Africa reports more threats associated with climate change ahead of COP26

As world leaders convene in Glasgow for the U.N. Climate Change Conference (COP26) next week, Gabon will lead Africa’s negotiation efforts. Officials in Gabon stated that the country will seek payment for its role in the fight against climate change. Home to 12 percent of the Congo Basin, Gabon has managed to protect its share of the rainforest, making it one of the few carbon-negative countries in the world.

Ahead of COP26, news outlets have continued to report stories of the devastating impacts of climate change on the African continent. The World Bank Groundswell Africa report highlights the concerns that the African continent will be hit the hardest by climate change, potentially displacing up to 86 million sub-Saharan Africans by 2050.

In East Africa alone, climate change could uproot tens of millions within the next 30 years, the World Bank said. Specifically, Kenya, Rwanda, Tanzania, Uganda, and Burundi are experiencing extreme weather events, such as droughts and floods. This trend also threatens wildlife in the East African region. For example, lower rainfall and associated river levels may be disrupting migration patterns of animals, such as wildebeest.

Moreover, as Madagascar faces the worst drought in 40 years, Amnesty International is encouraging the world to support the relief efforts for the country. Currently, more than a million people in southern Madagascar are experiencing “deep hunger” and in need of humanitarian aid and financial and technical support.

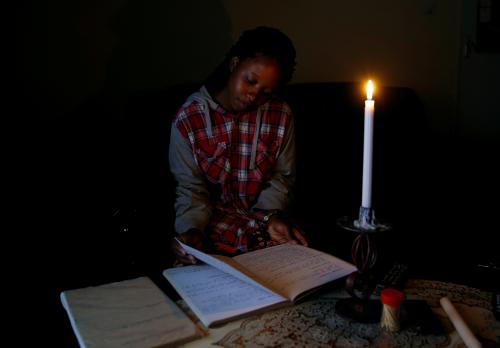

In other related climate news, Kenya plans to convert its heavy fuel oil-powered power plants to ones that use cleaner liquefied natural gas (LNG) by 2030. The Kenya Electricity Generating Company is undergoing a study to gauge the ability to reconfigure thermal power plants to support renewable energy. This is part of Kenya’s effort to successfully reach net-zero carbon emission by 2050.

Sudan military assumes power, could name new prime minister next week

The Sudanese military overthrew the country’s democratic transitional government led by Prime Minister Abdalla Hamdok on Monday. General Abdel Fattah al-Burhan, who led the coup, addressed the nation on state television. He announced that he would dissolve the transitional government, which has been in place since the Sudanese army toppled Omar al-Bashir’s decadeslong dictatorship in 2019. Burhan also asserted that the seizure was necessary to avoid a civil war.

In response, the African Union announced that it had suspended Sudan from participating in its activities until it restores the civilian-led government. The U.S. and World Bank also froze aid to Sudan just months after the North African nation became eligible for funding from global institutions; Sudan was previously on the U.S. list of state sponsors of terrorism. Civil unrest spilled over at home, as hundreds of protestors pelted rocks at security forces in Khartoum’s eastern district of Burri Wednesday night. Amid a vociferous global response, Sputnik news agency reported that al-Burhan said a technocratic candidate would lead the government and could be chosen within a week. Al-Burhan did not rule out the possibility of Hamdok returning as prime minister.

Nigeria launches Africa’s first central bank digital currency

More than half a year after Nigeria’s central bank banned financial institutions from trading or holding cryptocurrencies—perceiving the novel form of money as a threat to financial stability—the Central Bank of Nigeria issued its own digital currency “eNaira” this week. The eNaira is the first central bank digital currency (CBDC) launched in Africa and the world’s seventh implementation of such a currency. The CBDC is intended to complement the shift away from cash and toward digital payments. In general, CBDCs will be used in conjunction with the physical currency and will always maintain a 1:1 exchange rate with the physical currency.

Since its launch this week, the eNaira platform has “received more than 2.5 million daily visits,” integrated 33 banks, onboarded more than 2,000 customers, and minted 500 million eNaira ($1.2 million). The Nigerian government anticipates the eNaira can foster economic growth by bolstering financial inclusion, cross-border trade, remittance payment services, and the tax base by transitioning people and businesses out of the informal sector. More specifically, it is estimated that the eNaira will “increase Nigeria’s gross domestic product by $29 billion over the next 10 years.”

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Africa in the news: Africa at COP26, military takeover in Sudan, and debut of Nigeria’s eNaira

October 30, 2021