The 21st AGOA Forum, held July 24-26 in Washington, D.C., generated and renewed widespread support for the early renewal of the African Growth and Opportunity Act (AGOA), now set to expire on September 30, 2025.1

In a statement made just before the AGOA Forum began, President Biden called on Congress to “quickly reauthorize and modernize” AGOA. Similarly, when speaking to a Private Sector Forum, Secretary of State Antony Blinken emphasized that the U.S. government supports AGOA’s modernization and reauthorization. National Security Advisor Jake Sullivan echoed Blinken’s message in an address to the Forum, saying the “entire Biden-Harris administration is committed to working with [our] Congress to reauthorize the law.” In her public remarks at the Private Sector Forum, Ambassador Katherine Tai called for the “next era of AGOA” to be even more transformative than the current one. Equally significant at this year’s AGOA Forum was Congressional participation in the Forum and widespread support for AGOA.

AGOA’s economic benefits

A primary rationale for AGOA’s early renewal is to sustain those areas in which the program has seen success. Apart from having served as the cornerstone of the U.S.-Africa commercial partnership for nearly 25 years, AGOA has contributed to the creation of tens of thousands of jobs in the U.S. and Africa.

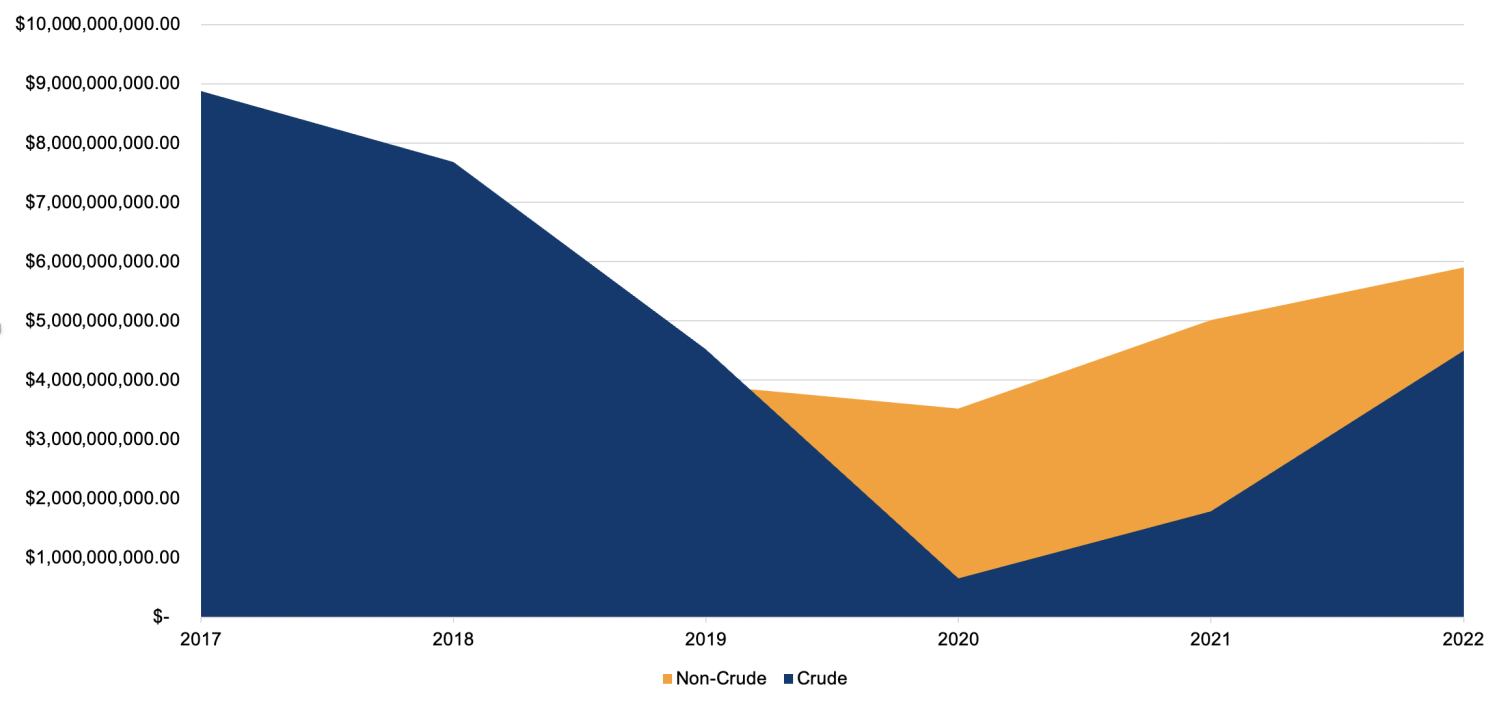

In addition, although exports of crude petroleum from African beneficiary countries under AGOA have historically outperformed value-added non-crude exports, current data indicates that non-crude products are beginning to outpace exports of crude petroleum, demonstrating that the program has gradually improved the export competitiveness of certain value-added products, especially in apparel. For example, while exports of crude petroleum from African beneficiary countries decreased by 50% from 2001 to 2022, exports of non-crude products over the same period increased by 241%.2

In fact, African beneficiary countries exported approximately $103 billion worth of non-crude products to the U.S. between 2001 and 2022. Still, there remains a significant amount of progress to be made, as crude petroleum still accounted for 43% of all products exported under the program in 2022.

For the purposes of this analysis, and unless otherwise noted, crude petroleum oils and oils from bituminous minerals have been excluded in an effort to keep the focus on those AGOA exports that have added value and led to the creation of African jobs.3

