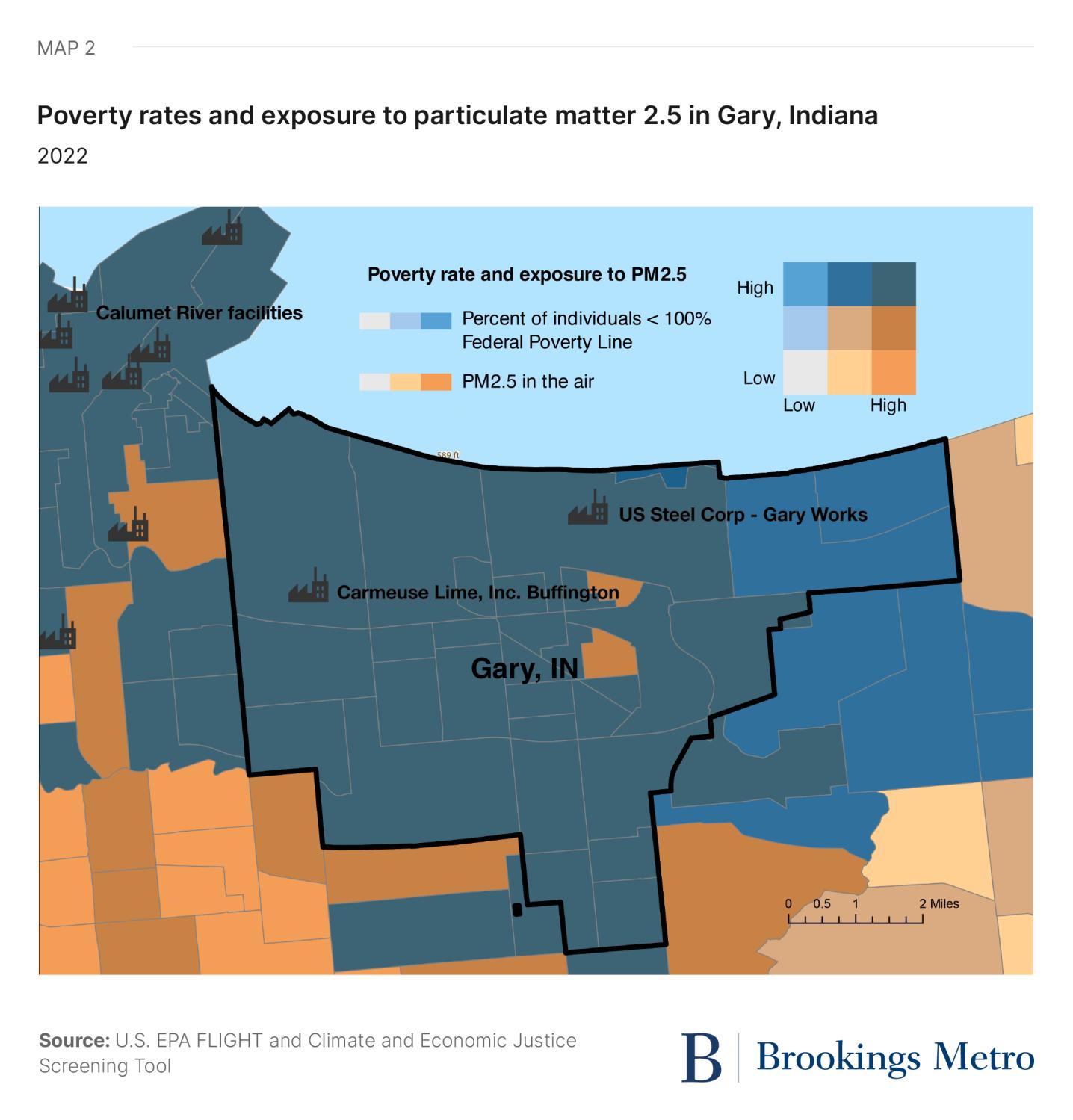

Still, these regulations alone do not address every concern locally—industry-related or otherwise—and widespread EJ concerns are mounting across the country. Concentrated poverty and economic disinvestment, combined with industrial pollution, continue to imperil the health and livelihood of households and neighborhoods. This is particularly the case in communities where large steel and cement facilities operate, such as Gary, Indiana, where GHG emissions contribute to some of the most hazardous air pollutant levels nationally. In fact, according to an EPA analysis, 92% of all hazardous air pollutants from steel mills nationally come from just three mills, concentrated in northwestern Indiana. The vast range of pollutants and climate impacts coming from industrial facilities is expansive, and efforts such as the EPA’s EJScreen tool are beginning to better map and identify areas in need of investment. Figure 3 below shows the 1,100-plus chemical, metal, and mineral facilities nationally that are responsible for more than 340 million metric tons of carbon dioxide emissions annually.3 Concentrated activity along the Gulf Coast and the Rust Belt is especially notable.

