At the beginning of 2002, Enron was the seventh largest company in the United States, with operations extending worldwide.

Telecommunications giant Global Crossing operated in twenty-seven countries and two hundred cities on five continents. But both companies collapsed last year under the weight of financial problems created by the self-dealing of a few corporate insiders and masked by nontransparent accounting.

These and other similar corporate failures deprived millions of company employees and shareholders of their lifetime savings and retirement benefits. Stock prices of other U.S. companies also took a beating, partly in response to the revelation of these scandals, and foreign markets have suffered enormous losses.

The practice of opaque self-dealing by a few insiders—as evidenced by insider trading and a lack of transparency in corporate and government operation—has contributed to the meltdown of the financial markets around the world. A crucial, invigorated reform effort is under way worldwide to stem the problem, which, if left unchecked, could lead to global financial ruin.

POLICY BRIEF #118

Roller Coaster Rides

Since January 2002, all major U.S. stock indexes have plummeted. NASDAQ fell almost a third in 2002, and the Dow Jones industrial average and S&P 500 tumbled for the third consecutive year, the longest downturn since 1939-41. Overseas, Japan’s Nikkei 225 closed down 18.6 percent for the year; Britain’s FTSE 100 was down 24.5 percent. Of course, the burst of the dot-com bubble, the uncertainty about a war in the Middle East, and a possible rise in oil prices may have all contributed to the stock price decline. However, it is only natural to suspect that “Enronitis? “opaque self-dealing by a few insiders” has contributed to the financial meltdown.

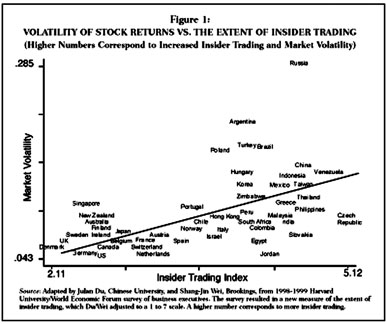

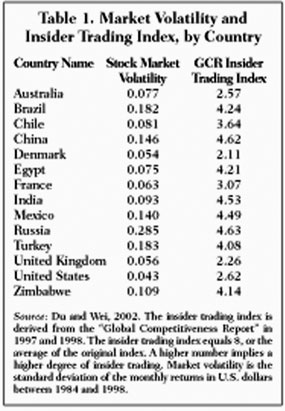

Insider trading—the buying and selling of stock by people who possess nonpublic information relevant for its price—is one of the primary indicators of self-dealing among an elite few within a corporation. Recent work by Julan Du of the Chinese University and Shang-Jin Wei has shown that insider trading can affect stock price volatility—and even more important, economic performance—around the world.

Stock markets are volatile. That is not news. But volatility varies significantly from one country to the next. Measured by the standard deviation of the monthly returns of a major market index, stock market volatility is almost twice as high in Italy as it is in the United States. Markets in developing countries are typically even more volatile. The Chinese market, for example, is three and a half times more volatile than the U.S. market; the Russian market, six and a half times more volatile.

Excessive volatility matters because it affects people’s incentives to save and to invest. A certain degree of market volatility is unavoidable, even desirable. Ideally, changing stock prices signal changing values across economic activities and thereby improve the way resources are allocated. But volatility that is unrelated to market fundamentals results in confusing signals that hamper resource allocation. To the degree that insider trading affects the volatility of a country’s stock market, it could also affect that country’s economic performance.

Some think that because insider trading allows relevant information to be quickly reflected in the stock price, it should reduce market volatility and improve economic efficiency. However, this view fails to take into account the rational actions that a few insiders would take to maximize personal benefits. Access to inside information is most valuable when prices are either rising or falling dramatically, so people who are positioned to possess inside information love market volatility. They realize that the actual extent of volatility could be partly a consequence of their actions.

There are two channels through which insiders may generate increased volatility. First, they may choose riskier projects or riskier technology than they normally would. Second, insiders have an incentive to manipulate the timing and content of the information release in such a way as to increase the price volatility.

Laws and enforcement regarding insider trading differ widely around the world. The set of activities defined as illegal can vary, as can the diligence with which laws are enforced. In the United States, for example, insider trading is a criminal offense with penalties including jail terms. In Hong Kong, insider trading is considered a civil violation with a maximum penalty of a fine.

But Hong Kong compensates for that light penalty with tight antifraud regulation and rigorous and predictable law enforcement. Government regulators are well trained, professional, and relatively incorrupt. Corporate insiders in Hong Kong would think twice before releasing misleading information or committing financial fraud.

Because insider trading is an opaque practice, it is difficult to precisely measure and compare among countries. Consequently, few empirical studies have been done on the subject. But a recent survey conducted by Harvard University and the World Economic Forum for their annual Global Competitiveness Report (GCR) polled business executives in approximately 3000 firms in 53 countries and resulted in a new measure of the extent of insider trading. As mentioned, both the differences in the definition of insider trading along with the fact that it is illegal in many countries make it difficult to assess. However, business executives who are savvy about financial markets should have a sense of the extent of insider trading. Therefore, although the GCR insider trading index is derived from subjective responses, these responses should reflect the practices within firms as accurately as possible.