AGOA beneficiary countries with the highest total value of non-crude exports over the life of the program include South Africa ($55.9 billion), Nigeria ($11.2 billion), Kenya ($7.3 billion), Lesotho ($6.8 billion), and Madagascar (3.6 billion).

Figure 1. African beneficiary exports under AGOA & GSP: Crude v. non-crude

Source: USITC Dataweb.

While utilization of the program remains uneven among African beneficiaries, nearly all countries (82%) experienced positive compound annual growth in non-crude exports over the life of the program. On average, the compound annual growth rate (CAGR) in non-crude exports among African beneficiary countries was 7% from 2001-2022. African beneficiary countries with the highest CAGR include Gabon (27%), Djibouti (25%), Senegal (25%), Namibia (23%), and Uganda (23%). Other notable countries include Ethiopia, Gambia, Kenya, Mauritania, Rwanda, Tanzania, and Zambia, all of which experienced compound annual growth in non-crude exports of above 10% over the period.

Current data also suggests that AGOA has made a significant economic contribution to the region in terms of gross domestic product (GDP). From 2001 to 2022, exports under AGOA accounted for 1% or more of total GDP for 12 African beneficiary countries, including but not limited to Lesotho, Eswatini, Madagascar, Mauritius, Malawi, and Kenya—none of which exported crude petroleum under the program. In fact, non-crude exports under AGOA accounted for 16% of Lesotho’s total GDP from 2001-2022, illustrating the critical role the program has played in economic growth for certain African countries.

Drilling down to the product level, high-value African exports displaying the most success under the program from 2001 to 2022 include non-crude petroleum oils, cocoa paste, vehicles and vehicle parts, textiles and apparel, and certain manufactured products. AGOA has also played a pivotal role in facilitating the importation of critical minerals to the U.S., such as copper, cobalt, and tungsten, which are used to produce the batteries that power electric vehicles (EV’s). For example, under AGOA, the U.S. imported $6.1 million worth of cobalt from the Democratic Republic of Congo (DRC), Madagascar, South Africa, and Zambia. While the volume is modest, it is indicative of a critical sector of AGOA that should be increased—providing a win-win by enabling the U.S. to build out its own critical minerals supply chain and support African countries to develop their own regional and domestic value chains for mineral processing and manufacturing.

