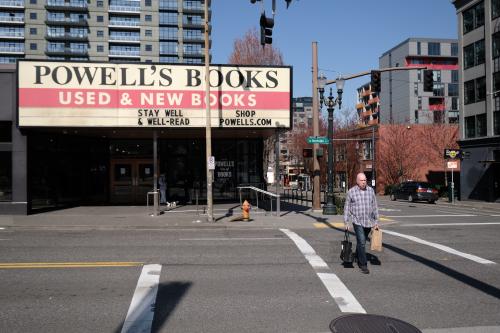

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed by the Senate on March 25 and expected to be rapidly approved by the House and President, is the largest aid package in history. The bipartisan deal allocates $2 trillion in an effort to mitigate the mounting fallout from the COVID-19 pandemic, including $1.5 trillion in spending and tax cuts and $500 billion in loans—$454 billion of which was allocated to the Federal Reserve as the basis for additional lending

The Act hits the mark in several key respects. It is big, it is timely, and it directly helps individuals, businesses, and state and local governments. Naturally, a mammoth package that moves rapidly through the Congress will have shortcomings. But the CARES Act is not the last COVID-19-based package Congress will need to enact, so there will be opportunities to correct mistakes and fix oversights. Here are 10 perspectives on the Act.

1. Relief more than stimulus

Though many have compared this legislation to the 2009 American Recovery and Reinvestment Act that Congress and President Obama enacted during the Great Recession, CARES is more appropriately thought of as relief—not stimulus.

What’s the difference? Relief addresses immediate fallout while stimulus aims to restore robust economic activity. This bill is relief; it cushions people and businesses from the immediate losses caused by COVID-19 and makes it easier for them to comply with public health guidelines and mandates. Stimulus programs will come later. Only after the disease is under control can pre-pandemic levels of economic activity be safely restored.

2. A Martial Plan, Not a Marshall Plan, for Health Care

The CARES Act allocates about $150 billion in funds to enhance hospital capacity, expand the strategic national stockpile of personal protective equipment, support the public health efforts of the Centers for Disease Control and Prevention (CDC), and underwrite vaccine and therapeutic research. Senate minority leader Chuck Schumer has called this a “Marshall Plan” for health care, but this is not rebuilding after the war, this is the war effort itself. Indeed, this is part of what Senate majority leader Mitch McConnell has aptly called “a wartime level investment in our nation.”

3. Direct payments may not reach key groups

CARES provides direct payments to individuals: $1,200 for single filers with adjusted gross income (AGI) below $75,000 and head of household filers with AGI below $112,500; $2,400 for joint filers with AGI below $150,000. Filing units will receive $500 for each child (defined as a dependent under the age of 17). The payment phases out at higher income levels depending on filing status and number of children (and reaches zero, for example, for a single filer with no children and AGI of $99,000).

The IRS will use 2019 tax returns (or 2018 returns if the 2019 return is not yet available), Social Security benefit statements, and Railroad Retirement benefit statements to calculate the direct payment owed. Almost three quarters of tax filers will qualify for aid; the others will be disqualified on account of high incomes. As a result, the distribution of the direct payments is progressive.

But it bears emphasis that many low-income or otherwise vulnerable households may struggle to obtain a payment, especially people who may not have filed a 2018 or 2019 return. These include workers who earn less than the standard deduction ($12,200 for single filers in 2019, $24,400 for joint filers, and slightly more respectively for seniors) and people who earn cash income but don’t report it. Dependents over the age of 17, such as cared-for parents and disabled children, are not eligible for the direct payment, but their caretakers also will not receive a $500 benefit for them. The CARES Act also excludes tax filers without Social Security numbers (SSNs), requiring both taxpayers and their spouses to have SSNs if their payments are determined from a joint return. The choice to give payments only to households with SSNs leaves out Dreamers and families of filers with only Individual Taxpayer Identification Numbers.

The law gives the Treasury discretion to get direct payments to some of these households using certain information that the federal government can access, but it remains to be seen how fully that discretion will be deployed. Many millions of low-income or otherwise vulnerable households may need to file an informational return in order to claim the direct payment. Previous experience with direct payments in 2008 and 2009 shows that many of these households will not file. Filing will only be harder now, when people are isolating and unable to get face-to-face help from family members or government agencies.

4. Direct payments aren’t universal basic income

Direct payments are not universal basic income (UBI). The CARES Act payments are a one-time event and are limited by income. Nevertheless, a pandemic certainly makes UBI proposals more attractive. Just as the drop in housing prices in the Great Recession would have been less damaging if homeowners had previously established low loan-to-value ratios, so the short-term economic distress caused by a pandemic would be smaller if households were guaranteed a non-trivial income. But pandemics are—or, at least, have been—rare events, so it may make more sense to build in social insurance mechanisms that are automatically triggered by adverse circumstances rather than to provide permanent guaranteed income. At the very least, the pandemic has exposed significant holes in the social safety net.

5. Don’t Expect Flawless Administration

There will certainly be snafus in the implementation of payments to individuals, both because of the sheer magnitude of the number of payments and because IRS operations are already stressed by deep cuts to its inflation-adjusted budget and staffing over the past 20 years. And the IRS staff and office are affected by the same public health measures other workplaces are facing. Treasury Secretary Steven Mnuchin is pushing for quick issuance of the payments, expecting households for which the IRS has direct deposit information to receive their payments within a month.

The direct payments in the CARES Act are much larger than previous payments made in the 2001 and 2008 tax cuts, but they are structured similarly. In 2001 single filers received $300 and joint filers received $600, while in 2008 each person received between $300 and $600, and married couples received up to $1200. In 2008, it took three months to get payments to households and the IRS had started working on this mechanism before the stimulus bill was enacted. One factor that may expedite payments this year is that the share of filers who opted to use direct deposit for their returns grew from 51 percent in 2009 to 59 percent in 2019. But payments will be slower for those who must first file qualifying returns.