The executives were asked: “Do you agree that insider trading is not common in [your country’s] domestic stock market?” The measure was adjusted by Du and Wei so that on a scale from 1 to 7, a higher number corresponds to more insider trading. The average of the answers for a particular country is used as a measure of that country’s extent of insider trading. Using this formula empirically, insider trading is shown to correlate with higher market volatility (figure 1).

To illustrate this comparatively, we look at what would happen to the market volatility if the extent of insider trading rises from a relatively low level, such as the U.S. rating of 2.62, to that of China, with a relatively high rating of 4.62 (see table 1). The statistical analysis shows that this rise in insider trading would increase the volatility of stock returns by 2.5 percentage points (e.g., stock volatility will go up from 5 percent to 7.5 percent). This is a substantial increase, considering that the average volatility of the entire sample of 56 countries is 9.8 percent.

In contrast, using the difference in the volatility of GDP growth rate for the two countries yields an increase of only one percentage point. In other words, China’s higher stock market volatility is explained more by excessive insider trading than by the volatility of its economic fundamentals.

Correlation does not necessarily imply causality, but the research by Du and Wei employs a statistical approach designed to address the issue. Using these additional statistical methods, their findings show that the positive correlation between insider trading and market volatility likely implies a causal relationship where an increase in insider trading leads to a rise in stock market volatility. Furthermore, insider trading is associated with a higher market volatility even after one takes into account the impact from the volatility of the real output growth, volatility of macropolicies, and market liquidity and maturity on stock market volatility. To sum up, an economy where insider trading is rampant is likely to have a very volatile stock market, resulting in less savings and lower investment than otherwise.

Opacity

Another symptom of “Enronitis” is a lack of transparency in corporate and government operation. The recent wave of corporate scandals in the United States has thrown open some corporate curtains to reveal practices that were routine but secret until now. Other countries, however, have even more serious deficiencies in transparency that exist not only in the private sector but in the government as well. These practices have caused countries like China, Russia, and Venezuela to lag behind the rest of the world in the financial realm, as research by Gaston Gelos of the International Monetary Fund (IMF) and Shang-Jin Wei demonstrates (see “Additional Reading,” p. 5).

Policymakers often cite lack of transparency as one cause of the financial crises in emerging markets over the past decade. A recent IMF report, for example, noted that a “lack of transparency was a feature of the buildup to the Mexican crisis of 1994-95 and of the emerging market crises of 1997-98.”

The report concluded that “inadequate economic data, hidden weaknesses in financial systems, and a lack of clarity about government policies and policy formulation contributed to a loss of confidence that ultimately threatened to undermine global stability.”

The international financial institutions have actively promoted increased transparency among their member countries and are aiming for more transparency in their own operations. The emphasis on greater transparency presupposes that destabilizing behavior by individual investors can be avoided or attenuated by making better information available. For example, international investment funds may be more likely to engage in herding—that is, to make investment decisions only because other funds are making them—in less transparent countries. As a result, investors may rush in and out of those countries even in the absence of substantial news about fundamentals. Greater transparency could discourage such behavior.

The term transparency denotes both the availability and the quality of information measured at the country level. In government, transparency refers to the availability of macroeconomic data (both timeliness and frequency) as well as to the conduct of macroeconomic policies. Corporate transparency refers to the availability of financial and other business information about firms.

In principle, for investment across countries, just as for investment across corporations within a country, greater transparency levels the playing field for all investors and increases the confidence of the investors collectively, and as a result, can encourage investment. While this is intuitive, it has not been demonstrated rigorously.

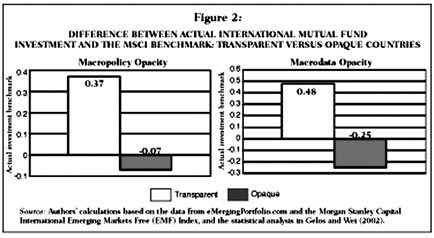

Advances have been made by Gelos and Wei, whose research tests this theory empirically. Before it can be concluded that international mutual funds invest less in less transparent countries, there must be a benchmark on how much international funds would have invested in various countries if they had the same degree of transparency. A natural benchmark is the index produced by Morgan Stanley Capital International (MSCI), which essentially documents the weight of a country’s stock market assets in the global market. Finance theory predicts that the allocation of investment across different countries should be proportional to the importance of these countries in the world stock market.

It is common for asset managers to report their positions relative to this index and for investment banks to issue recommendations relative to it (e.g., “over-weight Singapore” means “advisable to invest more than Singapore’s weight in the MSCI Emerging Markets Free index”).

Looking at the difference between the actual share in the world market portfolio and the MSCI weight for opaque and transparent countries, we see that the more transparent countries actually attract a greater amount of foreign investment than predicted by MSCI, whereas the more opaque countries obtain less than predicted (see figure 2).