Addressing—and paying for—these concentrated EJ concerns remain a work in progress. Even if the concerns themselves are clearly identified and measured (and this itself is a big if), a combination of federal, state, and local funding and private financing is only beginning to scratch the surface of demonstrated need. The IIJA and IRA both stress investments that can boost climate equity and build off other ongoing federal directives, including Justice40, yet the long tail to these investments (industry-related or not) and the struggle to clearly measure the benefits remain thorny challenges. Individual industrial firms, corporate banks, and other private-sector actors, likewise, have stated commitments to consider issues of climate equity as part of ESG criteria and corporate social responsibility programming; yet these and other “impact” investments can be difficult to manage for a variety of reasons: balancing financial returns and impact, developing accountability metrics, and more.

Addressing climate equity challenges in Gary, Indiana

Many U.S. communities face the twin threats of economic disinvestment and environmental degradation. But Gary, Indiana, is one of the most notable examples given its historically disadvantaged population and concentration of high-polluting industrial facilities.

Gary’s industrial might—and subsequent decline—are closely linked to steel production. As a center for U.S. Steel, Gary Works is the company’s largest manufacturing plant with an annual steelmaking capacity of 7.5 million net tons. It is also one of the highest emitters of nitrous oxide, soot, and other pollutants, which amount to 10 million tons annually (see Map 2). That is equivalent to the emissions of almost 2.4 million gas-powered vehicles annually. Similar to other Rust Belt cities, Gary lost jobs and population over time due to shifting demand, globalization, and technological changes in manufacturing. For example, Gary Works employs about a tenth as many workers (3,700) as it did at its peak (30,000). The city’s population (68,000) is also less than half of its peak population in 1960 (178,000), and nearly a third of all residents now live below the poverty line.

The combination of high poverty rates and high levels of particulate matter contribute to some of the most serious EJ concerns nationally. Public health assessments from the EPA and other groups have shined a light on the city’s hazardous air pollution, including especially high asthma rates. Additional soil and water contamination have not helped either, with polluted runoff and sewage overflow leading to exposure to water-borne illnesses. The nearby Calumet River, which winds through Illinois, also houses several industrial facilities along its banks; steel, chemicals, and other emissions-intensive production there contribute to additional air and water pollution throughout the region.

Moreover, since more than 80% of Gary’s residents are Black, the city is emblematic of the disproportionate pollution borne by low-income people and communities of color, with deeply entrenched legacy costs. A dwindling tax base unable to pay for needed infrastructure improvements makes it even harder to come up with new solutions, including remediation and job training grants. Nor is Gary alone. Other local governments across the country are struggling to plan and pay for upgrades—or effectively coordinate with private industry partners on needed facility improvements and cleanup efforts.

Public and private sector leaders recognize the severity of Gary’s long-standing EJ challenges, many of which are further intensifying amid climate change. On the one hand, federal regulators have designed interventions aimed at industry, like more stringent regulations to reduce toxic emissions. Other federal funding from the IIJA and IRA aims to steer more resources toward community-owned solutions, including a variety of infrastructure improvements and efforts to address EJ needs. For instance, the state of Indiana secured $127 million in new federal transportation funding to help improve pedestrian safety and reduce congestion (and related pollution) on the nearby Borman Expressway. In addition, the state of Indiana, working in concert with local leaders, has developed new climate action plans to identify pressing EJ concerns, better harness new federal funding, and target assistance. U.S. Steel, for its part, has pursued plant upgrades and installed new carbon capture technologies to reduce pollution and other climate impacts.

