Higher spending on social insurance programs can lead to higher wealth inequality

In a European Central Bank working paper, Pimin Fessler and Martin Schürz of the National Bank of Austria find that, because expenditures on social services are substitutes for personal wealth accumulation, average household wealth is lower in countries with higher welfare state expenditures. The authors note that this effect is larger for households with lower net wealth, implying that an increase in social service spending will increase wealth inequality.

Providing more information on student loans to large borrowers reduces future borrowing and improves academic achievement

Maximilian Schmeiser of the Federal Reserve Board and Christiana Stoddard and Carly Urban of Montana State University find that sending a warning letter and offer for financial counseling to students with large debt loads reduced future borrowing by one-third and increased student grade point averages. Students receiving the letter were also more likely to switch majors to a STEM field, and completed a higher number of credits.

Nearly half of previously uninsured people would be worse off by purchasing insurance on the exchanges

Mark Pauly, Adam Leive, and Scott Harrington of the Wharton School find that nearly half of the individuals who had no health insurance prior to the ACA would face both a higher financial burden and lower overall welfare by purchasing insurance on the exchanges. The authors note that this likely contributes to the relatively low takeup rates for higher-income individuals who do not qualify for large premium and cost sharing subsidies.

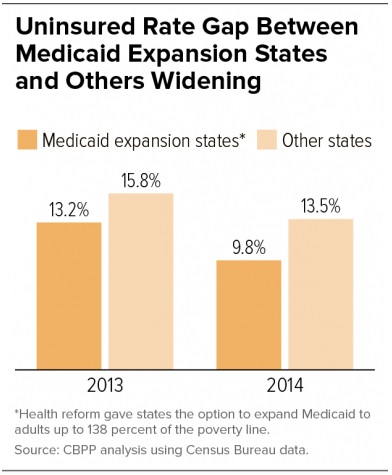

Chart of the week:

Quote of the week:Threat of Japan-style deflation not a major concern for the ECB

Could Europe experience what Japan has experienced?

I don’t think so. The development in wages will be always different from Japan. There is more rigidity in wages in a recession (in Europe) and that is an important factor and that is why I never really feared we would have actual deflation in Europe. Wages will not be as flexible down as they were in Japan. Most of euro area GDP comes from services and inflation in services is basically about wage developments. It is very difficult to go to a situation of deflation in Europe. That’s a difference with Japan.

– Vítor Constâncio, Vice President of the European Central Bank

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Hutchins Roundup: wealth inequality, student borrowing, and more

September 24, 2015