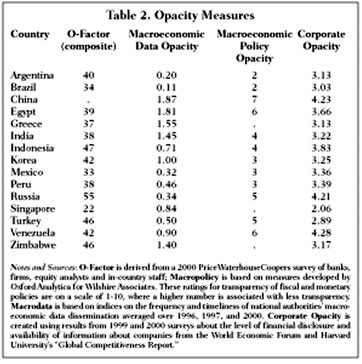

In this research by Gelos and Wei, transparency is measured for both government and corporate operations, independently and collectively. The variables used are referred to as opacity measures, as a higher rating is associated with a lack of transparency. The research examines two aspects of government transparency: the transparency and predictability of a government’s monetary and fiscal policies (Macro policy opacity) and the frequency and timeliness of the official release of the important macroeconomic data (Macro data opacity).

In addition, the lack of transparency at the corporate level is gauged from a survey of firms worldwide on executives’ own perception of the degree of mandatory disclosure requirement (corporate opacity).

The statistical analysis suggests that a lack of transparency on all levels is associated with a lower share of emerging market funds. For example, a country like Venezuela would quadruple its portfolio holdings if it increased its transparency to Singapore’s level (see opacity measures, table 2).

This increase in portfolio holdings should be an important incentive for countries to increase their transparency levels. In addition, greater transparency could moderate the herding tendency of outside investors, which might reduce the country’s vulnerability to financial contagion and crisis.

At least since the 1997-98 Asian financial crisis, herding behavior by international investors has been said to have contributed to the market volatility in the developing countries. Although in economic theory the relationship between transparency and herding is not clear, our research uncovers some evidence of a positive association between a country’s opacity and the tendency for international investors to herd when investing in its assets (see figure 3). Thus, if herding by international investors contributes to a higher volatility or more frequent financial crises in emerging markets, it is related to these countries’ transparency features.

Beyond herding, another important question is whether capital flight during a time of currency and financial crisis is related to a lack of transparency. Do differences in transparency, above and beyond macroeconomic indicators of a country’s economic health, explain why some countries suffer greater confidence loss than others during turbulent times? Our research suggests that more opaque countries do suffer larger outflows during crises. For example, during the Asian and Russian financial crises, we observed that capital exodus was greater in less transparent countries.

Wanted: Fair Play

It is not easy to restore confidence in financial markets where fraudulent and illegal practices within corporations have run rampant, and where government operation is not transparently accountable to its citizens. Greater transparency and investor confidence will not happen overnight. Even the United States, once the world’s unquestioned leader in attracting international funds, cannot bounce back immediately. More than a year after the onset of the 2002 corporate scandals, Wall Street is still trying to regain the trust of its many disillusioned investors, both at home and abroad.

In the United States, efforts have been made by both the government and its citizens to restore the credibility of the market and assure the public that the nation is serious about eliminating foul play within corporations. Shortly after the Enron scandal became public, several initiatives were put forth to improve the monitoring practices within corporations. Congress passed legislation to eliminate corporate fraud by requiring more careful governmental supervision from both outside and within a corporation and strengthening requirements on what companies must disclose to investors. In addition, the Securities and Exchange Commission has been more diligent in its efforts by adopting new regulations, such as one outlining the standard of conduct that must be followed by all attorneys representing corporate clients.

Corporate governance reform has gained momentum in other countries as well. The 1997 economic crisis played a major role in prompting corporate governance reforms throughout Asia and Latin America.

Many countries within Latin America have been plagued by a lack of corporate and government transparency largely as a result of the prominence of family-owned companies and the extent of government intervention. But Chile, for example, has passed legislation that gives increased protection and rights to minority shareholders, which can serve as an example for other lawmakers in the region.

In Korea, a minority shareholders’ movement that began in 1998 continues to raise awareness about the importance of corporate governance. The movement has also recently created a research center devoted to this topic in order to investigate the issue more thoroughly.

In China, instead of enacting immediate reforms at the national level, the government has set up a special governance zone (SGZ) in Shenzhen to experiment with anti-corruption reforms. A successful reform program there can serve as a model for the rest of the country.

But the significance of the experiment goes beyond that. Anti-reform bureaucrats often resist international best practices by claiming differences in culture, history, or tradition. Once anti-corruption reform succeeds in one SGZ, it will leave officials resistant to reform with one less excuse. It will also help galvanize popular demand for country-wide reforms.

Along with these individual country efforts, the IMF, the World Bank, and other international institutions have become more aggressive in assessing the adequacy of the existing standards and codes of financial supervision as well as the conduct of fiscal and monetary policies in their member countries. They have also become more persistent in advocating the international best practices in these areas.

None of the reforms can so far claim complete success; perhaps they never will. But the revelation of corporate scandals and the financial crises in the developing countries have persuaded many people around the world that “Enronitis,” in its various guises, can seriously damage people’s confidence in a financial system and retard economic development. An invigorated, worldwide reform effort, which is already under way, will reduce the chance of future economic devastation that could result from poor public and corporate governance.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).