The need to do better

In an effort to produce more impactful results under the program, Congress’s 2015 reauthorization of the legislation called for participating African beneficiary countries to develop and publish “AGOA utilization strategies.” In preparing these strategies, African beneficiary countries determine how their comparative advantage can enhance their own export competitiveness and, in turn, optimize their use of AGOA, which also benefits regional trade. In fact, the trade data suggests that developing a national AGOA utilization strategy is positively associated with boosting exports under the program.

To date, only 19 of the 32 eligible African beneficiary countries have developed a utilization strategy for AGOA. These countries include Burundi, Botswana, Eswatini, Ethiopia, Ghana, Kenya, Lesotho, Madagascar, Malawi, Mali, Mauritius, Mozambique, Namibia, Rwanda, Senegal, Sierra Leone, Tanzania, Togo, and Zambia.4

Of the 17 African beneficiary countries reporting data, all but two countries have seen an increase in the CAGR of non-crude exports under AGOA since the publication of an AGOA utilization strategy.5 These increases in exports range from 1% to more than 140%. Notably, Mozambique, Togo, and Zambia, who are not among the top performers under the program, experienced an increase in the compound annual growth of exports of over 70% following publication of an AGOA utilization strategy.

Bearing in mind the benefits generated from AGOA utilization strategies, it is encouraging that one of the outcomes of this year’s AGOA Forum was the commitment from the African delegation that African beneficiary governments would develop utilization strategies.

Strengthening AGOA

Whether Congress chooses an immediate renewal of AGOA or a more deliberative path, AGOA’s importance to Africa’s development cannot be underestimated. While challenges remain (such as uneven utilization rates and the need for further value addition by transitioning from basic commodity products to more complex and higher-value exports), AGOA’s positive impact on sub-Saharan Africa’s economic growth, export competitiveness, and U.S.-Africa trade relations is noteworthy.

Several of the reforms advocated during this year’s AGOA Forum include tax incentives to increase value-added U.S. investments in vital sectors such as critical minerals, as well as calls for AGOA to provide greater predictability and certainty to investors, given that eight countries have lost AGOA benefits in four years—including four countries in 2024 alone. Allowing cumulation with all signatories to the African Continental Free Trade Area (AFCFTA)6 was also identified as a way for African countries to meet AGOA’s rules of origin and better align AGOA with the AFCFTA. Furthermore, there was recognition that the African diaspora needs to play a greater role in the commercial relationship between the U.S. and Africa. In addition to these credible reforms and as supported by the above analysis, all stakeholders should redouble efforts to ensure that all African beneficiary countries develop AGOA utilization strategies.

Looking toward the future, the African delegation proposed the Democratic Republic of the Congo (DRC) as the host for next year’s AGOA Forum. This presents an important opportunity to increase exports from Africa to the U.S. under AGOA, while enhancing economic growth and opportunities for inter-regional trade.

-

Footnotes

- AGOA exempts duties on over 1,800 products and the General System of Preferences (GSP) exempts duties on an additional 5,000 products, providing essential duty-free access to the U.S. market.

- All preceding and following trade data from this source has been compiled by the authors and is sourced from the USITC DataWeb and World Bank Data and includes U.S. imports under AGOA and the Generalized System of Preferences from 2001 to 2022.

- Products excluded are classified under 2709 of the Harmonized Tariff Schedule of the United States (HTSUS).

- Note: Ethiopia and Mali became ineligible for AGOA benefits effective Jan. 2022. In light of this, the CAGR for both beneficiary countries excluded 2022.

- Note: The CAGR in non-crude exports under AGOA excludes exports under GSP.

- Cumulation allows materials originating in one AfCFTA member country to be considered as originating in another member country when used in the production of a final product.

Commentary

AGOA Forum 2024: Insights, economic benefits for Africa, and the road ahead

September 5, 2024