But despite the emergence of new plans and investments, the scale of Gary’s challenges demands more sustained funding and financing. The $150 million carbon capture upgrade by U.S. Steel, for instance, is only projected to capture 0.5% of the plant’s annual emissions, and additional technological upgrades (or outright replacements) are likely needed for the plant’s aging blast furnaces. Cleaner hydrogen-fueled furnaces can cost $1 billion or more. In isolation, these industrial updates do not address all the various public health and economic concerns that continue to hit residents across the city either. Proactively identifying and addressing these climate equity needs remains an ongoing task for Gary, which cannot afford to tackle every need by itself. The city’s industrial past, present, and future point to the need for even more coordinated investment involving the polluter and the polluted.

Investing in climate-related workforce development

Industrial investments that prioritize certain individuals or communities are not just about minimizing climate impacts; leaders are also increasingly seeking ways to support workforce needs amid the transition to a cleaner and more resilient economy. As industries involved in cement, steel, and chemical production upgrade equipment and adjust prevailing processes, their workers are often caught in the crosshairs of these transitions—not simply in terms of carrying out current work but also in terms of being ready to take on new tasks; acquire new competencies; and develop new knowledge, skills, and experience for the years to come. And that assumes that these workers do not lose their jobs due to automation and other new technologies.

The just transition is a frequent concern across the entire labor market, and the industrial sector faces perhaps the most glaring need to invest in worker training, retention, and continued career growth given rapid changes unfolding across the country. The shift from extractive, resource-intensive, and high-emitting processes to more regenerative approaches is upending how employers and workers continue to drive output. As the International Labor Organization defines it, the just transition means “greening the economy in a way that is as fair and inclusive as possible to everyone concerned, creating decent work opportunities and leaving no one behind.” For industries involved in cement, steel, and chemical production, that means firms have a responsibility not only as employers but also as trainers and collaborators with educational institutions, community-based organizations, and other groups.4 Providing flexible, work-based learning opportunities for younger and other traditionally marginalized workers (such as women and people of color) remains an ongoing challenge in this space, as does making intentional investments in worker retention and supportive services (including transportation and child care).

While public funding and prioritization of these worker needs has gained greater momentum amid the rollout of the IIJA, IRA, and other efforts such as the Good Jobs Initiative, industrial firms and other investors are still testing new approaches and navigating this transition in real time. Even with additional federal funding and incentives to help some of these industry actors help invest in workers, concerns persist around the targeting and impact of this funding across different geographies—and amid the reality that current operations may still require layoffs and leave some communities behind. More than 1.7 million workers are employed in fossil-fuel related industries in the U.S., and the specific occupations they fill are undergoing rapid transitions due to changing technologies and market forces, more than any intentional investments in training or supportive services can likely control. Specific states, such as Colorado and New Mexico, have created offices to help employers and workers navigate such transitions, but these efforts are still evolving, and public funding will ultimately need to complement larger, private-led investments.

Conclusion

The industrial sector is contributing to several climate challenges nationally, especially the outsized GHG emissions from the steel, cement, and chemical industries. While a variety of technological and process improvements are making a difference—including greater energy efficiency and recycling of waste—the reality is that more systematic, sustained investment is needed to scale these improvements. New climate-related government funding and incentives via the IIJA and IRA are helping unleash more widespread industrial innovations, but additional private climate financing is essential. The enormous amount of upfront capital needed to drive industrial upgrades hinges on corporate commitments—and spending—that matches net-zero targets. Continued shifts in consumer and producer demand for lower-carbon goods also depend on the affordable and reliable availability of more sustainable materials.

Prevailing climate equity concerns are also prompting action. Concentrated pollution and climate impacts are hitting communities, such as residents of Gary, Indiana, with significant public health and economic costs. The transition risks associated with job loss and reskilling/upskilling needs are significant, too. While planning and paying for additional climate-related projects, public and private sector leaders have an opportunity not only to better account for these climate equity concerns but also to address them through more targeted, proactive investments.

Equitable climate finance series

-

Acknowledgements and disclosures

The author wishes to thank Anna Singer for excellent research assistance.

Funding for this research was provided by HSBC Bank USA, N.A. The program is also grateful to the Metropolitan Council, a network of business, civic, and philanthropic leaders that provides both financial and intellectual support to the program. The views expressed in this report are solely those of its authors and do not represent the views of the donors, their officers, or employees.

-

Footnotes

- Note: This figure includes spending on goods and services.

- Note: This includes emissions tied to other services as well, not just goods consumption.

- Brookings’ analysis of EPA Facility Level GHG emissions data.

- For example, this is often the need across other skilled-trade industries and occupations, including through sector partnerships.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).