6. A timely expansion of unemployment insurance

The Act expands unemployment insurance by extending the duration of benefits by 13 weeks, increasing payments by $600 per week for 4 months, and makes gig economy workers and the self-employed newly eligible recipients. Crucially, these new expansions of unemployment insurance are federally funded.

By increasing benefits, the UI provisions may encourage some people to leave the workforce, especially when coupled with the health and safety concerns surrounding some jobs. The reduction in the labor force would not be wholly inappropriate—some jobs are impossible to perform under the social distancing rules that current conditions require. In any case, workers may not rush to quit jobs, valuing the stability of continuing employment more than a brief bump in income. And it is worth emphasizing that people who quit jobs voluntarily (other than for good cause – which includes substantial risk to health and safety) are not eligible for UI to begin with.

7. Back to the Future: Net Operating Loss Rules

Given all of the controversies regarding the $500 billion loan fund for businesses in distress, less attention has been paid to changes in tax rules regarding net operating losses, which will help small businesses significantly.

Before 2017, businesses that had net operating losses could claim refunds for taxes paid in the prior two years. This so-called ‘loss carry-back’ served as an automatic stabilizer, helping firms during downturns and reflecting the fact that a firm’s natural planning horizon may not coincide with the tax year. In the 2009 stimulus, the look-back period was temporarily extended to five years, but the 2017 Tax Cut and Jobs Act eliminated the look-back provision.

The CARES Act reinstates the carryback period to five years for net operating losses sustained in 2018, 2019, or 2020. This will provide welcome tax relief for businesses at a time when their revenues may be profoundly constrained, supplementing the Act’s provisions that provide liquidity for businesses.

8. Helping states and localities weather the storm.

State and local governments, constitutionally barred from running deficits or facing the risk of bond-downgrades, will suffer reduced revenues as demands for spending increase. In the absence of federal aid, they would be unable to meet their constituents’ needs. The CARES Act provides $150 billion in direct support to state and local governments to help fight the coronavirus. This aid comes on top of the Family First Coronavirus Aid Package, enacted last week, which increased the federal share of Medicaid payments through the emergency period by 6.2 percentage points and provided reimbursements to states for the cost of expanding certain public assistance programs. To some extent, these transfers should free up other state and local resources for other uses.

But subfederal governments will need even more assistance. State revenues fell 9 percent during the Great Recession, equivalent of $246 billion today. If budget constraints prompt state and local governments to lay off workers, it will deepen the economic contraction by lowering consumer spending and depriving people of services they need. States and localities will need to tap into rainy day funds (or budge on longstanding and ingrained balanced budget rules). At least some states will need additional assistance because of the severity of this situation and heterogeneity in state finances.

9. America’s got debt but that’s not the point.

The CARES Act will raise U.S. debt substantially relative to a scenario where the economy did not have coronavirus. But, of course, that is not a relevant counterfactual. When the alternative scenario is an economy with coronavirus but without the CARES Act, the new legislation will have a much smaller impact on debt, because it will help prop up the economy, reduce the severity (and possibly the duration) of the recession, and leave the economy in a stronger situation to bounce back after the virus has been neutralized. And with interest rates staying low, we have an enormous amount of fiscal space to focus on the economy rather than the budget. The economy is more important than the budget, and people’s health is paramount. Deficits will have to take a back seat to preventing a Depression and supporting public health.

10. What next?

Together with the first two Acts that Congress enacted in response to COVID-19, the CARES Act makes significant changes in policy, boosting health care spending and providing direct aid to key sectors of the economy. Still, there is a lot left to do.

Controlling the virus will take time. So will the economic recovery. The bills enacted to date do not address the challenge of what may be a long-lasting recession. During the Great Recession, support for additional economic stimulus evaporated after the stimulus bill passed, even though most economists thought that additional fiscal stimulus was desirable. Congress should avoid repeating that error if, as seems all but certain, additional stimulus and more direct payments turn out to be necessary.

Second, recent legislation provided homeowners some limited protection against foreclosure and forbearance on federally-backed mortgages, and protection against eviction for tenants of federally-assisted rental properties. The CARES Act offers no additional forbearance regarding mortgage and rental payments. Additional action may be needed.

Third, the safety net should be strengthened. The 14 states that have not yet expanded Medicaid coverage, as permitted by the Affordable Care Act, should do so immediately. Further steps to move the nation to universal coverage should be taken now.

The Families First Coronavirus Act waived work requirements for the Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, and a federal court recently issued a national injunction against recent cuts to the program. Benefit levels could be increased, at least in times of acute economic distress. In the Great Recession, SNAP benefits were increased, which helped in reducing poverty, reducing food insecurity, and boosting the economy through higher consumer spending.

Fourth, state and local government will need cash infusions to deal with their impending massive revenue loss—the Act only provides support for COVID-related payments. Likewise, the non-profit sector faces unique historical burdens in this episode but has been somewhat “lost in the shuffle” in the policy discussion so far (with the notable exception of a generous payment to the Kennedy Center). Charities, universities, and other non-profit organizations may merit a new round of support as events unfold. (Disclosure: the authors work at a non-profit.)

Lastly, policy makers should be making contingency plans for the uncertainty that marks the future path of COVID-19 and the economy. It is currently unclear what the worst-case scenario is and there are a number of high-impact options to mitigate potential catastrophe. For example, policy makers could offer prizes for the creation of a COVID vaccine.

The CARES Act is a much-needed relief package but policy makers and the public will need to keep an eye on the virus and the economy and be ready to respond quickly as the situation inevitably changes.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Careful or careless? Perspectives on the CARES Act

March 27, 2020